Certiorari to the supreme court of nevada. Dean freeman supervising deputy attorney general tim.

Apa Fob Ftb -definisi Ftb Singkatan Finder

While this change may imply that texas has

Franchise tax bd des. On june 24 the first appellate district court of california, division three, decided an appeal in favor of the ftb that upheld the application of the sourcing income rules to nongrantor, complex trusts (paula trust et. United states supreme court case franchise tax bd. Contrary to what the name implies, a franchise tax is.

California imposes a corporate franchise tax geared to income. The smiths paid the additional taxes but continued to dispute the ftb's determination and, in 2015, the smiths filed a lawsuit seeking a refund of the additional taxes. (1964) 231 cal.app.2d 278, 284.

Log in to your myftb account. Discover short videos related to franchise tax bd casttaxrfd on tiktok. (mar 12, 2015) berjikian v.

The franchise tax here involved is that for the tax year ending august 1952, based on plaintiff's earnings for its tax year ending august 31, 1951. During that period plaintiff's principal income was derived from the production and sale of petroleum and petroleum products in more than a score of states, including california, and in foreign countries. I think in 2013 i did end up owing right around the amount that was.

The new margin tax incorporates the i.r.c. Argued january 9, 2019—decided may 13, 2019. D054439 san diego county superior court case no.

Franchise tax bd., 463 u. That would be your california refund only. Attorney general of california paul d.

United states district court, c.d. This case was closely followed by many promoters because, had the court ruled differently, it would flood the state with trusts designed to relocate source. Franchise tax board of california.

The jury found for hyatt, awarding him $1 million for fraud, $52 million for invasion of privacy, $85 million for emotional distress, and $250 million in punitive damages. This court (division one) rejected an equal protection argument identical to that made here and sustained the constitutionality of the statute. Franchise tax bd casttaxrfd 022117 xxxxx5 +$16.00 02/24/17 is this something from my tax return?

While a taxpayer may have more than one residence simultaneously for different purposes, a. Strauss, judge respondent's brief edmund g. Franchise tax board, defendant and respondent.

Gifford senior assistant attorney general w. 488 335 p.3d 125 578 u.s. Hyatt supreme court of the united states argued january 9, 2019 decided may 13, 2019 full case namefranchise tax board of california, petitioner v.

1683, 155 l.ed.2d 702 (2003). The ftb therefore disallowed the tax deferral with respect to the funds used to purchase the mcdowell road property and assessed additional taxes, with interest, in the amount of $129,733. 905], wherein the taxpayer claimed the right to a credit for taxes paid to canada.

File a return, make a payment, or check your refund. 2d 768 argumentoral argument decisionopinion case history prior 538 u.s. No, they send it all at once.

The deposit stands for franchise tax board california state tax refund. Beamfinancialgroup(@beamfinancialgroup), small biz attorney(@thelegalpreneur), beautiful boss(@beautiful_boss1), karlton dennis(@karltondennis), tax divva(@taxdivva). A franchise tax is a levy paid by certain enterprises that want to do business in some states.

Franchise tax bd., legal ruling no. It says “franchise tax bd des:casttaxrfd”, which google slething tells me is a ca state tax refund. Follow the links to popular topics, online services.

Respondent hyatt sued petitioner franchise tax board of california (board) in nevada state court for alleged torts committed during a tax audit. The nevada supreme court rejected the board’s argument They send a letter out in the weeks following the refund to.

Watch popular content from the following creators: Franchise tax board, 179 cal. It employs the unitary business principle and formula apportionment in applying that tax to corporations doing business both inside and outside the state.

Although the question was briefed and argued, the court was equally divided on whether to overrule hall and thus affirmed the. Subsequently, in 1996, the tax board issued an assessment of taxes,. If the refund is less than what you're expecting from the state of ca, it may be due to some kind of past due state fees (parking tickets, dmv, courts, etc) and the state has adjusted the refund.

Ftbcagov

Will You Get A Check California Readying New Round Of 600 Stimulus Payments Orange County Register

California Sending Out 2 Million 600-1100 Stimulus Payments Next Week Orange County Register

California Franchise Tax Board – Wikipedia

Franchise Tax Definition Examples How To Calculate

California Franchise Tax Board Liens How To Resolve Them Tax Resolution Professionals A Nationwide Tax Law Firm 888 515-4829

Franchise Tax Board Homepage Ftbcagov

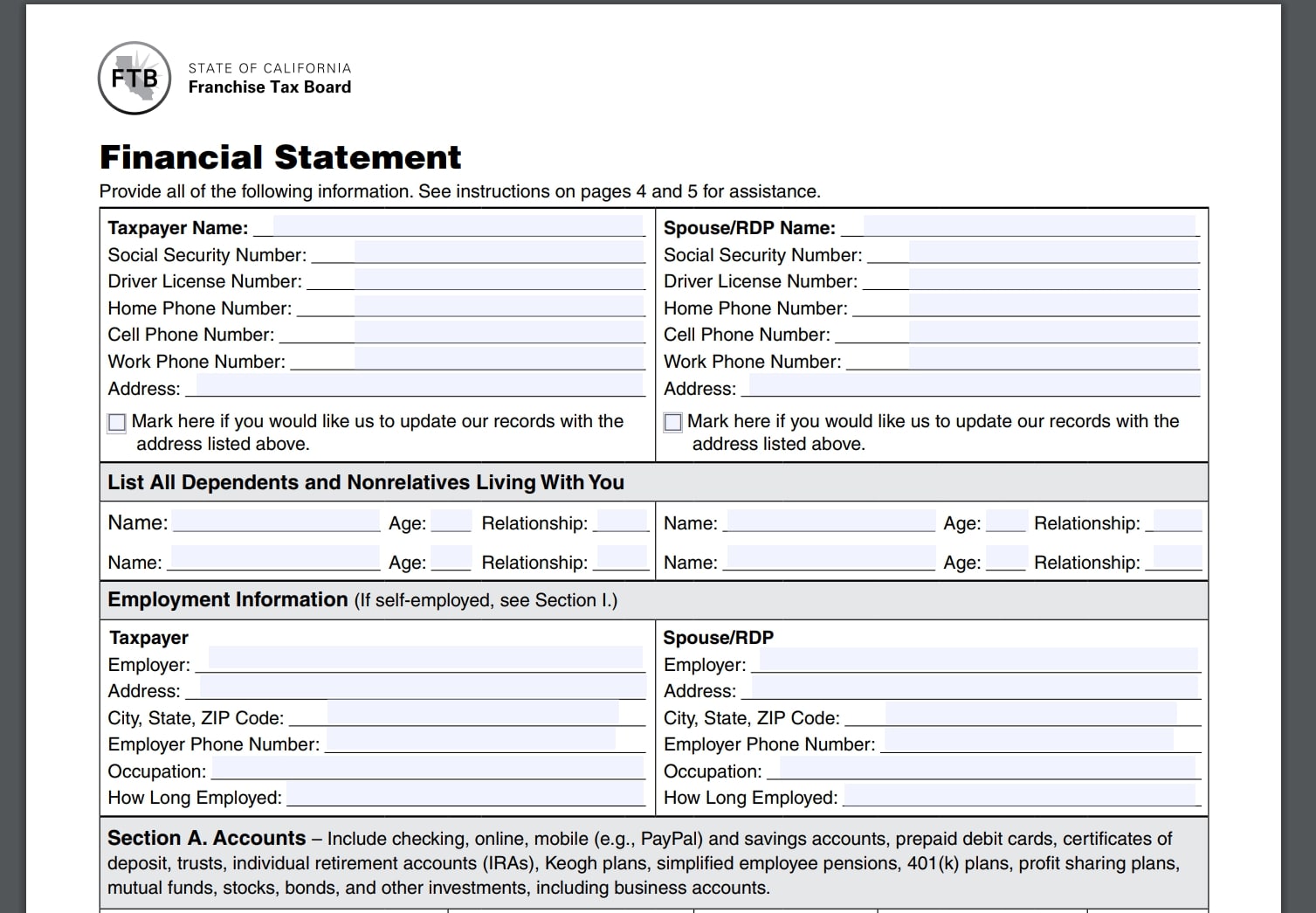

Involuntary Case Resolution Section – State Of California Case Resolution Section Levying Officer To Enter Private Property

Eldoradoarcherscom

California Franchise Tax Board Bank Levy – How To Release And Resolve Tax Resolution Professionals A Nationwide Tax Law Firm 888 515-4829

Closing Your Probate Estate Instructions Pdf Probate Debt

Ftbcagov

2011 Instructions For Form 540-es – California Franchise Tax Board

Ach Credit Franchise Tax Bd – How To Discuss

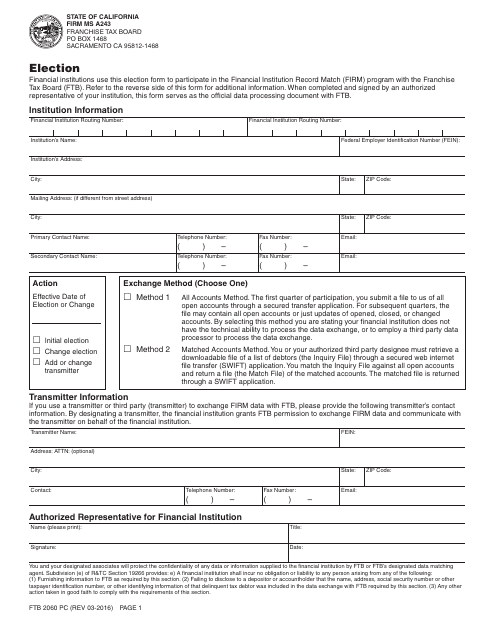

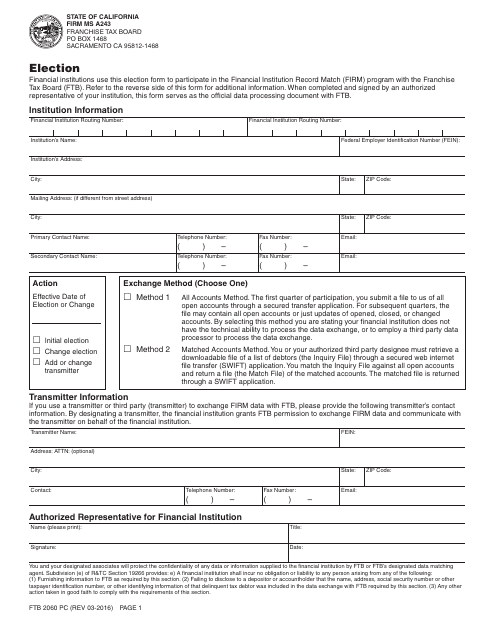

Form Ftb2060 Pc Download Fillable Pdf Or Fill Online Financial Institution Record Match Firm Election California Templateroller

Franchise Tax Board – 13 Reviews – Public Services Government – 1515 Clay St Oakland Ca – Phone Number

Central Hollywood Coalition Cleared By Franchise Tax Board Of All Fiscal Wrongdoing Tax Exempt Status Reinstated After Months Of Struggle And It Wasnt An Audit After All Michael Kohlhaas Dot Org

Stop Wage Garnishments From The California Franchise Tax Board Tax Resolution Professionals A Nationwide Tax Law Firm 888 515-4829

Franchise Tax Board Homepage Ftbcagov