How to calculate taxes taken out of a paycheck. Alternatively, you can use the range of tax tables we produce.

Federal Income Tax Fit – Percent Method – How To Calculate Fit Using Percent Method – Youtube

Divide the sum of all assessed taxes by the employee’s gross pay to determine the percentage of taxes deducted from a paycheck.

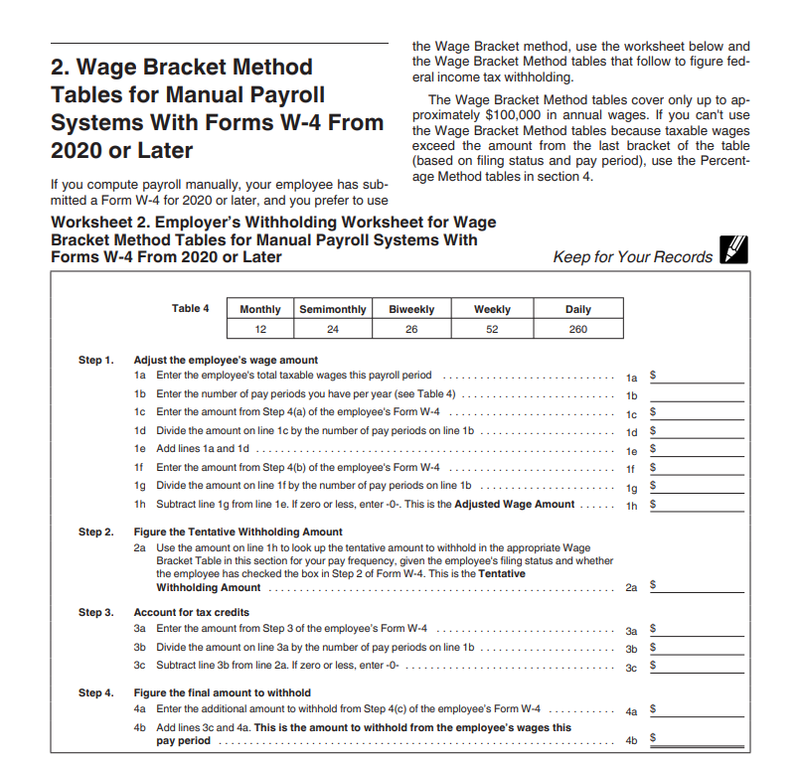

How to calculate tax withholding for employee. Tax withholding is simply the chunk of money your employer sets aside from each paycheck to cover your taxes. Employee federal tax withholding 2021. Please select a pay period.

For each category of recipients, it is calculated differently. The gross pay for a salaried employee is the amount of salary for that period (usually, the employee's annual salary divided by the number of pay periods). The easiest and quickest way to work out how much tax to withhold is to use our online tax withheld calculator.

Please enter values where employee's gross earnings are neither equal to nor less than the total of withholdings. How do you calculate fit withholding? However, the 6.2% that you pay only applies to income up to the social security tax cap, which for 2021 is $142,800 (up from $137,700 in 2020).

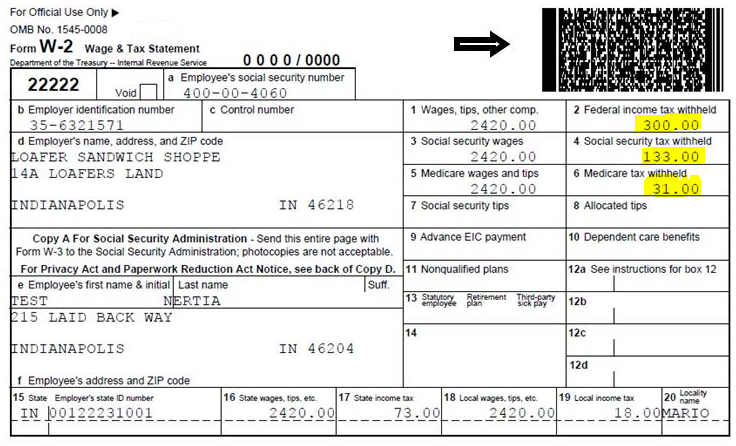

For example, the retention tax on wages is calculated as per the withholding table and. When you pay salary to your employee, at the end of year ( or when your employee leaves your company mid of year, at the timing of payment of last salary ), you need to provide your employee ” withholding tax slip = statement of earnings of earned income ( gensen choshu hyo = 源泉徴収票 )”. How to calculate withholding tax?

Small businesses need to calculate withholding tax to know how much money they should take from employee paychecks to send to the internal revenue service to cover tax payments. Withhold too much, and you’ll get a tax refund. Examples for calculating withholding tax

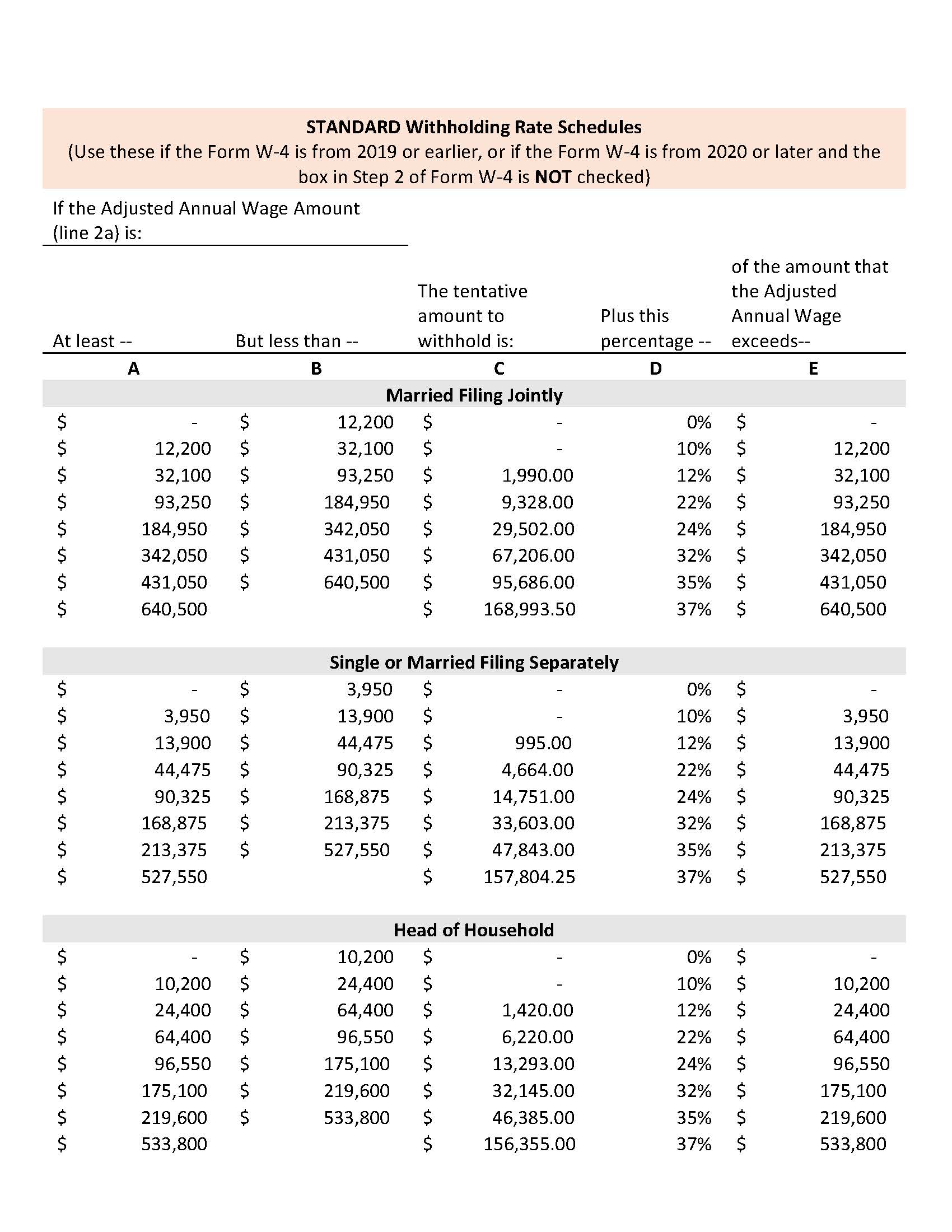

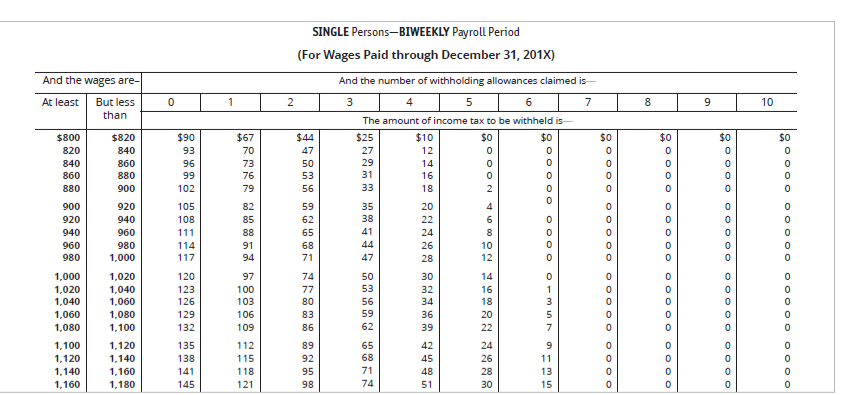

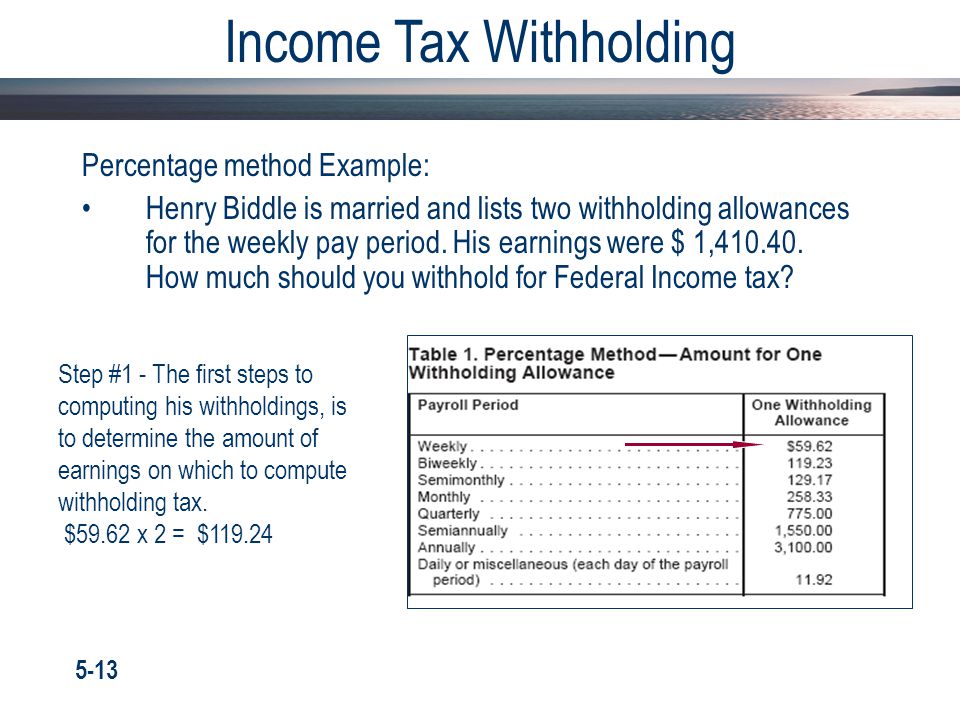

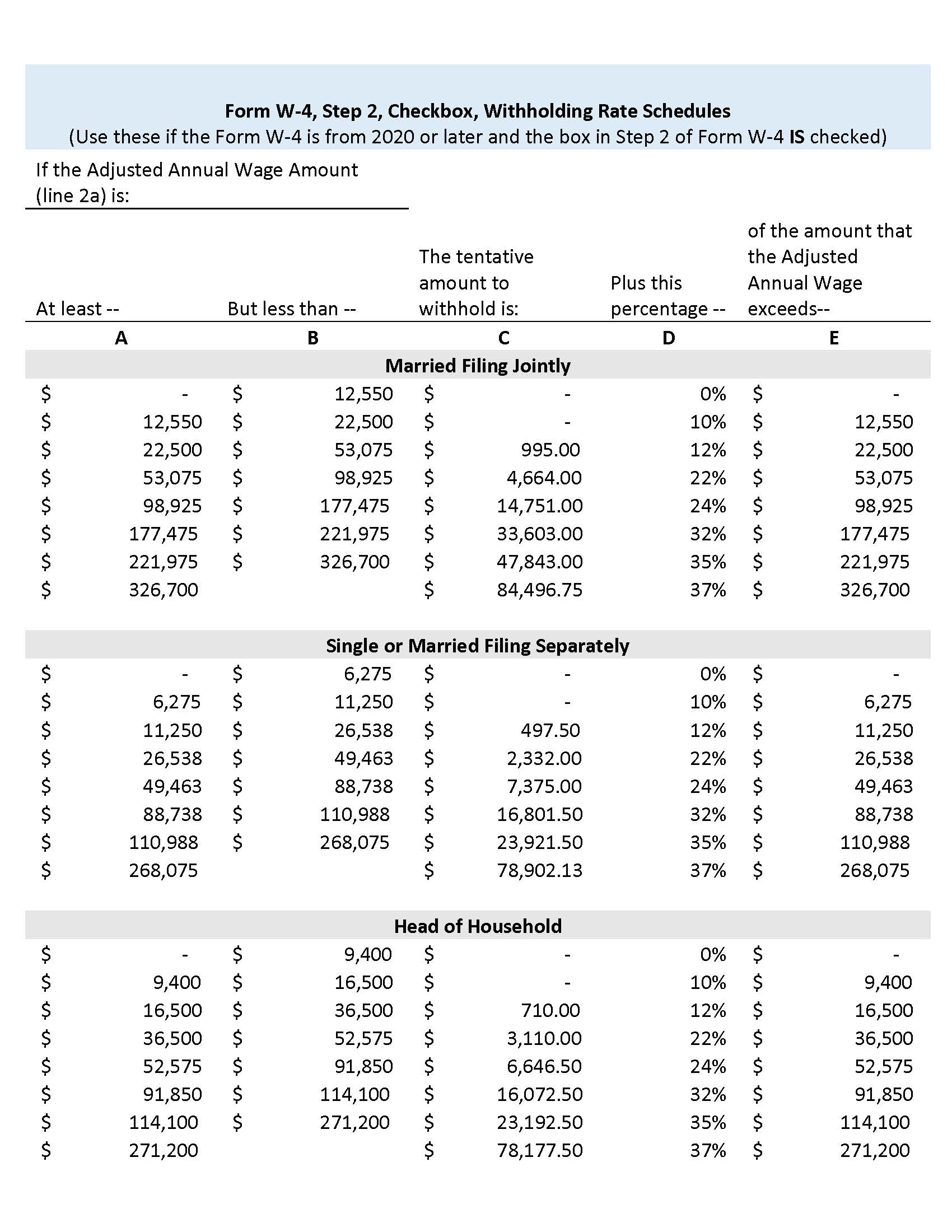

6.2% of each of your paychecks is withheld for social security taxes and your employer contributes a further 6.2%. There are two main methods for determining an employee’s federal income tax withholding: Amount sent for higher order:

Gather the most recent pay statements for yourself, and if you are married, for your spouse too. The maximum tax possible is $8,853.60. Fica contributions are shared between the employee and the employer.

Accordingly, the withholding tax due computed by the calculator cannot be used as basis of. Even though tax returns are due in april, you pay your tax bill a little at a time all year long through a process called tax withholding. To calculate the amount of social security and/or medicare withheld from your paycheck, calculate your taxable gross:

Begin your calculation with the employee's gross pay amount for a given pay period, then calculate the social security and medicare withholding. Gather information for other sources of income you may have. Open the tax withholding assistant and follow these steps to calculate your employees’ tax withholding for 2022.

Have your most recent income tax return handy. Keep in mind that the tax withholding estimator’s results will only be as accurate as the information you enter. Social security is calculated at 6.2% of taxable gross up to $142,800.00.

August 20, 2021 by trafalgar d. This tax calculator assists you identify simply how much withholding allowance or extra withholding must be documented on your w4 form. It requires multiplying the amount of one withholding tax by the number of allowances the employee claims, subtracting that from the employee’s wages and then finding the range for that number to calculate the tax amount.

This estimator may be used by almost all taxpayers. Employees should fill out and return these forms as soon as they're hired. The application is simply an automated computation of the withholding tax due based only on the information entered into by the user in the applicable boxes.

Paycheck Calculator – Take Home Pay Calculator

How To Determine Your Total Income Tax Withholding Tax-ratesorg

Verify Taxes Withheld – Procare Support

Calculation Of Federal Employment Taxes Payroll Services The University Of Texas At Austin

Withholding Taxes How To Calculate Payroll Withholding Tax Using The Percentage Method – Youtube

Solved Compute The Net Pay For Each Employee Using The Cheggcom

Payroll Tax What It Is How To Calculate It Bench Accounting

Payroll Tax Vs Income Tax Whats The Difference The Blueprint

Federal Income Tax Fit – Payroll Tax Calculation – Youtube

Determining Payroll Deductions – Ppt Download

How To Calculate Payroll Taxes For Your Small Business The Blueprint

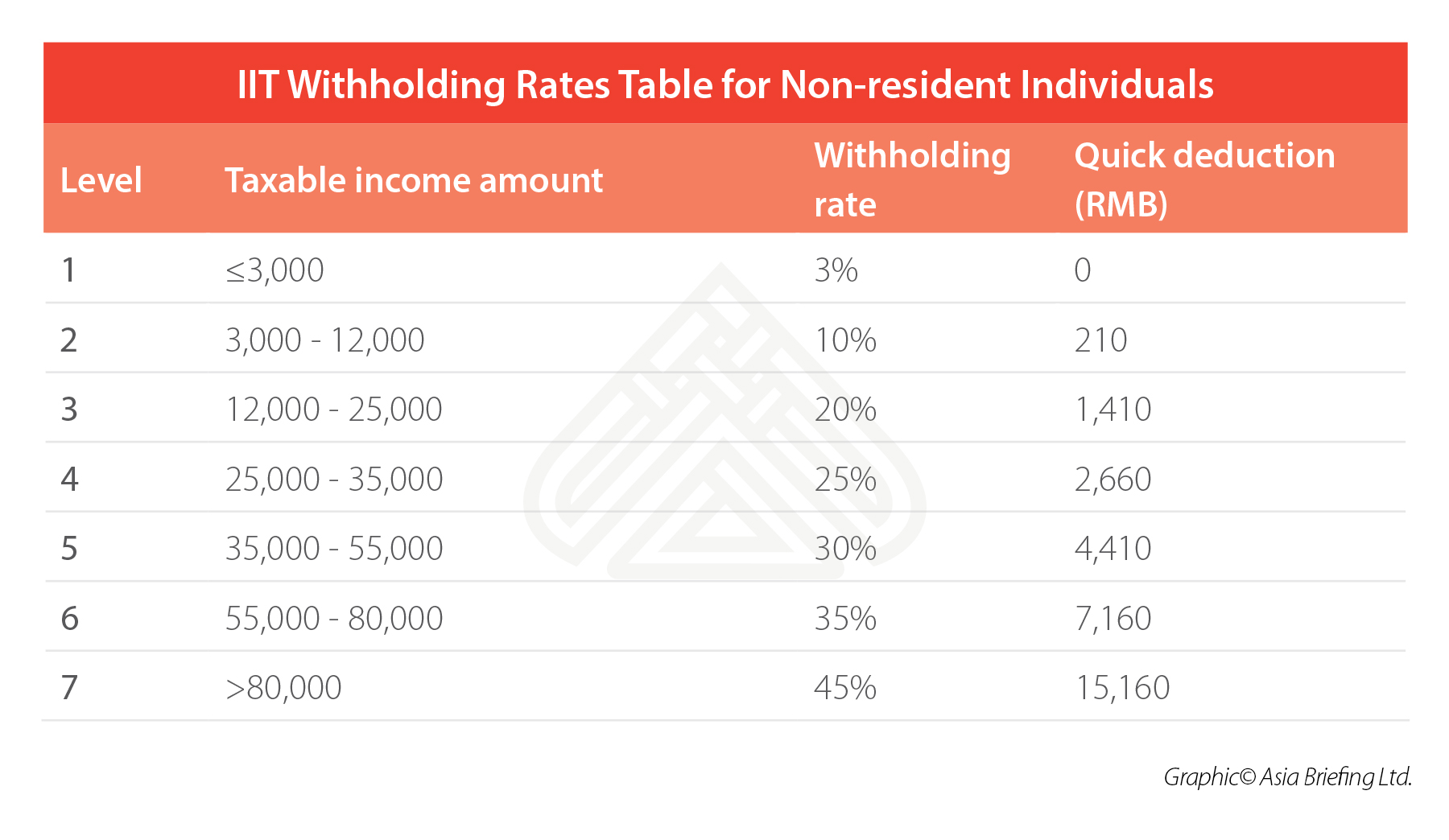

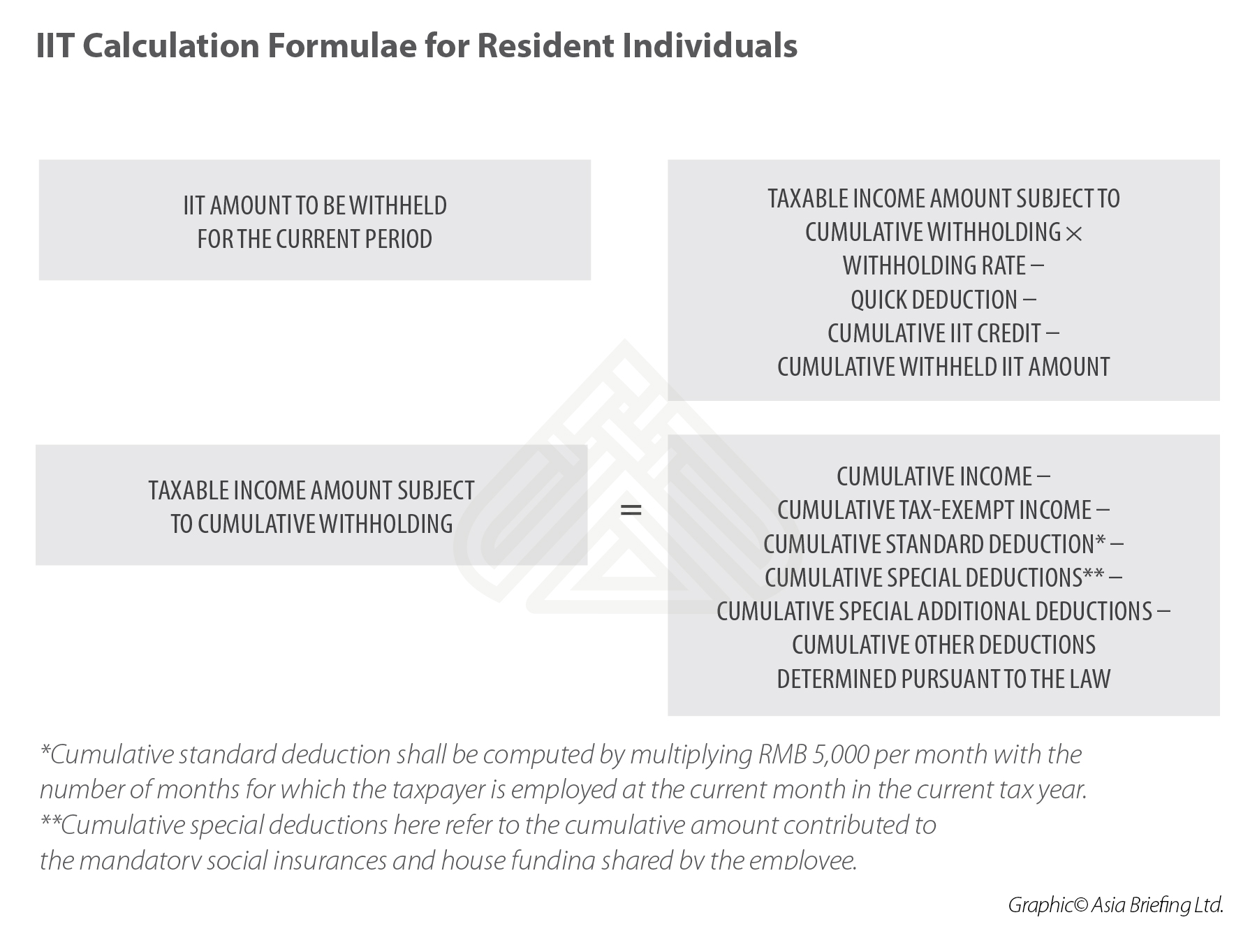

How To Calculate And Withhold Iit For Your Employees In China

Calculation Of Federal Employment Taxes Payroll Services The University Of Texas At Austin

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

How To Calculate And Withhold Iit For Your Employees In China

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Irs Improves Online Tax Withholding Calculator Cpa Practice Advisor

How To Calculate Payroll Taxes For Your Small Business The Blueprint

How To Calculate Payroll Taxes For Your Small Business The Blueprint