These tax statements are mailed out on or before november 1st of each year with the following discounts in effect for early payment: (1) administer tax law for 36 taxes and fees, processing nearly $37.5 billion and more than 10 million tax filings annually;

A Guide To Your Property Tax Bill Alachua County Tax Collector

Our attorneys have a wealth of knowledge and experience in all aspects of property tax law and appeals, to help.

Ad valorem property tax florida. The taxable value of the property is determined by the county property appraiser, a constitutional officer. Ad valorem taxes on real property are collected on an annual basis beginning on november 1 for the tax year january through december. The owner of the property must file this application

(1) “ad valorem tax” means a tax based upon the assessed value of property. All owners of property shall be held to know that taxes are due and payable annually before april 1 st , and are charged with the duty of ascertaining the amount of current and. Article vii of the florida constitution and chapters 192, 193, 194, 195, 196, 197, 200,.

In collier county, florida, ad valorem or “real” taxes on “real” things “according to their worth” includes taxes on real estate and taxes on a business’s tangible personal property. The total of these two taxes equals your annual property tax amount. Tangible personal property taxes are an ad valorem tax assessed against furniture, fixtures and equipment located in businesses and rental property.

According to florida statute 197.122, all property owners have the responsibility to know the amount of tax. Taxes usually increase along with the assessments, subject to certain exemptions. Santa rosa county property taxes provide the fund local governments to provide.

The ad valorem tax roll consists of: The real estate and tangible personal property tax rolls are prepared by the property appraiser’s office. (2) enforce child support law on behalf of about 1,025,000 children with $1.26 billion collected in fy 06/07;

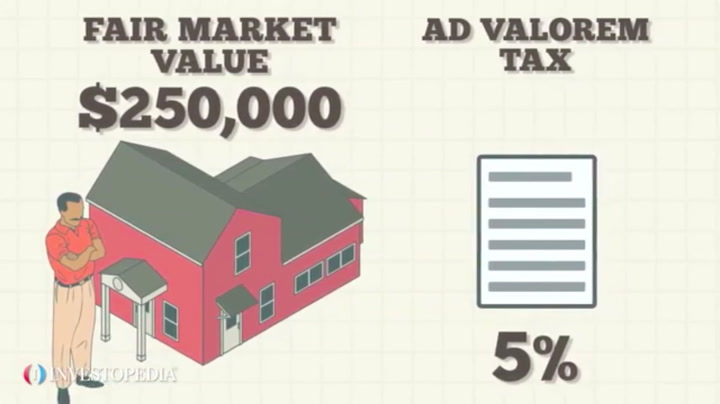

4% if paid in november; Your ad valorem property taxes are determined by multiplying the taxable value of your property by the millage rate for the current tax year. The millage rate is set by each ad valorem taxing authority for properties within their boundaries.

Rennert vogel mandler & rodriguez has one of the largest and most successful ad valorem taxation departments in florida. Ad valorem means based on value. Ad valorem taxes are levied annually based on the value of real estate property and tangible personal property.

Using these figures, the property appraiser prepares the tax roll. Property tax can be one of the biggest single expense items for commercial properties. Tangible personal property taxes refers to ad valorem taxes on the assessed value of furniture, fixtures, and equipment located in.

The property tax oversight (pto) program publishes the florida ad valorem valuation and tax data. Taxes are normally payable beginning november 1 of that year. If a county property appraiser is in doubt whether a taxpayer is entitled.

(3) oversee property tax administration. The greater the value, the higher the assessment. Ad valorem taxes ad valorem is a latin phrase meaning “according to the worth”.

Please take a minute to carefully examine the information on the enclosed tax notice and verify the following information: • 2021 osceola county property tax • 1. Using these figures, the property appraiser prepares the tax roll.

“ad valorem” is a latin phrase meaning “according to worth”. 3% if paid in december; Florida ad valorem valuation and tax data book.

The term “property tax” may be used interc hangeably with the term “ad valorem tax.” They determine the ownership, mailing address, legal description and value of the property. This application is for use by any charter school that owns property used as a charter school facility, or any owner of property leased and used as a charter school facility, to apply for an ad valorem tax exemption for property as provided in section 196.1983, florida statutes.

In florida, property taxes and real estate taxes are also known as ad valorem taxes. The property appraiser establishes the taxable value of real estate property. Taxes are assessed by the property appraiser as of january 1 of each year and levied in hillsborough county by the taxing authorities.

The property appraiser assesses the value of a property, and the board of county commissioners and other levying bodies set the millage rates. 2% if paid in january The property appraiser assesses the value of a property, and the board of county commissioners and other levying bodies set the millage rates.

The ad valorem tax roll consists of real estate taxes, tangible personal property taxes and railroad taxes. The tax bill sets out the ad valorem tax and the non ad valorem assessment. Your property’s assessed value is determined by the palm beach county property appraiser.

Ad valorem taxes on real property and tangible personal property are collected by the tax collector on an annual basis, beginning on november 1st for the calendar year january through december. Paying property taxes is an unavoidable consequence of owning real property in florida. There are two types of ad valorem property taxes in florida which are real estate property and tangible personal property.

Ad valorem taxes are levied on real estate property and are based on the assessed value of the. Exemptions for homestead, disability, widows, and agricultural classifications are also determined by the property appraiser’s office.

Real Estate Property Tax – Constitutional Tax Collector

Form Dr-462 Download Printable Pdf Or Fill Online Application For Refund Of Ad Valorem Taxes Florida Templateroller

Ad Valorem Tax – Overview And Guide Types Of Value-based Taxes

Car Insurance Quotes Best Auto Insurance Comparison Online

Good Morning The Florida Homestead Exemption Generally The Florida Homestead Exemption Reduces The I Love My Friends Real Estate Branding Miami Real Estate

Ad Valorem Tax Definition

Time Is Running Out To Pay Your Property Taxes No Worries Stop By Avb Banks Downtown Broken Arrow Location 322 S Main St Thi County Property Tax Bank

Do Not Miss Your Opportunity To Save It Is Due By March 1st The Florida Homestead Exemption Reduces The Taxable Florida Law Miami Real Estate Real Estate Tips

Floridas Ad Valorem Tax Exemption Dean Mead

Real Estate Taxes City Of Palm Coast Florida

Car Insurance Quotes Examples Quotesgram

Appealing Ad Valorem Tax Assessments – Johnson Pope Bokor Ruppel Burns Llp

County Property Tax Payment Deadline – Jennifer Sego Llc

Citrus Property Values And Estimated Ad Valorem Taxes Levied In Florida Download Table

Pin By Lisa Desimone On My Favorite Things Hair Styles Long Hair Styles Beauty

Free Form Dr-462 Application For Refund Of Ad Valorem Taxes – Free Legal Forms – Lawscom

Car Insurance Quotes Online South Africa Car Saab Car Insurance Online Home Insurance Quotes Auto Insurance Quotes Car Insurance

About Us – Cosmetic Dentistry Charlotte Harbor Fl Harborside Dental Associates Home Decor Decals Decor Resident

Pin On Con Artists Scams Frauds