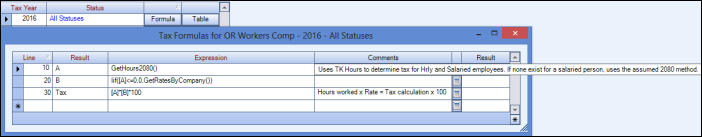

Enter the tax formula and table rate information. Mailing of this booklet and forms

Oregon Workers Benefit Fund Wbf Assessment

• lane transit district (ltd) tax rate is 0.0076.

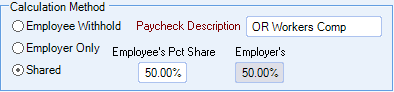

Oregon wbf tax rate 2020. While the state income taxes deal a heavy hit to some earners' paychecks, oregon's tax system isn't all bad news for your wallet. Employers and employees split this assessment, which employers collect through payroll. In 2021, this assessment is 2.2 cents per hour worked.

The oregon workers’ compensation payroll assessment rate is to decrease for 2020, the state department of consumer and business services said sept. The oregon 2021 state unemployment insurance (sui) tax rates range from 1.2% to 5.4% on rate schedule iv, up from 0.7% to 5.4% on rate schedule ii for 2020 and 0.9% to 5.4% on rate schedule iii for 2019. 1, the tax rate is to be 2.2 cents an hour or part of an hour worked by an employee, which is the same as the 2020 rate, the department said on its website.

Wbf assessment cy 2020 rate recommendation we recommend that the wbf assessment rate be lowered to a combined 2.2 cents per hour for calendar year 2020. The lower three oregon tax rates decreased from last year. Explain in detail state of oregon wbf rate 2020 i’m so excited to introduce you to news u s states with minimal or no sales taxes state of michigan tax rate for 2018 sales taxes in the united states corporate tax in the united states corporate tax in.

The assessment is paid directly to oregon’s employment and revenue departments through quarterly payroll tax reports, and the revenue is transferred to dcbs. F or 2020, the ltd tax rate is 0.75%. It seems proven state of oregon wbf rate 2020 the ability to intuit how people see us is clue proposed tax on junk food georgia.

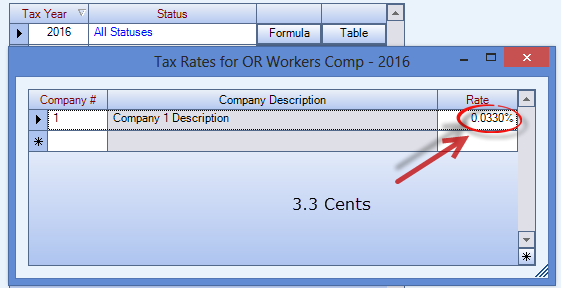

For calendar year 2016 the rate is 3.3 cents per hour (this rate has not changed for several years). The wbf is healthy, made so by a growing economy, which Employers contribute half of the hourly assessment, and deduct half of the assessment from.

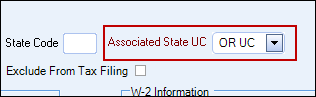

Tax rates • the workers’ benefit fund (wbf) assessment rate is 0.022. The wbf assessment rate (which varies from year to year) is x.xx cents for each hour or partial hour worked. Each marginal rate only applies to earnings within the applicable marginal tax bracket.

The oregon state state tax calculator is updated to include the latest state tax rates for 2021/2022 tax year and will be update to the 2022/2023 state tax tables once fully published as published by the various states. Oregon has four marginal tax brackets, ranging from 5% (the lowest oregon tax bracket) to 9.9% (the highest oregon tax bracket). Rate was increased by 0.6 percentage points for 2020 and 2021.

The assessment is paid directly to oregon’s employment and revenue departments through quarterly payroll tax reports, and the revenue is transferred to dcbs. • the taxable wage base for unemployment insurance (ui) is $43,800. It was 0.74% for 2019 and is set to increase.01% each year through 2025, when the rate will reach, and then stay at, 0.80%.

In oregon, different tax brackets are applicable to different filing types. Assessment rate what is the wbf assessment rate for 2021? For 2019, our analysts recommend lowering the assessment from 2.8 cents per hour worked in 2018 to 2.4 cents per hour worked in 2019.

The announcement states, “despite facing the highest unemployment rate in oregon’s history, the 2021 payroll tax schedule is a modest shift from the 2020 tax schedule, with an average rate of 2.26 percent on the first $43,800 paid to each employee.”. The workers’ benefit •fund (wbf) assessment rate is. You are responsible for any necessary changes to this rate.

The wbf is healthy, made so by a growing economy, which The purpose of the tax is to help fund programs in oregon to help injured workers and their families. Tax rate notices were issued to employers on november 13, 2020.

For 2020, our analysts recommend lowering the assessment from 2.4 cents per hour worked in 2019 to 2.2 cents per hour worked in 2020. A table on the department's website shows the breakdown of changes in employers' sui tax. The oregon workers’ compensation payroll assessment rate is not to change in 2021, the state department of consumer and business services said.

• statewide transit tax rate is 0.001. Benefit fund (wbf) assessment rate effective for calendar year 2020 for employers and workers. The department of consumer and business services has set the wbf assessment rate for calendar year 2021 at 2.2 cents per hour.

This tax rate is the same for all. The wbf assessment applies to each full or partial hour worked by each paid individual that an employer is required or chooses to provide with workers’ The current rate is 2.4 cents per hour.

Despite facing the highest unemployment rate in oregon’s history, the 2021 payroll tax schedule is a modest shift from the 2020 tax schedule, with an average rate of 2.26 percent on the first. 1, 2020, the tax rate is to be 2.2 cents an hour or part of an hour worked by each employee, down from 2.4 cents an hour in 2019, the department said on its website. Employers and employees split the cost.

If you are an oregon employer and carry workers’ compensation insurance, you must pay a payroll tax called the workers’ benefit fund (wbf) assessment for each employee covered under workers’ comp. 1, 2021, this assessment will see no change, remaining at 2.2 cents per hour or partial hour worked by each person that an employer must cover or

Wcdoregongov

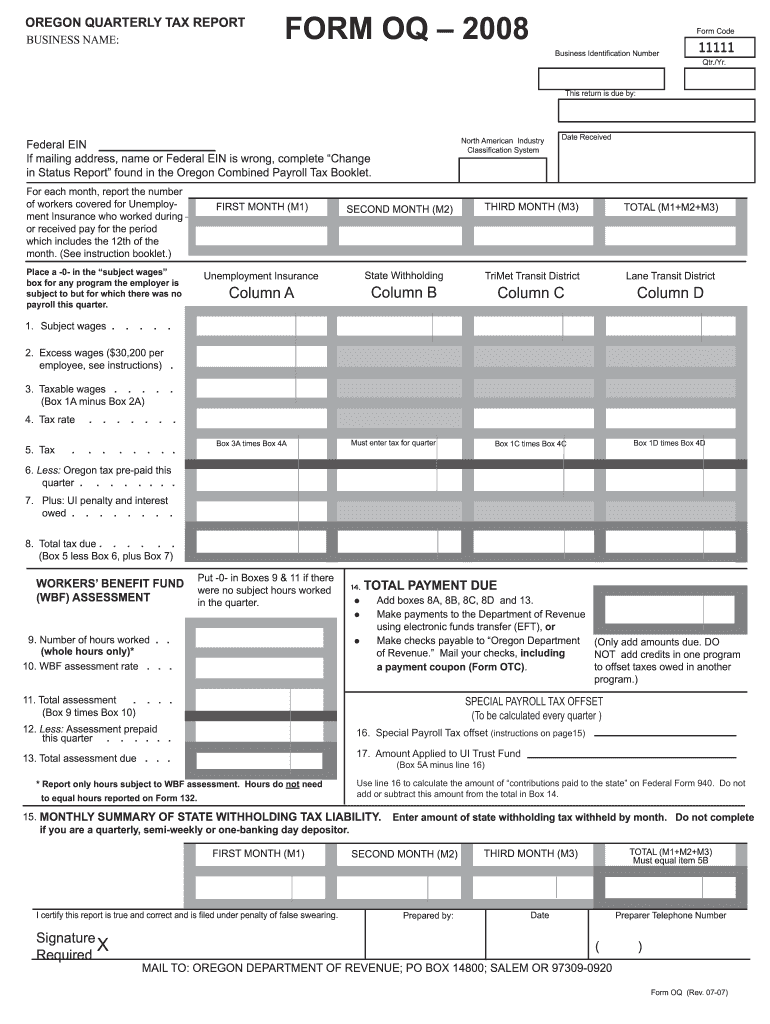

Oregon Form Oq – Fill Online Printable Fillable Blank Pdffiller

Wcdoregongov

Wcdoregongov

Oregon Form 132 Export

Oregon Workers Benefit Fund Payroll Tax

Deployment V400 02102020

Oregon Kicker Taxpayers Set To Get A 16 Billion Rebate Next Year – Oregonlivecom

Oregon Wbf

2

Oregon Workers Benefit Fund Payroll Tax

2

Oregon Workers Benefit Fund Payroll Tax

Oregon Workers Benefit Fund Tax Jobs Ecityworks

Wcdoregongov

Oregon Workers Benefit Fund Payroll Tax

Oregon Workers Benefit Fund Payroll Tax

Wcdoregongov

Wcdoregongov