The united states has income tax treaties (or conventions) with a number of foreign countries under which residents (but not always citizens) of those countries are taxed at a reduced rate or are exempt from u.s. B) there shall be allowed as a credit against german tax on income, subject to the provisions of german tax law regarding credit for foreign tax, the united states tax paid in accordance with the law of the united states and with the provisions of this convention on the following items of income:

Pin On Political

There shall be regarded as taxes on income and on capital gains all taxes imposed on total income, or on elements of income, including taxes on gains from the alienation of property.

Us germany tax treaty interest income. For example, interest earned on a u.s. First, to avoid double taxation of income earned by a citizen or resident of one country in the other country. If you have problems opening the pdf document or viewing pages, download the latest version of adobe acrobat reader.

Meanwhile, german students who are studying in the us can avail of tax treaty benefits on any income they receive related to their training, education or maintenance. For income arising in the us though, they can claim german tax credits against income taxes paid to the irs. 3 german income tax act), in the form of significant aggravations.

8 of 1970) and the. International tax compliance, further building on that relationship, whereas, article 26 of the convention between the united states of america and the federal republic of germany for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income and capital and to certain other taxes, signed at bonn on august 29, 1989, as. Germany is a member of the european union (eu), the united nations (un), nata, the g&, g20, and oecd.

The income must also be reported on the u.s. Income taxes on certain income, profit or gain from sources within the united states. The tax authorities can order a.

The complete texts of the following tax treaty documents are available in adobe pdf format. This means that if you are a us nra, you would report the interest on your us tax return, but then use the foreign tax credit to reduce any taxes owed to zero. (hereinafter referred to as german tax);

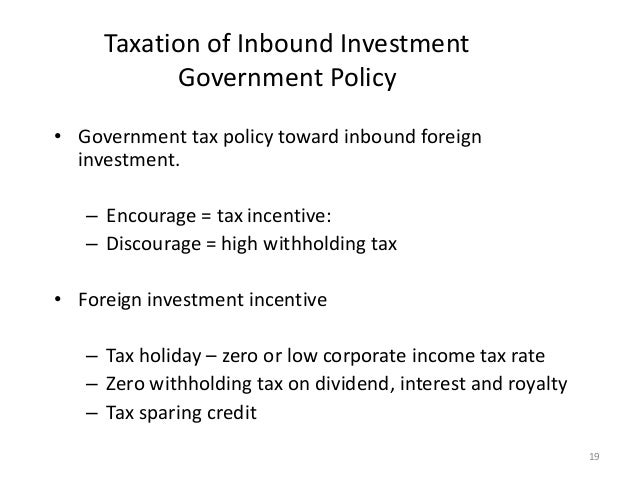

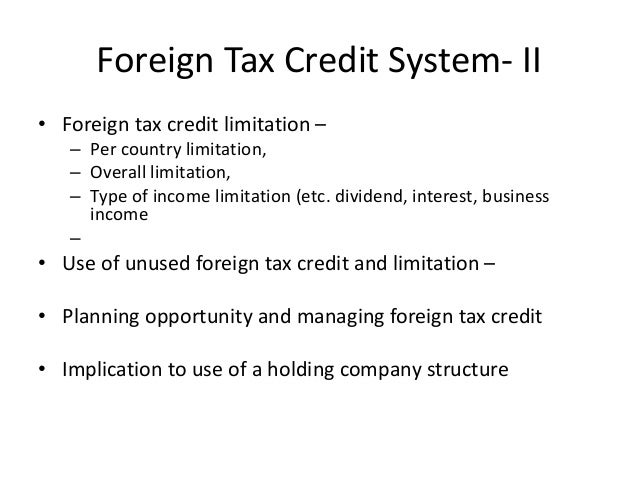

Exemption from withholding if a tax treaty between the united states and your country provides an exemption from, or a reduced rate of, withholding for certain items of income, you should notify the payor of the income (the withholding agent) of. Return, and a foreign tax credit can then be claimed. There are tax treaties between germany and many other countries which stipulate where the taxes must be paid.

7 of 1983) and to the extent provided in such income tax law, the company tax imposed under the ordonansi pajak perseroan 1925 (state gazette no. United states and the income from the services is not attributable to a fixed base in the united states, article 14 (independent personal services) would normally prevent the united states from taxing the income. Convention between the united states of america and the federal republic of germany for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income and capital and to certain other taxes, together with a related protocol, signed at bonn on august 29, 1989.

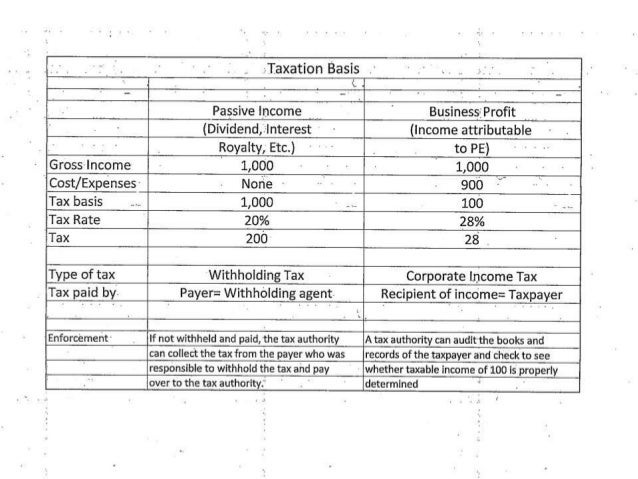

For most types of income, the solution set out in the treaty for us expats to avoid double taxation in germany is that they can claim us tax credits against german taxes that they’ve paid on their income. Tax on loans secured on german property is not imposed by withholding, but by assessment to corporation tax at 15% (plus solidarity surcharge) of the interest income net of attributable expenses. This convention shall apply to taxes on income and on capital gains imposed on behalf of a contracting state irrespective of the manner in which they are levied.

Convention between the united states of america and the federal republic of germany for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income and capital and to certain other taxes. Aa) income from dividends within the meaning of article 10 (dividends) to which. In addition, the convention will provide for exemption of german residents from united states tax on united states social security benefits.

For further information on tax treaties refer also to the treasury department's tax treaty documents page. To help minimize double taxation, the united states government has negotiated reciprocal tax treaties with a number of foreign nations, such as germany. If, however, the german resident is also a citizen of the united states, the saving clause permits the united states to include the remuneration in the worldwide income.

In the federal republic of germany this will include sleeping partnership interests. Most importantly for german investors in the united states, the protocol would eliminate the withholding Anyone earning income from outside germany will want to review any treaties between that country and germany, and most likely will want to speak with an expert.

But the credit is not reported/claimed in the same way as the credit for german source interest, it is claimed using these special rules described in pub 514. 319 of 1925 as lastly amended by law no. The treaty has two main goals.

Bank account by an american residing in germany will be taxable in germany under the u.s./german tax treaty. A treaty between germany and the united states helps clarify situations. The convention further provides both states with the flexibility to deal with hybrid financial instruments that have both debt and equity features.

On june 1, 2006, the united states and germany signed a protocol (the “protocol”) to the income tax treaty between the two countries as amended by a prior protocol (the “ existing treaty ”).

International Taxation

International Taxation

What Is Difference Between Nri And Nre Account Nri Saving And Investment Tips Savings And Investment Accounting Investment Tips

How To File Us Tax On Nre Nro Interest Without 1099-int – Usa

What Is The Us Germany Income Tax Treaty – Becker International Law

International Taxation

International Taxation

Nri Can Use Double Tax Avoidance Agreement Dtaa To Save Tax Nri Saving And Investment Tips Investment Tips Savings And Investment Investing

International Taxation

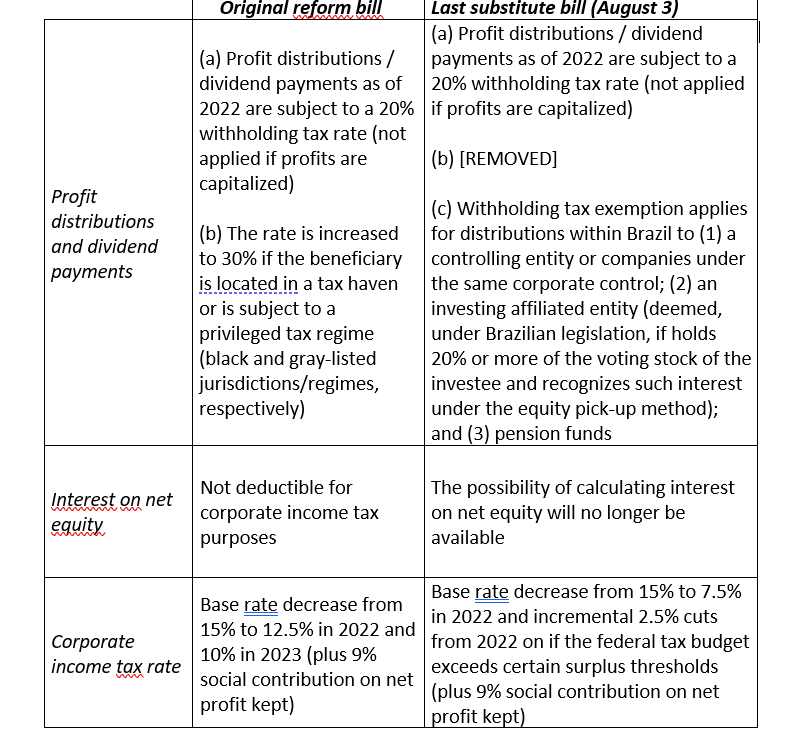

Brazils Upcoming Tax Reform Will Impact Inbound Investors Mne Tax

Can You Deposit Indian Rupees To Nre Account Savings Investment Tips Savings And Investment Accounting Investment Tips

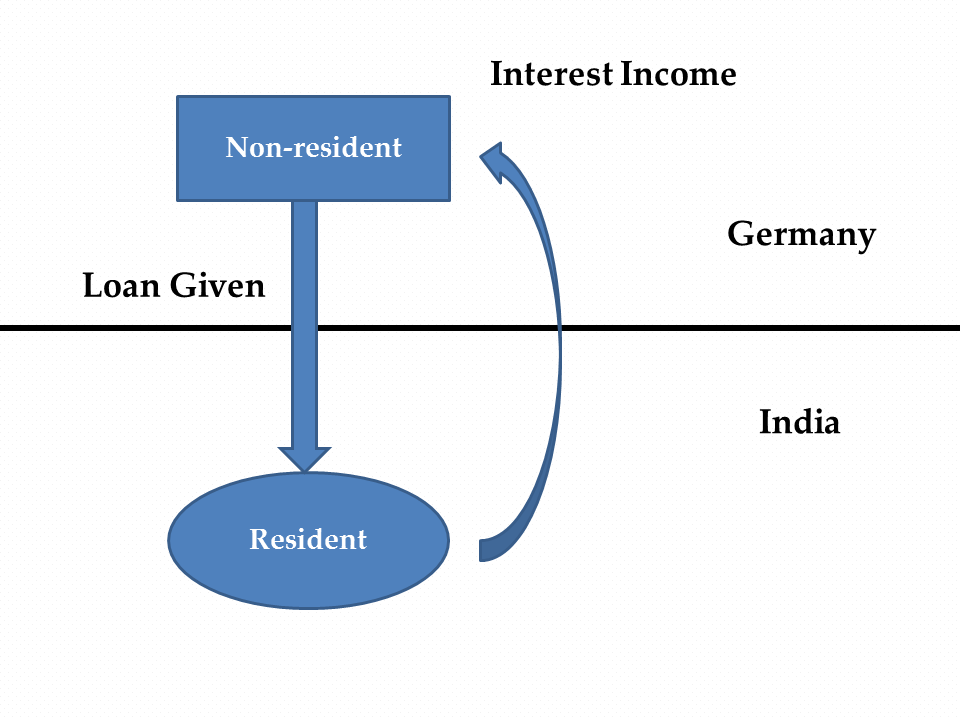

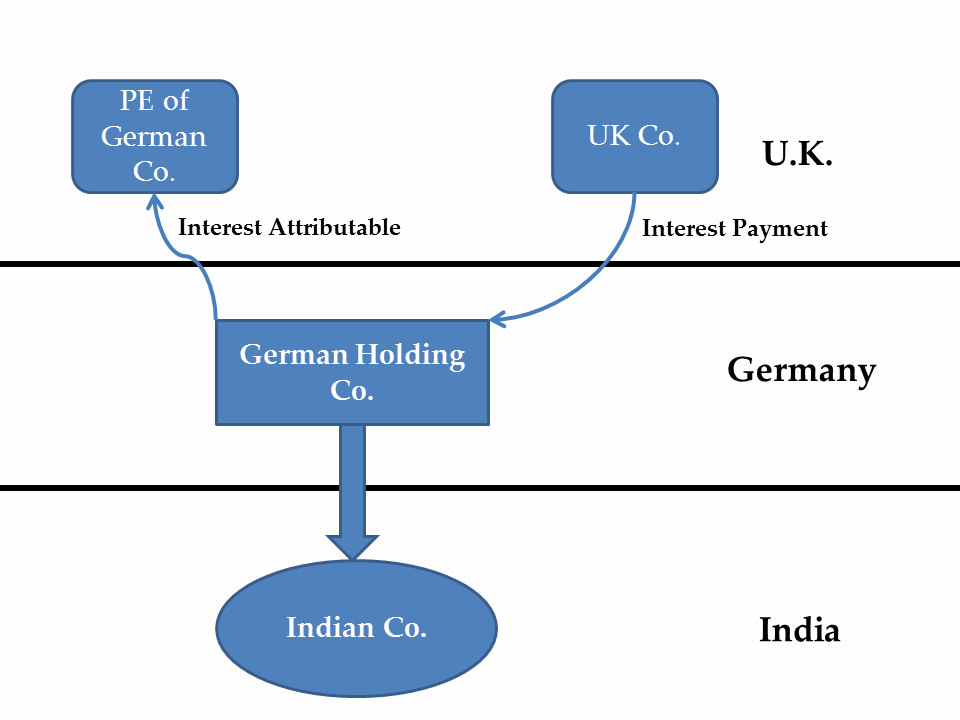

Taxation Of Income From Cross-border Interest

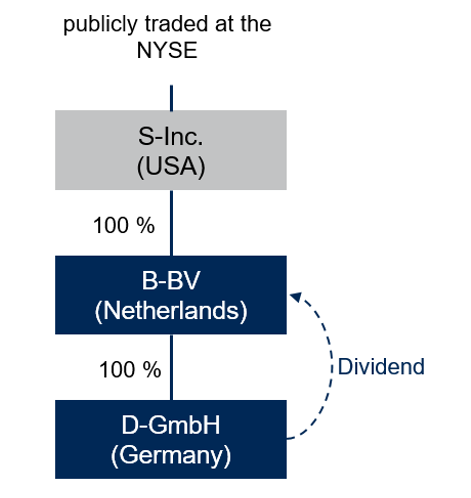

Tax Treaty Limitation On Benefits Lob Form W8-ben-e – International Tax Blog

Germany Adopts Substantial Transfer Pricing And Anti-treaty Shopping Rule Changes Mne Tax

Taxation Of Income From Cross-border Interest

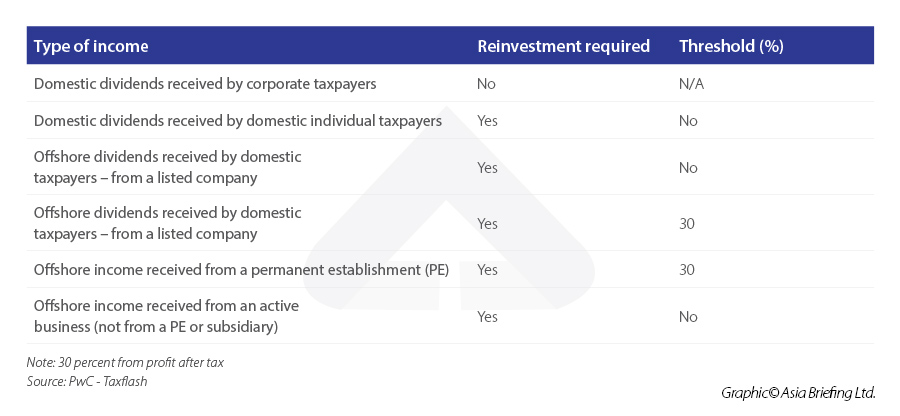

What Are The Changes In Tax Treatment Under Indonesias Omnibus Law

2

Tax Treaty Limitation On Benefits Lob Form W8-ben-e – International Tax Blog

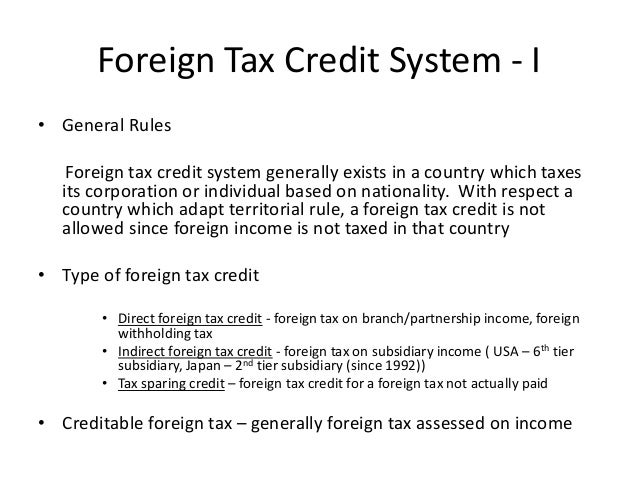

Introduction To Tax Treaties – Ppt Download