Before you enter law school, you need to be a holder of a baccalaureate degree and must meet certain number of units of certain subjects in your college transcript (di ko tanda pero merong required number of units in english, social studies and even the mandatory rizal. Ad study the cpa program with the level of support you need to succeed.

Mission History – Aaa-cpa

Many employers prefer to hire accountants who possess cpa certification.

How to become cpa lawyer. Study the cpa program with the level of support you need to succeed. The exact amount of time that will take you to become a cpa will depend on your prior experience and the rules in your state. How to be a cpa lawyer in the philippines.

Study the cpa program with the level of support you need to succeed. Ad study the cpa program with the level of support you need to succeed. So i looked into doing international tax, state and local tax, etc.

First, apply to become a cpa australia member, complete the cpa programme, meet your experience requirements, make sure you have a degree. The requirements for obtaining a cpa license are demanding, with a recommended 150 credit hours of higher education, several years of field experience, and passing the rigorous cpa exam. After law school and obtaining my cpa license, i knew i wanted to begin working in an area of law that had an emphasis on tax.

Then you're officially a cpa, and can use the cpa designation to enhance your personal brand. A cpa is a certified public accountant and is licensed by the state. By attaining a cpa license, accountants can boost their career outlook, job security, and earning potential.

But before getting to all the benefits of cpa/lawyer superstardom, there is the little matter of going to law school. David klasing for example, has a master’s degree in taxation. Cpa certification is a professional recognition most beneficial for ca, cs, mba, financial advisors, cost accounting professionals, etc.

Since most states require 150 semester credit hours to become a cpa, you may need to obtain a master's degree to meet this requirement. Apply for a summer internship at a tax law firm after your first year of law school to gain valuable experience and increase your chances of finding employment after graduation. Following that year, i studied for and passed the cpa exam.

While many lawyers we’ve talked to have said that the law school you attend is everything, it really depends on what you’re looking to accomplish with the degree. Don't wait, apply to become a cpa today. If you are unsure whether your qualify to sit for the exam, nasba provides an education checklist and details on their website.

Earn your juris doctor degree (jd), which typically takes three years. In most states, you’re required to have 150 hours of college credit, as well as two years of professional accounting experience before you can sit for the cpa exam. Tax attorneys also go through a rigorous educational process during law school and must pass the notoriously difficult bar exam before being licensed as an attorney.

Certified public accountant (cpa) certification confirms an accountant’s skills in taxation, auditing, regulatory compliance, and financial analysis. Tax attorneys usually have some specialized training or certification in the complex field of tax law. Link to how to become a lawyer in the philippines:

Once this step is completed, they must acquire at. Lawyers can obtain the cpa designation by completing 150 semester hours of education at the undergraduate or graduate level. In california, to earn the prestige associated with the cpa license, individuals are required to demonstrate their knowledge and competence by passing the uniform cpa exam, meeting high educational standards and completing a specified amount of general accounting.

Earn a bachelor's degree in accounting or another related financial field from an accredited college or university.

Ep 03- How Being Fired As A Lawyer Led Erin Wade To Become A Widely Successful Restauranteur – Lessons From A Quitter Success How To Get Motivated Quitters

Cpa Vs Tax Attorney Top 10 Differences With Infographics

Todays Student Success Story Features Quan Vuong Jd Llm Cpa Learn More About His Decision To Become Both A Lawyer And Cpa And Cpa Review Cpa Cpa Exam

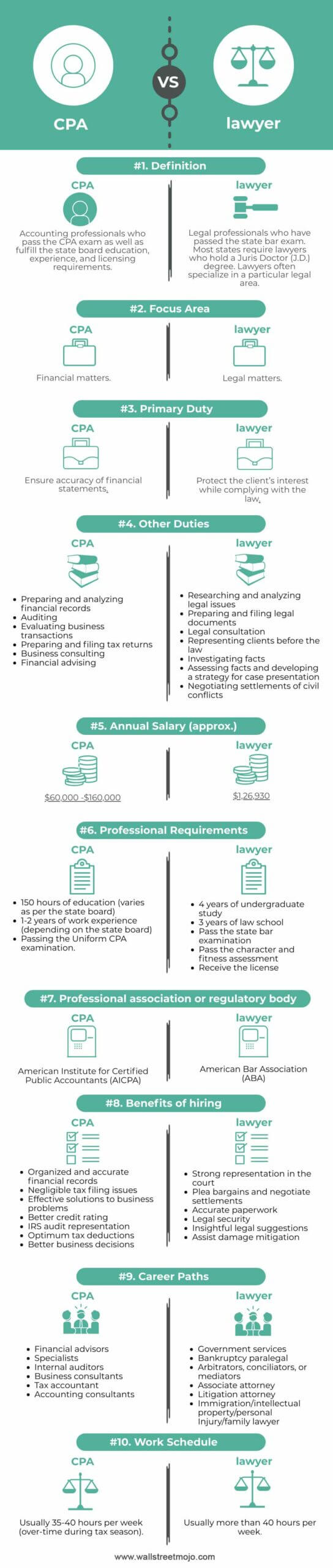

Cpa Vs Lawyer Top 10 Best Differences With Infographics

Accounting Websites Accounting Student Accounting Jobs Accounting Major

Pin On Simply Business Accounting

7 Skills Cpas Need And How To Get Them Robert Half

Cpa Vs Lawyer Top 10 Best Differences With Infographics

Differences Between Solicitors And Barristers In 2021 Barrister Solicitor Career Development

How Are The Bar Exam And Cpa Exam Different Compare And Find Out Which Is Right For You Cpaexam Cpa Bar Barexam Cpa Exam Bar Exam Bar Exam Prep

Pin By Carol Carlson On Content Marketing Legal Marketing Local Marketing Tax Lawyer

Our Active Learning Methodology Is A Proven Approach That Fuels Our Entire Program Whether Youve Been Out Of School For A Week In 2021 Cpa Exam Cpa Review Cpa Course

Pin On Accounting Career Path

Step-by-step Guides For 10 Careers Becoming A Pharmacist Nursing Jobs Pharmacist

Mchenry County Child Custody Business Personal Inury Lawyers Legal Firm Accounting Estate Planning

Hire Professionals Lawyer Quotes Real Estate Quotes Planner Quotes

The Power Of The Dual View Cpas Should Consider A Law Degree

For Fulfillment Of Such Jobs You Should Seek Quality Lawyers And Preferably An Irs Lawyer Review The Following Lin Cpa Accounting Services Financial Advisory

Pin On College