This means that the reit does not pay any corporate tax in exchange for paying out strong, consistent dividends. As per current rules, dividends obtained from reits are completely taxable in the hands of the investor.

India – Implications Of The Finance Bill 2020 On Invits Reits And Its Unitholders Conventus Law

While the redistributive principals of taxation are met with the removal of ddt, the potential effective tax for the resident individual taxpayer now peaks at 35.88%.

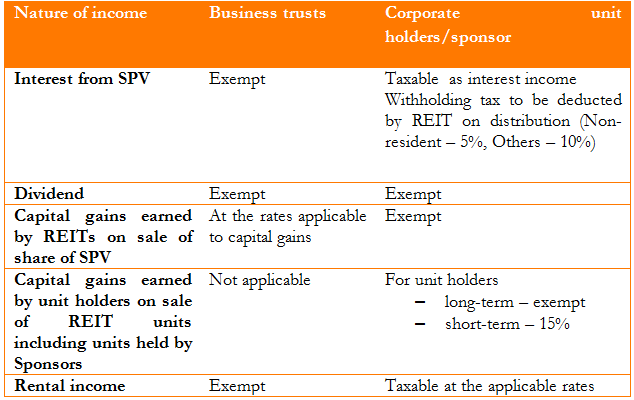

Reit dividend taxation india. Interest income paid by spv: India has traditionally been a high tax jurisdiction with specific profit repatriation taxes. When adjusted for the 25.17% effective corporate tax by the dividend paying company the effective tax rate is ~52%.

The dividends distributed by reits are tax free in the investors’ hands. However, dividend income of an By 2026, the rate will be 6%, plus a third.

The reit is also exempt from tax on its rental income, which it may have earned if it owned a property. Rental income distributed by reit: Unit holders are taxed at the same rate at which reits are taxed.

Reits will pay the dividend distribution tax. How is income from reits taxed? Reit platform will encourage all kinds of investors to invest in the indian real estate market.

Taxation works the same for all reits except for dividend income. A qualified reit dividend typically has a 29 percent effective tax rate if you take into account the 20% deduction. Dividend income distributed by reit:

Reits having the highest non taxable portion of ndcf are likely to gain higher interest among investors. The government to allow foreign investments in reits and rationalisation of the taxation regime is expected to enable the launch of successful reit listings in india. Dividend distribution tax replaced with dividend withholding tax:

Investment income is subject to an 8% surtax. Investment income is subject to an 8% surtax. There are no proper standards,procedures or benchmarks in india for property valuations.

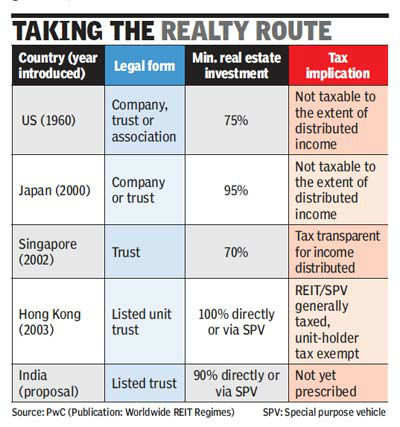

Worldwide real estate investment trust (reit) regimes compare and contrast 2 introduction 3 australia 4 belgium 6 brazil 11 bulgaria 14 canada 17 finland 20 france 23 germany 27 greece 30 hong kong 34 hungary 37 india 41 ireland 46 italy 49 japan 53 luxembourg 56 malaysia 60 mexico 64 new zealand 68 singapore 70 south africa 75 south korea 80 spain 83 taiwan 86 thailand 88 the netherlands 90 Dividend income received by reit from spv: Dividend payouts from reits are included in the annual income of the investor and taxed according to the investor’s slab rate for the applicable financial year.

By 2026, the rate will be 6%, plus a third. Also as hemal mehta, partner, deloitte india, explains, before the interest and dividend are paid out, a 10 per cent withholding tax (for resident investors) is deducted by the invit/ reit. W.e.f 1st april 2020, the dividends are taxable in the investors’ hands.

A qualified reit dividend typically has a 29 percent effective tax rate if. Dividends from reit companies are taxed at a maximum rate of 37% (returning to 39 percent). It depends on the tax regime the spvs had opted for.

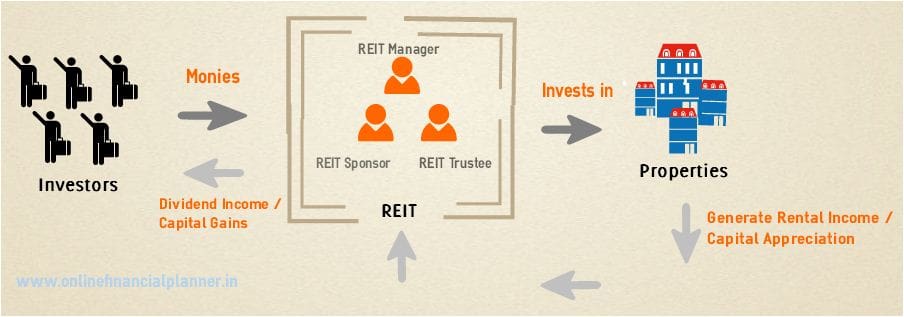

The interest and dividends received by the reit/invit from the spvs is exempt from tax. Dividends from reit companies are taxed at a maximum rate of 37% (returning to 39 percent). How to invest in reits in india

It would create an opportunity worth $19.65 billion in the indian market over the years.

What Is Reit India Whether To Invest Or Avoid – Getmoneyrich

One More Push Required By Govt For Popularising Reits Real Estate News Et Realestate

Ddt Proposed Dividend Distribution Tax On Invits Reits May Hit Six Planned Trusts – The Economic Times

India – Update Tax Implications On Invits Reits And Its Unitholders Under Finance Act 2020 Conventus Law

Indias First Reit Is Finally Here Should You Invest

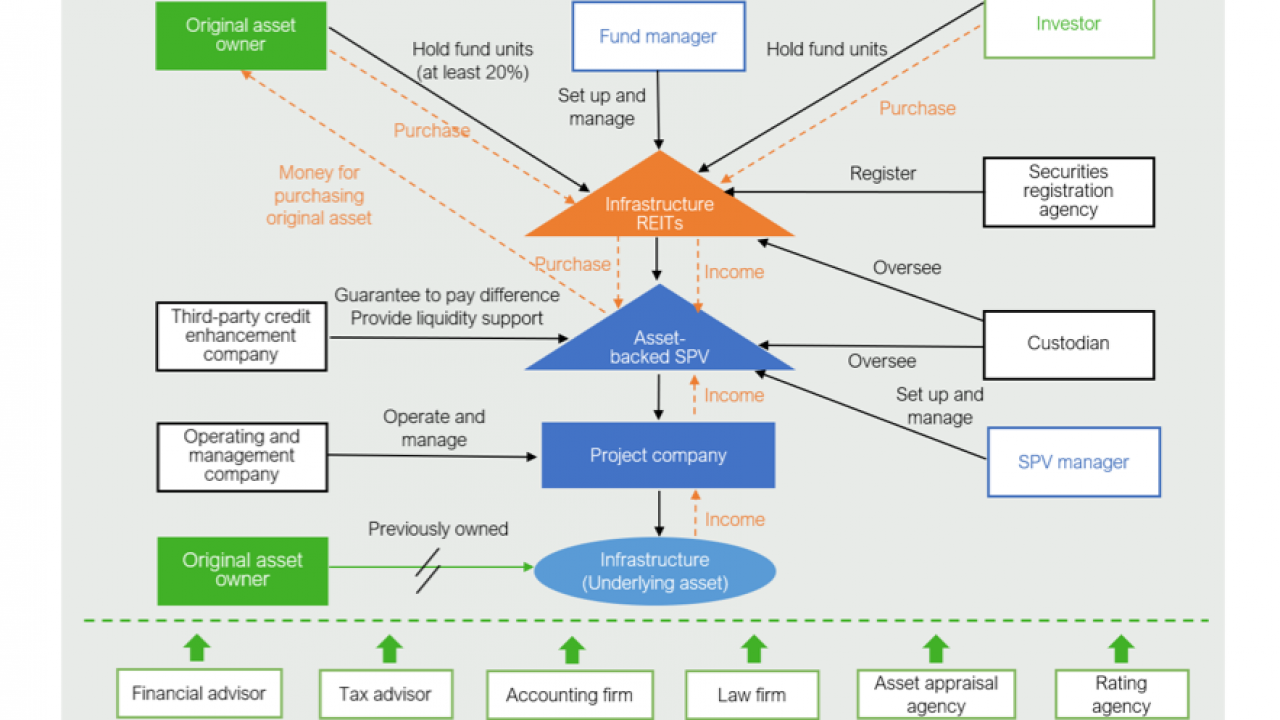

Chinas Infrastructure Reits Program Faces A Bumpy Path – Asia Financial News

Reits Real Estate Investment Trusts And Tax – Tax – Worldwide

Embassy Office Parks Reit Public Issue Mar 2019 – Analysis Review

Reits Face Tax Clouds Regulatory Hurdles – Times Of India

Part Iv Taxation Of Reits In India India Corporate Law

Reits In India – Features Pros Cons Tax Implications

Reits In India – Features Pros Cons Tax Implications

Tax On Dividend Income In The Philippines 2020 – Kg Consult Group Inc

Taxation On Embassy Reit Dividend – Stocks – Trading Qa By Zerodha – All Your Queries On Trading And Markets Answered

How Income Tax Rules Help Reit Investors Earn More In Long Term

Reits To Lure Investors With Tax-free Dividends And Capital Returns Business Standard News

Reits To Lure Investors With Tax-free Dividends And Capital Returns Business Standard News

How Invit Reit Income Is Taxed – The Hindu Businessline

Which Is The Best Reit In India Capitalmind – Better Investing