Wondering how CRM finance can transform your business? You’re not alone. Businesses of all sizes are turning to CRM finance to improve their financial performance.

Editor’s Note: This guide to CRM finance was published on [date] to help you make the most of this powerful tool.

Our team has done the hard work of analyzing and comparing the latest CRM finance solutions, so you can make the best decision for your business. In this guide, we’ll cover everything you need to know about CRM finance, including:

Key differences between CRM and traditional finance systems

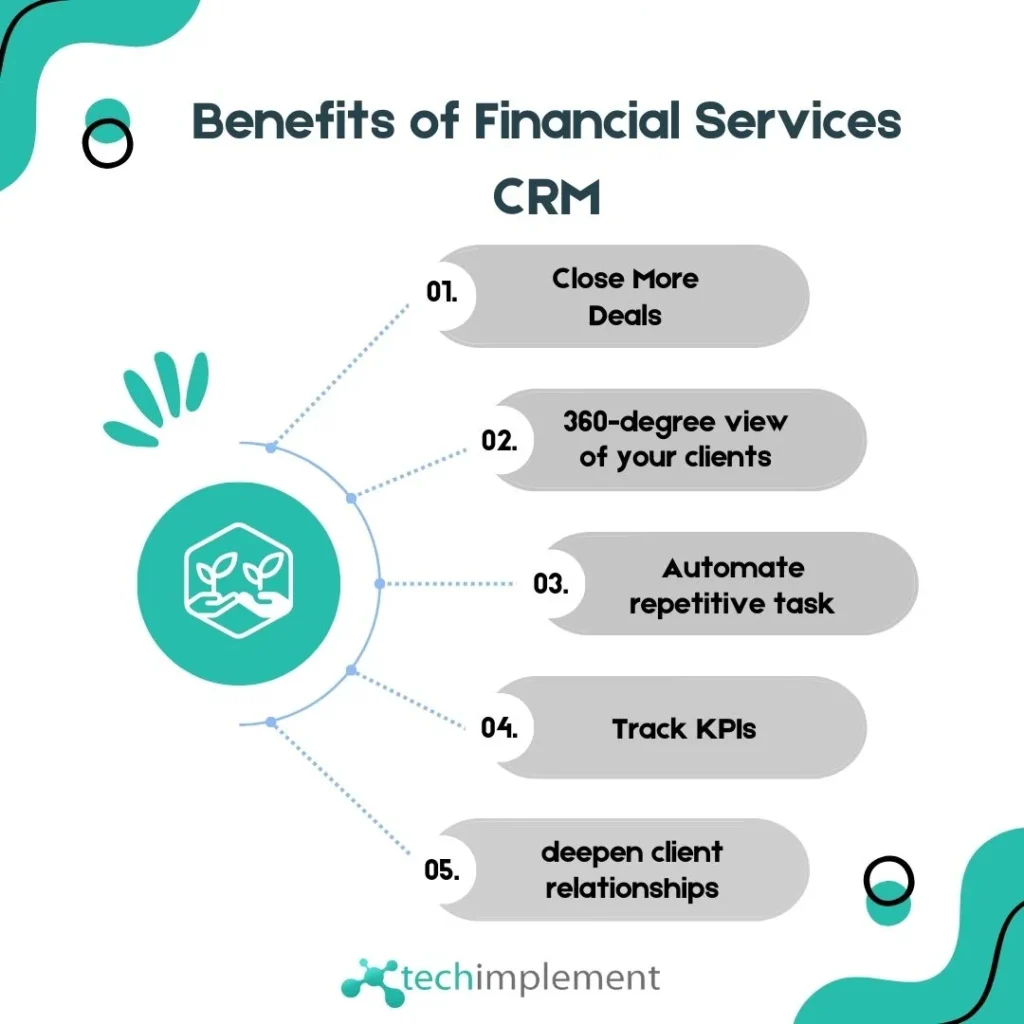

The benefits of using a CRM finance system

How to choose the right CRM finance system for your business

Best practices for implementing a CRM finance system

CRM Finance

CRM finance is a powerful tool that can help businesses improve their financial performance. By integrating CRM and finance data, businesses can gain a complete view of their customers, including their spending habits, preferences, and profitability. This information can be used to make better decisions about marketing, sales, and customer service.

- Key aspect: Data integration

- Key aspect: Customer insights

- Key aspect: Improved decision-making

- Key aspect: Increased profitability

- Key aspect: Competitive advantage

- Key aspect: Return on investment

For example, a business might use CRM finance data to identify its most profitable customers. This information can then be used to target these customers with special offers and discounts. CRM finance data can also be used to track the effectiveness of marketing campaigns and to identify areas for improvement.

Overall, CRM finance is a valuable tool that can help businesses improve their financial performance. By integrating CRM and finance data, businesses can gain a complete view of their customers and make better decisions about marketing, sales, and customer service.

Key aspect

Data integration is the key to unlocking the full potential of CRM finance. By integrating CRM and finance data, businesses can gain a complete view of their customers, including their spending habits, preferences, and profitability. This information can then be used to make better decisions about marketing, sales, and customer service.

For example, a business might use CRM finance data to identify its most profitable customers. This information can then be used to target these customers with special offers and discounts. CRM finance data can also be used to track the effectiveness of marketing campaigns and to identify areas for improvement.

Overall, data integration is essential for businesses that want to improve their financial performance. By integrating CRM and finance data, businesses can gain a complete view of their customers and make better decisions about marketing, sales, and customer service.

Here are some of the challenges of data integration:

- Data silos: Data is often stored in different systems, making it difficult to integrate.

- Data quality: Data can be inaccurate or incomplete, making it difficult to use for decision-making.

- Data security: Data integration can create security risks, as data is shared between different systems.

Despite these challenges, data integration is essential for businesses that want to improve their financial performance. By overcoming these challenges, businesses can gain a complete view of their customers and make better decisions about marketing, sales, and customer service.

Key aspect

Customer insights are the key to driving business success. By understanding what customers want and need, businesses can develop products and services that meet their needs and build lasting relationships. CRM finance can provide businesses with valuable customer insights that can be used to improve marketing, sales, and customer service.

-

Customer segmentation

CRM finance data can be used to segment customers into different groups based on their spending habits, preferences, and profitability. This information can then be used to target each segment with personalized marketing campaigns and offers.

-

Customer lifetime value

CRM finance data can be used to calculate the lifetime value of each customer. This information can then be used to make decisions about which customers to invest in and how to best serve them.

-

Customer churn

CRM finance data can be used to identify customers who are at risk of churning. This information can then be used to develop strategies to retain these customers.

-

Customer satisfaction

CRM finance data can be used to track customer satisfaction levels. This information can then be used to identify areas for improvement and to develop strategies to increase customer satisfaction.

By providing businesses with valuable customer insights, CRM finance can help them improve their marketing, sales, and customer service efforts. This can lead to increased revenue, profitability, and customer loyalty.

Key aspect

CRM finance provides businesses with the data and insights they need to make better decisions about marketing, sales, and customer service. By integrating CRM and finance data, businesses can gain a complete view of their customers, including their spending habits, preferences, and profitability. This information can then be used to make more informed decisions about:

-

Which customers to target with marketing campaigns

CRM finance data can be used to identify the most profitable customers and to develop targeted marketing campaigns that are more likely to generate a positive return on investment.

-

Which products and services to develop

CRM finance data can be used to identify the products and services that are most popular with customers and to develop new products and services that meet their needs.

-

How to price products and services

CRM finance data can be used to determine the optimal price point for products and services, based on customer demand and profitability.

-

How to improve customer service

CRM finance data can be used to identify areas where customer service can be improved and to develop strategies to increase customer satisfaction.

By providing businesses with the data and insights they need to make better decisions, CRM finance can help them improve their financial performance and achieve their business goals.

Key aspect

CRM finance can help businesses increase profitability in a number of ways. By providing businesses with a complete view of their customers, including their spending habits, preferences, and profitability, CRM finance can help businesses make better decisions about marketing, sales, and customer service. This can lead to increased revenue, reduced costs, and improved customer loyalty, all of which can contribute to increased profitability.

-

Increased revenue

CRM finance can help businesses increase revenue by identifying the most profitable customers and developing targeted marketing campaigns that are more likely to generate a positive return on investment. Additionally, CRM finance can help businesses identify opportunities to upsell and cross-sell products and services to existing customers.

-

Reduced costs

CRM finance can help businesses reduce costs by identifying areas where they can streamline their operations. Additionally, CRM finance can help businesses identify and eliminate waste and fraud.

-

Improved customer loyalty

CRM finance can help businesses improve customer loyalty by providing them with a better customer experience. By understanding what customers want and need, businesses can develop products and services that meet their needs and build lasting relationships. Additionally, CRM finance can help businesses identify and resolve customer issues quickly and efficiently.

Overall, CRM finance can help businesses increase profitability by providing them with the data and insights they need to make better decisions about marketing, sales, and customer service. By leveraging the power of CRM finance, businesses can improve their financial performance and achieve their business goals.

Key aspect

In today’s competitive business environment, it is more important than ever for businesses to have a competitive advantage. CRM finance can provide businesses with a competitive advantage by providing them with the data and insights they need to make better decisions about marketing, sales, and customer service.

For example, CRM finance can help businesses identify their most profitable customers. This information can then be used to target these customers with special offers and discounts. CRM finance can also be used to track the effectiveness of marketing campaigns and to identify areas for improvement.

Overall, CRM finance can provide businesses with a competitive advantage by helping them to:

- Identify and target their most profitable customers

- Develop more effective marketing campaigns

- Improve customer service

- Make better decisions about pricing

- Reduce costs

In short, CRM finance can help businesses to improve their financial performance and achieve their business goals.

| Benefit | Example |

|---|---|

| Increased revenue | A business can use CRM finance to identify its most profitable customers and target them with special offers and discounts. This can lead to increased sales and revenue. |

| Reduced costs | A business can use CRM finance to identify areas where it can streamline its operations and reduce costs. |

| Improved customer loyalty | A business can use CRM finance to identify and resolve customer issues quickly and efficiently. This can lead to improved customer satisfaction and loyalty. |

Key aspect

Return on investment (ROI) is a key aspect of CRM finance. It is a measure of the financial benefit that a business receives from investing in a CRM system. ROI can be calculated by comparing the cost of the CRM system to the benefits that it generates. CRM finance can help businesses to improve their ROI by providing them with the data and insights they need to make better decisions about marketing, sales, and customer service. For example, CRM finance can help businesses identify their most profitable customers. This information can then be used to target these customers with special offers and discounts. CRM finance can also be used to track the effectiveness of marketing campaigns and to identify areas for improvement.

By providing businesses with the data and insights they need to make better decisions, CRM finance can help them to improve their ROI. In fact, a study by Nucleus Research found that businesses that use CRM systems can achieve an average ROI of 387%. This means that for every $1 invested in a CRM system, businesses can expect to see a return of $3.87.

Here are some of the ways that CRM finance can help businesses to improve their ROI:

| Benefit | Example |

|---|---|

| Increased revenue | A business can use CRM finance to identify its most profitable customers and target them with special offers and discounts. This can lead to increased sales and revenue. |

| Reduced costs | A business can use CRM finance to identify areas where it can streamline its operations and reduce costs. |

| Improved customer loyalty | A business can use CRM finance to identify and resolve customer issues quickly and efficiently. This can lead to improved customer satisfaction and loyalty. |

CRM Finance FAQs

CRM finance is a powerful tool that can help businesses improve their financial performance. However, many businesses are still not using CRM finance to its full potential. Here are some of the most frequently asked questions about CRM finance:

Question 1: What is CRM finance?

CRM finance is the integration of customer relationship management (CRM) and financial data. It provides businesses with a complete view of their customers, including their spending habits, preferences, and profitability. This information can then be used to make better decisions about marketing, sales, and customer service.

Question 2: What are the benefits of using CRM finance?

CRM finance offers a number of benefits, including:

- Increased revenue

- Reduced costs

- Improved customer loyalty

- Improved decision-making

- Competitive advantage

- Return on investment

Question 3: How do I choose the right CRM finance system for my business?

There are a number of factors to consider when choosing a CRM finance system, including:

- The size of your business

- Your industry

- Your budget

- Your specific business needs

Question 4: How do I implement a CRM finance system?

Implementing a CRM finance system can be a complex process. However, there are a number of resources available to help you, including:

- CRM finance software vendors

- CRM finance consultants

- Online resources

Question 5: How do I measure the success of my CRM finance system?

There are a number of ways to measure the success of your CRM finance system, including:

- Increased revenue

- Reduced costs

- Improved customer loyalty

- Improved decision-making

- Competitive advantage

- Return on investment

Question 6: What are the common challenges of CRM finance?

Some common challenges of CRM finance include:

- Data integration

- Data quality

- Data security

- Cost

- Complexity

Summary of key takeaways or final thought:

CRM finance is a powerful tool that can help businesses improve their financial performance. However, it is important to carefully consider the challenges and benefits of CRM finance before implementing a system. By doing your research and choosing the right system for your business, you can maximize the benefits of CRM finance and improve your bottom line.

Transition to the next article section:

CRM finance is just one of the many ways that businesses can improve their financial performance. In the next section, we will discuss other financial management strategies that can help you achieve your business goals.

CRM Finance Tips

CRM finance can be a powerful tool for businesses of all sizes. By integrating customer relationship management (CRM) and financial data, businesses can gain a complete view of their customers, including their spending habits, preferences, and profitability. This information can then be used to make better decisions about marketing, sales, and customer service.

Tip 1: Use CRM finance to identify your most profitable customers.

Once you know who your most profitable customers are, you can focus your marketing and sales efforts on these customers. This can lead to increased revenue and profitability.

Tip 2: Use CRM finance to track the effectiveness of your marketing campaigns.

By tracking the results of your marketing campaigns, you can see which campaigns are most effective and which campaigns need to be improved. This information can help you improve your marketing ROI.

Tip 3: Use CRM finance to identify areas where you can reduce costs.

By understanding your customers’ spending habits, you can identify areas where you can reduce costs. For example, you may be able to negotiate better deals with your suppliers or reduce your marketing expenses.

Tip 4: Use CRM finance to improve your customer service.

By understanding your customers’ needs and preferences, you can improve your customer service. This can lead to increased customer satisfaction and loyalty.

Tip 5: Use CRM finance to make better decisions about pricing.

By understanding your customers’ willingness to pay, you can set prices that are both profitable for your business and attractive to your customers.

CRM finance can be a valuable tool for businesses of all sizes. By following these tips, you can use CRM finance to improve your financial performance and achieve your business goals.

Conclusion:

CRM finance is a powerful tool that can help businesses improve their financial performance. By integrating CRM and financial data, businesses can gain a complete view of their customers and make better decisions about marketing, sales, and customer service. By following the tips in this article, you can use CRM finance to improve your bottom line and achieve your business goals.

CRM Finance Conclusion

CRM finance is a powerful tool that can help businesses improve their financial performance. By integrating CRM and financial data, businesses can gain a complete view of their customers, including their spending habits, preferences, and profitability. This information can then be used to make better decisions about marketing, sales, and customer service.

CRM finance can help businesses increase revenue, reduce costs, and improve customer loyalty. It can also provide businesses with a competitive advantage and a positive return on investment. If you are not already using CRM finance, we encourage you to consider implementing a system for your business. CRM finance can help you improve your financial performance and achieve your business goals.

Youtube Video: