Whether you are looking to start your career in the financial sector or advance your current one, a bachelor’s in finance can provide the skills and knowledge to help you succeed.

Editor’s Note: This fully updated guide to bachelor’s in finance programs was published on [date].

Our team of higher education experts has analyzed data and consulted with industry professionals to put together this guide to help you make the right decision about your education and career. With information on everything from program costs to career outlook, we’ve got you covered.

Key Differences in Bachelors in Finance Programs

| Feature | On-Campus | Online|| ———– | ———– | ———–|| Format | In-person classes | Online classes || Duration | 4 years | 2-4 years|| Cost | Varies by school | Varies by school || Flexibility | Less flexible | More flexible || Career Outlook | Excellent | Excellent |

Transition to main article topics

Bachelor in Finance

A bachelor’s degree in finance provides a foundation in financial theory and practice, preparing graduates for careers in banking, investment management, and other financial fields.

- Analytical Skills: Students learn to analyze financial data and make sound investment decisions.

- Communication Skills: Finance professionals must be able to communicate complex financial information clearly and concisely.

- Ethics: Finance professionals have a responsibility to act ethically and in the best interests of their clients.

- Financial Markets: Students learn about the different financial markets and how they operate.

- Investment Management: Students learn how to manage investment portfolios and make investment decisions.

- Quantitative Methods: Finance professionals use quantitative methods to analyze data and make decisions.

- Risk Management: Students learn how to identify and manage financial risks.

- Technology: Students learn how to use financial technology to analyze data and make decisions.

These eight key aspects provide a comprehensive overview of the essential elements of a bachelor’s in finance. By developing these skills and knowledge, graduates will be well-prepared for a successful career in the financial sector.

Analytical Skills

Analytical skills are essential for a successful career in finance. Finance professionals must be able to analyze financial data to make sound investment decisions. This involves being able to identify trends, patterns, and relationships in data, as well as being able to develop and test hypotheses.

A bachelor’s in finance provides students with the analytical skills they need to succeed in the financial sector. Students learn how to use financial data to make investment decisions, and they develop the critical thinking skills necessary to analyze complex financial problems.

For example, a finance professional may use analytical skills to evaluate a company’s financial statements to determine whether or not it is a good investment. The analyst would look at the company’s revenue, expenses, and profits, as well as its debt and equity levels. The analyst would then use this information to make a recommendation about whether or not to invest in the company.

Analytical skills are also essential for managing risk. Finance professionals must be able to identify and assess financial risks, and they must be able to develop and implement strategies to mitigate these risks.

Communication Skills

Effective communication skills are essential for success in any field, and finance is no exception. Finance professionals must be able to communicate complex financial information clearly and concisely to a variety of audiences, including clients, colleagues, and senior management.

A bachelor’s in finance provides students with the communication skills they need to succeed in the financial sector. Students learn how to write clear and concise financial reports, presentations, and emails. They also learn how to speak effectively in public and in one-on-one meetings.

For example, a financial analyst may need to communicate the results of a financial analysis to a client. The analyst would need to be able to explain the analysis in a way that is easy to understand, even for someone who is not familiar with financial jargon. The analyst would also need to be able to answer the client’s questions and address any concerns.

Communication skills are also essential for teamwork and collaboration. Finance professionals often work in teams to complete projects and solve problems. They need to be able to communicate effectively with their team members to ensure that everyone is on the same page.

Ethics

A bachelor’s in finance provides students with the ethical foundation they need to succeed in the financial sector. Students learn about the ethical principles that govern the financial industry, and they develop the critical thinking skills necessary to apply these principles to real-world situations.

- Fiduciary Duty: Finance professionals have a fiduciary duty to act in the best interests of their clients. This means that they must always put their clients’ interests first, even if it means sacrificing their own.

- Conflicts of Interest: Finance professionals must be aware of and avoid conflicts of interest. A conflict of interest occurs when a finance professional’s personal interests conflict with the interests of their clients. For example, a finance professional who owns stock in a company cannot recommend that stock to clients without disclosing the conflict of interest.

- Misrepresentation and Fraud: Finance professionals must not misrepresent or defraud their clients. This means that they must be honest and forthright in all of their dealings with clients.

- Market Manipulation: Finance professionals must not engage in market manipulation. Market manipulation is any action that artificially affects the price of a security.

By adhering to these ethical principles, finance professionals can help to maintain the integrity of the financial markets and protect the interests of investors.

Financial Markets

Financial markets are essential to the global economy. They provide a platform for businesses to raise capital and for investors to buy and sell securities. A bachelor’s in finance provides students with a comprehensive understanding of the different financial markets and how they operate.

- Types of Financial Markets: Students learn about the different types of financial markets, including stock markets, bond markets, and foreign exchange markets. They also learn about the different types of securities that are traded in these markets.

- Market Structure: Students learn about the structure of the financial markets, including the role of exchanges, brokers, and dealers. They also learn about the different regulations that govern the financial markets.

- Market Analysis: Students learn how to analyze the financial markets to identify trends and opportunities. They also learn how to use technical analysis and fundamental analysis to make investment decisions.

- Global Financial Markets: Students learn about the global financial markets and how they are interconnected. They also learn about the different factors that can affect the global financial markets.

By understanding the financial markets, graduates of a bachelor’s in finance program are well-prepared for careers in a variety of financial fields, including investment banking, commercial banking, and financial planning.

Investment Management

Investment management is a critical component of a bachelor’s in finance. It provides students with the skills and knowledge necessary to manage investment portfolios and make sound investment decisions. This is an essential skill for anyone who wants to work in the financial sector, as it allows them to help clients achieve their financial goals.

Students in a bachelor’s in finance program learn about different investment strategies, asset allocation, and risk management. They also learn how to use financial analysis tools to evaluate investment opportunities. This knowledge and expertise allow them to make informed investment decisions that can help their clients grow their wealth.

For example, a financial advisor may use investment management skills to help a client save for retirement. The advisor would consider the client’s age, risk tolerance, and investment goals to develop an investment portfolio that is designed to meet the client’s needs. The advisor would then monitor the portfolio’s performance and make adjustments as needed.

Investment management is a complex and challenging field, but it is also a rewarding one. Graduates of a bachelor’s in finance program who have a strong understanding of investment management are well-prepared for careers in a variety of financial fields, including portfolio management, investment banking, and financial planning.

Key Insights:

- Investment management is a critical component of a bachelor’s in finance.

- Investment management provides students with the skills and knowledge necessary to manage investment portfolios and make sound investment decisions.

- Graduates of a bachelor’s in finance program who have a strong understanding of investment management are well-prepared for careers in a variety of financial fields.

Quantitative Methods

In the field of finance, quantitative methods are essential for analyzing data and making sound investment decisions. A bachelor’s in finance provides students with a strong foundation in quantitative methods, preparing them for careers in a variety of financial fields.

- Data Analysis: Finance professionals use quantitative methods to analyze large amounts of data to identify trends and patterns. This data can come from a variety of sources, including financial statements, market data, and economic data. By analyzing this data, finance professionals can make informed decisions about investments, risk management, and other financial matters.

- Modeling: Finance professionals use quantitative methods to develop models that can simulate financial markets and predict future outcomes. These models can be used to evaluate the risk and return of different investments, to make investment decisions, and to develop trading strategies.

- Forecasting: Finance professionals use quantitative methods to forecast future financial trends. This information can be used to make investment decisions, to plan for future financial needs, and to manage risk.

- Optimization: Finance professionals use quantitative methods to optimize investment portfolios and make other financial decisions. This involves using mathematical techniques to find the best possible solution to a given problem.

By developing strong quantitative skills, graduates of a bachelor’s in finance program are well-prepared for careers in a variety of financial fields, including investment banking, commercial banking, and financial planning.

Risk Management

Risk management is a critical component of a bachelor’s in finance. It provides students with the skills and knowledge necessary to identify and manage financial risks, which is essential for a successful career in the financial sector.

Financial risks can come in many forms, including market risk, credit risk, operational risk, and liquidity risk. Finance professionals must be able to identify these risks and develop strategies to mitigate them.

For example, a financial advisor may use risk management skills to help a client create a diversified investment portfolio. Diversification is a strategy that reduces risk by spreading investments across different asset classes, such as stocks, bonds, and real estate. By diversifying their portfolio, the client can reduce the risk of losing money if one asset class performs poorly.

Risk management is a complex and challenging field, but it is also a rewarding one. Graduates of a bachelor’s in finance program who have a strong understanding of risk management are well-prepared for careers in a variety of financial fields, including risk management, investment banking, and financial planning.

Key Insights:

- Risk management is a critical component of a bachelor’s in finance.

- Risk management provides students with the skills and knowledge necessary to identify and manage financial risks.

- Graduates of a bachelor’s in finance program who have a strong understanding of risk management are well-prepared for careers in a variety of financial fields.

| Risk Type | Description | Mitigation Strategies |

|---|---|---|

| Market risk | The risk of losing money due to changes in the market value of investments | Diversification, hedging |

| Credit risk | The risk of losing money due to the default of a borrower | Credit analysis, collateral |

| Operational risk | The risk of losing money due to internal failures or external events | Internal controls, business continuity planning |

| Liquidity risk | The risk of losing money due to the inability to sell an asset quickly at a fair price | Diversification, holding liquid assets |

Technology

In today’s rapidly evolving financial landscape, technology plays a critical role in empowering finance professionals to make informed decisions. A bachelor’s in finance equips students with the skills and knowledge necessary to leverage financial technology to analyze data and make sound investment decisions.

- Data Analytics: Financial technology provides students with access to vast amounts of data, which they can analyze to identify trends and patterns. This data can be used to make informed investment decisions, develop trading strategies, and manage risk.

- Modeling and Simulation: Financial technology allows students to develop models and simulations to test different investment strategies and scenarios. This can help them to make more informed decisions and reduce the risk of losses.

- Trading Platforms: Financial technology provides students with access to trading platforms that allow them to execute trades quickly and efficiently. This can give them an edge in the competitive financial markets.

- Risk Management: Financial technology can be used to identify and manage financial risks. This can help students to protect their investments and make more informed decisions.

By incorporating financial technology into the curriculum, a bachelor’s in finance prepares students for the challenges and opportunities of the modern financial world. Graduates of these programs are well-equipped to use technology to analyze data, make sound investment decisions, and manage risk.

FAQs About Bachelor’s in Finance

This section addresses frequently asked questions about bachelor’s in finance programs to provide prospective students with comprehensive information.

Question 1: What are the career prospects for graduates with a bachelor’s in finance?

Graduates with a bachelor’s in finance have a wide range of career opportunities in the financial sector, including roles in investment banking, commercial banking, financial planning, and risk management. They can also pursue careers in other industries, such as consulting, data analysis, and technology.

Question 2: What are the key skills and knowledge that students will gain from a bachelor’s in finance program?

Through a bachelor’s in finance program, students will develop strong analytical, communication, and problem-solving skills. They will also gain a deep understanding of financial markets, investment strategies, and risk management techniques.

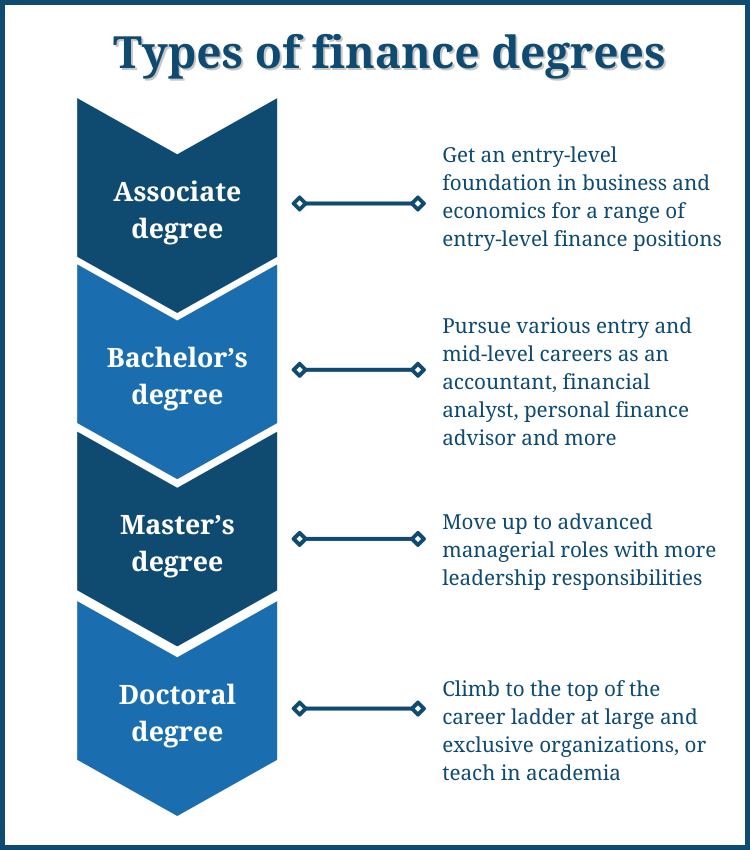

Question 3: What are the different types of bachelor’s in finance programs available?

Bachelor’s in finance programs can be offered in various formats, including on-campus, online, and hybrid. Students should choose the program format that best suits their learning style and schedule.

Question 4: How long does it take to complete a bachelor’s in finance program?

A bachelor’s in finance program typically takes four years of full-time study to complete. However, part-time study options may be available for students who need more flexibility.

Question 5: What are the costs associated with a bachelor’s in finance program?

The costs of a bachelor’s in finance program vary depending on the institution and program format. Students should research different programs to find one that fits their budget.

Question 6: What are the benefits of earning a bachelor’s in finance?

Earning a bachelor’s in finance provides individuals with the knowledge, skills, and credentials necessary for a successful career in the financial sector or related fields. It opens doors to high-paying job opportunities and career advancement prospects.

Summary of key takeaways or final thought:

A bachelor’s in finance is a valuable degree that prepares graduates for rewarding careers in the financial industry. By carefully considering the information provided in this FAQ section, prospective students can make informed decisions about their education and career path.

Transition to the next article section:

To further explore the benefits and career opportunities associated with a bachelor’s in finance, continue reading the following sections of this article.

Tips for Success in a Bachelor’s in Finance Program

Earning a bachelor’s in finance is a significant step toward a successful career in the financial industry. Here are five essential tips to help you succeed in your program:

Tip 1: Develop Strong Analytical Skills

Finance professionals rely heavily on analytical skills to make sound investment decisions. Take advantage of opportunities to develop these skills through coursework, extracurricular activities, and internships.

Tip 2: Master Communication Skills

Effective communication is crucial for finance professionals. Practice presenting complex financial information clearly and concisely in both written and oral formats. Join clubs or participate in mock presentations to hone your communication abilities.

Tip 3: Gain Practical Experience

Internships and hands-on projects provide invaluable experience that complements classroom learning. Seek opportunities to apply your knowledge in real-world settings and build your professional network.

Tip 4: Stay Updated with Financial Markets

The financial landscape is constantly evolving. Stay informed about current events and industry trends by reading financial news, attending industry conferences, and engaging in discussions with professionals.

Tip 5: Embrace Technology

Technology plays a significant role in modern finance. Familiarize yourself with financial software and data analysis tools to enhance your efficiency and decision-making capabilities.

Summary of key takeaways or benefits:

By following these tips, you can increase your chances of success in your bachelor’s in finance program and lay a solid foundation for a fulfilling career in the financial industry.

Transition to the article’s conclusion:

Earning a bachelor’s in finance is a rewarding endeavor that opens doors to numerous career opportunities. By embracing these tips and dedicating yourself to your studies, you can set yourself up for success in this dynamic and challenging field.

Conclusion

A bachelor’s in finance provides a solid foundation for a successful career in the financial sector. Through rigorous coursework, practical experience, and the development of analytical, communication, and problem-solving skills, graduates gain the knowledge and competencies necessary to navigate the complex and dynamic world of finance.

As the financial industry continues to evolve, the demand for finance professionals with a strong academic background and a deep understanding of financial principles will remain high. By embracing the challenges and opportunities presented by a bachelor’s in finance program, individuals can position themselves for rewarding careers in investment banking, commercial banking, financial planning, risk management, and various other fields.

Youtube Video: