Revenue-based financing is an innovative funding option that has gained significant traction in recent years. Unlike traditional loans, which are based on a company’s assets and credit history, revenue-based financing is based on a company’s future revenue potential.

Editor’s Notes: Revenue-based financing has grown in popularity over the past several years as an alternative to debt and equity financing. This type of financing is especially attractive to startups and small businesses that may not qualify for traditional financing options.

Our team has done extensive research and analysis to put together this comprehensive guide to revenue-based financing. We’ll cover everything you need to know about this financing option, including its benefits and drawbacks, so that you can make the best decision for your business.

Revenue-Based Financing

Revenue-based financing is a form of financing in which a company receives funding based on its future revenue potential. This type of financing is often used by startups and small businesses that do not have a long track record or significant assets.

- Flexible: Revenue-based financing can be tailored to the specific needs of each business.

- Non-dilutive: Revenue-based financing does not require the company to give up any equity.

- Quick and easy: Revenue-based financing can be obtained quickly and easily, with minimal paperwork.

- Growth-oriented: Revenue-based financing is designed to help companies grow their revenue.

- Transparent: Revenue-based financing is a transparent form of financing, with clear terms and conditions.

- Scalable: Revenue-based financing can be scaled up or down as needed.

- Complementary: Revenue-based financing can be used in conjunction with other forms of financing.

These are just some of the key aspects of revenue-based financing. This type of financing can be a valuable tool for startups and small businesses that are looking to grow their revenue and achieve their business goals.

Flexible

Revenue-based financing is a flexible form of financing that can be customized to meet the specific needs of each business. This flexibility is one of the key advantages of revenue-based financing, as it allows businesses to access the funding they need without having to give up equity or take on debt.

- Tailored repayment plans: Revenue-based financing providers can work with businesses to develop a repayment plan that fits their specific cash flow. This flexibility can be especially beneficial for businesses that have seasonal or unpredictable revenue streams.

- Variable funding amounts: Revenue-based financing providers can provide businesses with varying amounts of funding, depending on their needs. This flexibility can be helpful for businesses that are looking to grow their revenue quickly or that need to cover unexpected expenses.

- Flexible terms: Revenue-based financing agreements can be structured with a variety of terms, including the length of the loan, the interest rate, and the repayment schedule. This flexibility allows businesses to find a financing solution that works for them.

The flexibility of revenue-based financing makes it a valuable tool for businesses of all sizes and industries. This type of financing can provide businesses with the funding they need to grow their revenue and achieve their business goals.

Non-dilutive

One of the key advantages of revenue-based financing is that it is non-dilutive. This means that the company does not have to give up any equity in order to receive funding. This is in contrast to traditional forms of financing, such as venture capital, which often require the company to give up a significant amount of equity in exchange for funding.

- Ownership: With revenue-based financing, the company retains full ownership of its business. This means that the company does not have to share its profits with investors or give up control of its operations.

- Control: The company maintains complete control over its business decisions. This means that the company can make decisions about its products, services, and marketing without having to consult with investors.

- Flexibility: Revenue-based financing can be tailored to the specific needs of each business. This flexibility allows businesses to access the funding they need without having to give up equity or take on debt.

The non-dilutive nature of revenue-based financing makes it a valuable tool for businesses that are looking to grow their revenue without giving up equity or control of their business.

Quick and easy

Revenue-based financing is a quick and easy way to get the funding you need to grow your business. The application process is simple and straightforward, and you can typically get approved for funding within a few days. This is in contrast to traditional forms of financing, such as bank loans, which can take weeks or even months to get approved.

The minimal paperwork required for revenue-based financing is another major advantage. This is especially beneficial for startups and small businesses that do not have a lot of time or resources to devote to the financing process.

The quick and easy nature of revenue-based financing makes it a valuable tool for businesses that need to access funding quickly and easily. This type of financing can be used to cover a variety of expenses, such as marketing, inventory, and payroll.

Here are some examples of how businesses have used revenue-based financing to grow their businesses:

- A software company used revenue-based financing to fund the development of a new product. The company was able to get the funding it needed quickly and easily, and it was able to launch the product on time and within budget.

- An e-commerce company used revenue-based financing to fund a marketing campaign. The company was able to reach a wider audience and increase its sales.

- A manufacturing company used revenue-based financing to purchase new equipment. The company was able to increase its production capacity and meet the growing demand for its products.

These are just a few examples of how businesses have used revenue-based financing to grow their businesses. This type of financing can be a valuable tool for any business that needs to access funding quickly and easily.

Growth-oriented

Revenue-based financing is a financing option that is designed to help companies grow their revenue. This type of financing is typically used by startups and small businesses that do not have a long track record or significant assets. Revenue-based financing providers typically offer flexible terms and repayment schedules, making it easier for businesses to access the funding they need to grow their revenue.

- Access to capital: Revenue-based financing can provide businesses with access to the capital they need to invest in growth initiatives, such as marketing, sales, and product development.

- Flexible terms: Revenue-based financing providers typically offer flexible terms and repayment schedules, making it easier for businesses to manage their cash flow and avoid financial distress.

- Focus on growth: Revenue-based financing is designed to help businesses focus on growth. This type of financing does not require businesses to give up equity or take on debt, which can be a drag on growth.

Revenue-based financing is a valuable tool for businesses that are looking to grow their revenue. This type of financing can provide businesses with the capital they need to invest in growth initiatives, without having to give up equity or take on debt.

Transparent

Revenue-based financing is a transparent form of financing, with clear terms and conditions. This means that businesses know exactly how much they will owe and when they will owe it. This transparency is in contrast to traditional forms of financing, such as bank loans, which can have hidden fees and complex terms and conditions.

- Clear terms and conditions: Revenue-based financing agreements are typically clear and concise, with no hidden fees or surprises. This makes it easy for businesses to understand the terms of their financing and to budget accordingly.

- Regular reporting: Revenue-based financing providers typically provide businesses with regular reports on their financial performance. This reporting helps businesses to track their progress and to make informed decisions about their business.

- Access to data: Revenue-based financing providers typically give businesses access to their own financial data. This data can be used by businesses to track their progress, to identify areas for improvement, and to make informed decisions about their business.

The transparency of revenue-based financing is a major advantage for businesses. This transparency allows businesses to understand the terms of their financing, to track their progress, and to make informed decisions about their business.

Scalable

Revenue-based financing is a scalable form of financing, meaning that it can be increased or decreased as needed. This is in contrast to traditional forms of financing, such as bank loans, which are typically fixed amounts that cannot be changed. The scalability of revenue-based financing makes it a valuable tool for businesses that are experiencing rapid growth or that have seasonal fluctuations in their revenue.

- Flexibility: Revenue-based financing can be tailored to the specific needs of each business. This flexibility allows businesses to access the funding they need without having to give up equity or take on debt.

- Growth: Revenue-based financing can be used to fund growth initiatives, such as marketing, sales, and product development. This can help businesses to grow their revenue and achieve their business goals.

- Seasonality: Revenue-based financing can be used to cover seasonal fluctuations in revenue. This can help businesses to avoid financial distress and to maintain a consistent level of operations.

The scalability of revenue-based financing makes it a valuable tool for businesses of all sizes and industries. This type of financing can provide businesses with the flexibility they need to grow their revenue and achieve their business goals.

Complementary

Revenue-based financing is a flexible and versatile financing option that can be used in conjunction with other forms of financing to meet the specific needs of a business. This can be a valuable strategy for businesses that need to access additional capital without giving up equity or taking on debt.

- Equity financing: Revenue-based financing can be used to complement equity financing, which involves selling a portion of the business to investors in exchange for funding. This can be a good option for businesses that need to raise a large amount of capital and are willing to give up some control of their business.

- Debt financing: Revenue-based financing can also be used to complement debt financing, which involves borrowing money from a bank or other lender. This can be a good option for businesses that need to raise capital but do not want to give up equity or pay high interest rates.

- Government grants: Revenue-based financing can be used to complement government grants, which are free money that does not have to be repaid. This can be a good option for businesses that are eligible for government grants and need additional funding.

- Crowdfunding: Revenue-based financing can be used to complement crowdfunding, which involves raising money from a large number of people. This can be a good option for businesses that need to raise a small amount of capital and want to build a community of supporters.

By combining revenue-based financing with other forms of financing, businesses can access the capital they need to grow their business without having to give up equity or take on excessive debt. This can be a valuable strategy for businesses of all sizes and industries.

Frequently Asked Questions About Revenue-Based Financing

Revenue-based financing is a relatively new financing option that has gained popularity in recent years. It is a flexible and scalable form of financing that can be used by businesses of all sizes and industries. However, there are still some common questions and misconceptions about revenue-based financing.

Question 1: What is revenue-based financing?

Revenue-based financing is a type of financing in which a company receives funding based on its future revenue potential. This type of financing is often used by startups and small businesses that do not have a long track record or significant assets.

Question 2: How does revenue-based financing work?

Revenue-based financing providers typically advance a business a sum of money in exchange for a percentage of the business’s future revenue. The percentage of revenue that is paid to the provider varies depending on the terms of the agreement.

Question 3: What are the benefits of revenue-based financing?

Revenue-based financing has a number of benefits, including:

- It is a flexible and scalable form of financing that can be tailored to the specific needs of each business.

- It is non-dilutive, meaning that the company does not have to give up any equity in order to receive funding.

- It is quick and easy to obtain, with minimal paperwork.

- It is growth-oriented, meaning that it can be used to fund growth initiatives such as marketing, sales, and product development.

Question 4: What are the drawbacks of revenue-based financing?

There are a few potential drawbacks to revenue-based financing, including:

- It can be more expensive than traditional forms of financing, such as bank loans.

- It can be difficult to qualify for, especially for businesses with low revenue or high risk.

- It can put a strain on a company’s cash flow, especially if revenue is seasonal or unpredictable.

Question 5: Is revenue-based financing right for my business?

Revenue-based financing can be a good option for businesses that are looking for a flexible and non-dilutive form of financing. However, it is important to carefully consider the benefits and drawbacks of revenue-based financing before making a decision.

Question 6: How can I find a revenue-based financing provider?

There are a number of revenue-based financing providers available. You can find a list of providers on the website of the Revenue-Based Finance Association.

Summary of key takeaways or final thought:

Revenue-based financing is a valuable tool for businesses of all sizes and industries. It is a flexible, non-dilutive, and quick and easy way to get the funding you need to grow your business.

Transition to the next article section:

If you are considering revenue-based financing, it is important to do your research and find a provider that is right for your business. There are a number of factors to consider when choosing a provider, including the terms of the agreement, the fees, and the provider’s track record.

Revenue-Based Financing Tips

Revenue-based financing is a valuable tool for businesses of all sizes and industries. It is a flexible, non-dilutive, and quick and easy way to get the funding you need to grow your business. However, there are a few things you should keep in mind when considering revenue-based financing.

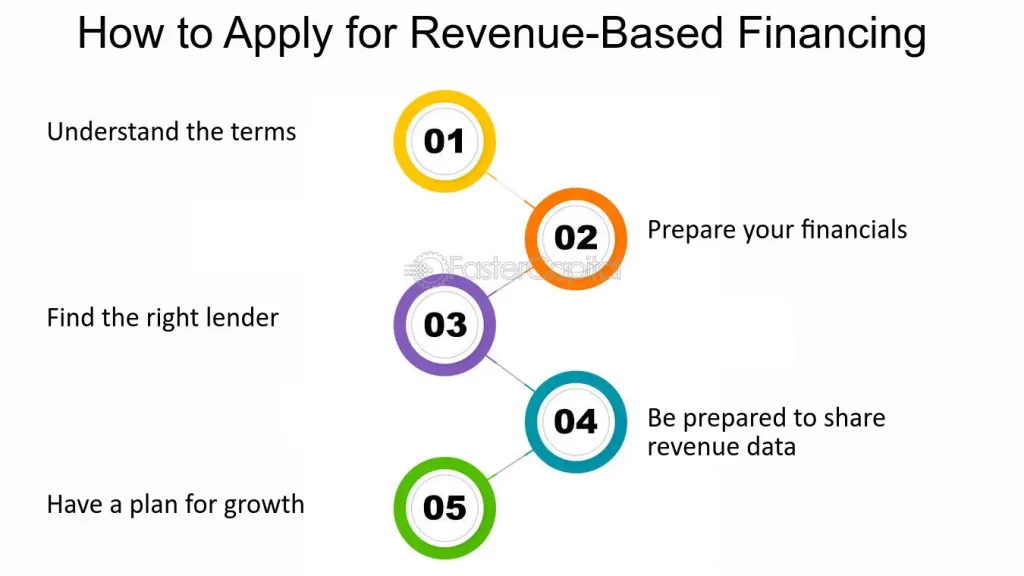

Tip 1: Understand the terms of the agreement.

Before you sign a revenue-based financing agreement, it is important to carefully review the terms of the agreement. This includes the amount of funding you will receive, the percentage of your revenue that you will pay to the provider, and the length of the agreement. Make sure you understand all of the terms of the agreement before you sign it.

Tip 2: Shop around for the best deal.

There are a number of revenue-based financing providers available. It is important to shop around and compare the terms of the agreements offered by different providers before you make a decision. Make sure you find a provider that offers a competitive interest rate and flexible repayment terms.

Tip 3: Make sure you can afford the payments.

Revenue-based financing can be a valuable tool for businesses that are growing rapidly. However, it is important to make sure you can afford the payments before you sign a revenue-based financing agreement. The payments will be based on a percentage of your revenue, so it is important to make sure you have enough revenue to cover the payments.

Tip 4: Use the funds wisely.

The funds you receive from revenue-based financing should be used to grow your business. This could include investing in marketing, sales, or product development. Make sure you use the funds wisely to maximize the impact on your business.

Tip 5: Monitor your progress.

It is important to monitor your progress after you receive revenue-based financing. This will help you to ensure that you are using the funds wisely and that you are on track to repay the loan. Track your revenue and expenses carefully, and make sure you are meeting the terms of the agreement.

By following these tips, you can increase your chances of success with revenue-based financing. This type of financing can be a valuable tool for businesses of all sizes and industries. It can provide you with the funding you need to grow your business and achieve your goals.

Summary of key takeaways or benefits:

- Revenue-based financing can be a valuable tool for businesses of all sizes and industries.

- It is important to understand the terms of the agreement before you sign it.

- Shop around for the best deal.

- Make sure you can afford the payments.

- Use the funds wisely.

- Monitor your progress.

Transition to the article’s conclusion:

Revenue-based financing is a flexible and non-dilutive way to get the funding you need to grow your business. By following these tips, you can increase your chances of success with revenue-based financing.

Conclusion

Revenue-based financing has emerged as a transformative financing solution for businesses seeking to unlock their growth potential. Its flexible and non-dilutive nature make it an attractive option for startups and small businesses that lack traditional collateral or a lengthy operating history.

As the business landscape continues to evolve, revenue-based financing is expected to play an increasingly vital role. By providing businesses with access to capital based on their future revenue potential, this financing mechanism empowers them to pursue growth opportunities and achieve their long-term objectives. With its potential to revolutionize the way businesses access capital, revenue-based financing is poised to shape the future of business financing.

Youtube Video: