The digital advertising provisions of maryland's new tax law could raise an estimated $250 million in its first year, with revenues being earmarked for. 732, imposes a tax of up to 10% on gross revenue from digital advertising services placed by large digital advertisers, such as facebook inc.

Maryland Tax On Digital Advertising Services Enacted – Kpmg United States

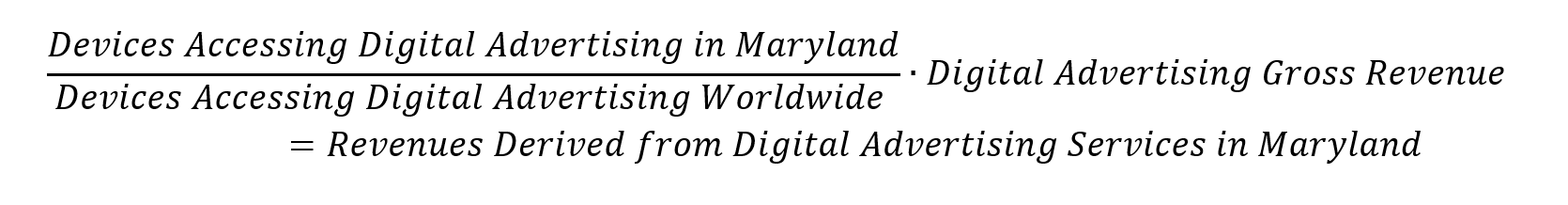

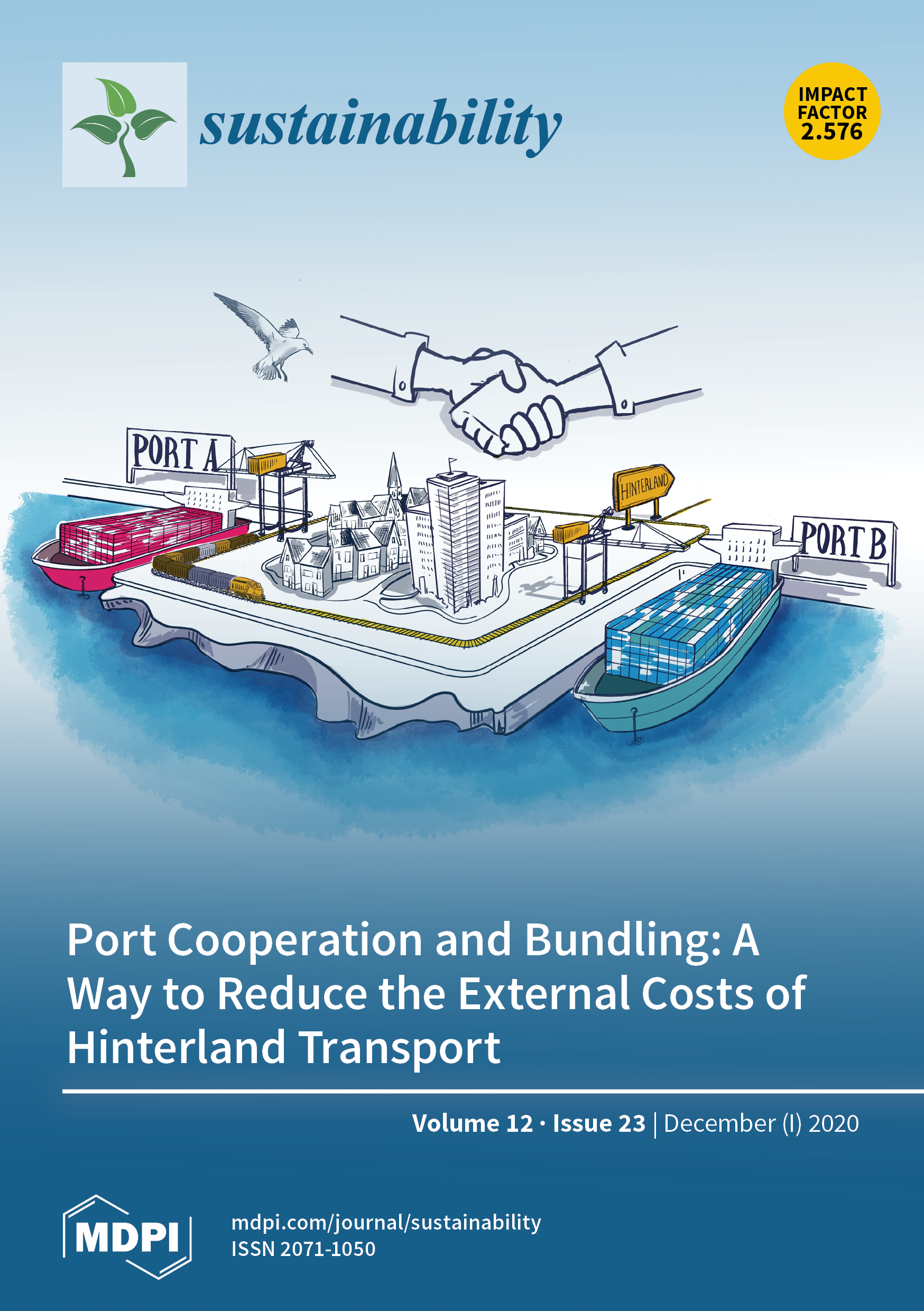

In practice, the law imposes a sliding scale tax on the money that a company makes from the sale of digital ads that are displayed to the citizens of maryland.

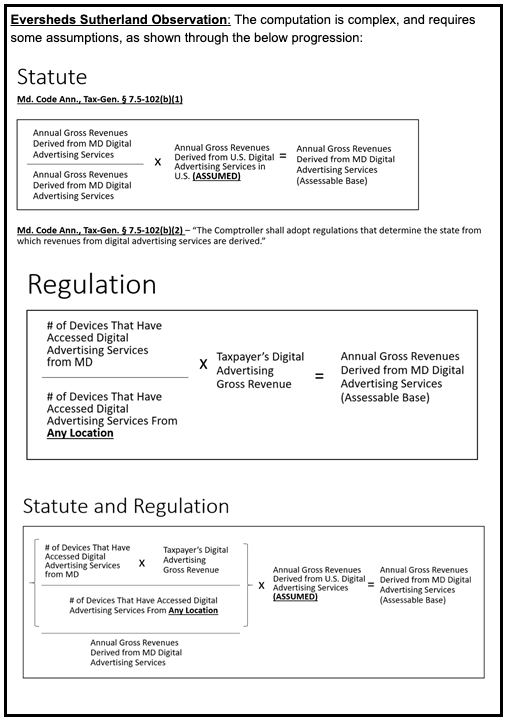

Maryland digital advertising tax sourcing. It's a gross receipts tax that applies to companies with global annual gross revenues of at least $100 million and with digital ad revenue. Prior to the enactment of house bill 932, digital products were not subject to maryland sales and use tax, and the sale of canned software was taxable only if delivered in tangible form. Today, mcdermott will & emery filed suit in maryland federal court on behalf of a number of leading trade associations against maryland comptroller peter franchot, challenging the state’s recently enacted 10% gross receipts “tax” applicable to digital advertising revenue.

The tax rate is 2.5% on annual global gross receipts of $100 million to $1 billion, 5% on amounts between $1 billion and $5 billion, 7.5%. The new tax had been approved by the state’s legislature in early 2020 but, rather than signing hb 732 into law, governor hogan rejected the bill, noting that it would “be unconscionable” to raise taxes and. District court in maryland challenges the state’s recently enacted gross receipts tax on digital advertising revenue as unconstitutional and illegal under a.

A company that makes at least $100 million a year in. Maryland’s digital ad tax under pressure from big tech. The statutory references contained in this publication are not effective until march 14, 2021.

The maryland tax, which applies to revenue from digital ads that are displayed inside the state, is based on the ad sales a company generates. The tax is 2.5% for businesses that make between $100 million and $1 billion in global revenue, and that rate goes up to 5% for companies with revenue of $1 billion or more. The primary feature of the proposal was a.

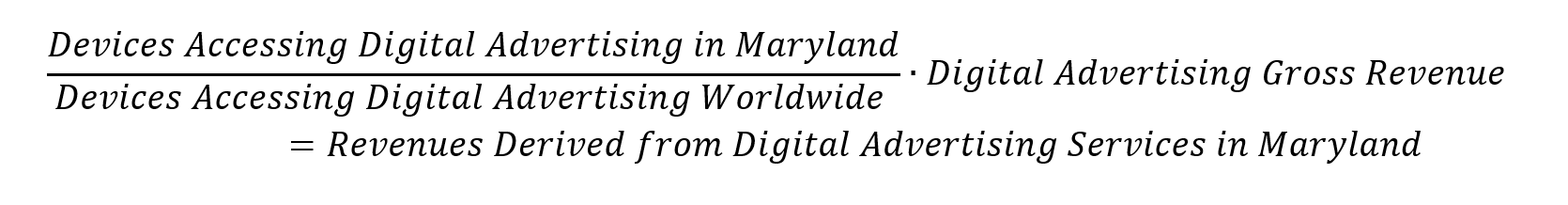

The total tax now would double to $50 million, 5%. On february 12, 2021, the maryland senate voted to join the house of delegates in overriding the governor’s veto of house bill 932. Effective march 14, 2021, the maryland sales and use tax applies to the sale or use of a digital product or a digital code.

The maryland digital advertising tax, applied to gross revenue derived from digital advertising services, has a rate escalating from 2.5 percent to 10 percent of the advertising platform’s assessable base based on its annual gross revenues from all sources (i.e., not just digital advertising, and not just in maryland). Maryland previously estimated its digital tax could raise as much as $250 million in its first full year by taxing annual gross revenues derived from types of digital advertising services in the. As expected, the maryland law that created an online advertising tax is facing.

Sourcing factors tweaked tax still slated to start jan. Maryland sued over digital advertising “tax”. Now suppose the taxpayer receives $1 more in total revenue, so now it has $1,000,000,001.

On 12 february 2021, the maryland legislature overrode maryland governor larry hogan's veto (pdf) of legislation that imposes a new tax on digital advertising. At that date, the sales and use tax rate on a sale of a digital product or a digital code is 6%. We'll assume that's all maryland advertising revenue.

In the december 3, 2021 issue of the maryland register, the comptroller confirmed that it adopted regulations to the digital advertising gross revenues tax on november 24, 2021.despite robust comments provided to the proposed regulations (including those provided by eversheds sutherland), the comptroller made almost no changes in the final version. (cnn)just days after maryland became the first state in the country to impose a tax on digital advertising targeting big tech, lobbying groups representing companies including amazon, facebook.

Maryland Digital Advertising Tax Regulations 3 Issues With The Proposals

Just When You Thought You Were Out The Maryland Comptroller Drops Proposed Sourcing Reg For The Digital Ad Tax Eversheds Sutherland Us Llp – Jdsupra

Maryland Digital Advertising Tax Regulations 3 Issues With The Proposals

In Sourcing Vs Outsourcing What Is The Difference – Keen Alignment Outsourcing Business Leader Merchandising Companies

Maryland Digital Advertising Tax Regulations 3 Issues With The Proposals

Menuju Banjarmasin Smart City Finance How To Plan Commercial Property

Sustainability December-1 2020 – Browse Articles

Maryland Proposes Method To Calculate New Digital Ad Taxes 1

2

Digital Ad Tax Maryland Digital Advertising Tax Amendments

Maryland Breaks Ground With Digital Advertising Tax Covering Your Ads Blog

The Rise Of Digital Ad Taxes Could Impact Online Marketplaces

Just When You Thought You Were Out The Maryland Comptroller Drops Proposed Sourcing Reg For The Digital Ad Tax Eversheds Sutherland Us Llp – Jdsupra

Just When You Thought You Were Out The Maryland Comptroller Drops Proposed Sourcing Reg For The Digital Ad Tax Eversheds Sutherland Us Llp – Jdsupra

Just When You Thought You Were Out The Maryland Comptroller Drops Proposed Sourcing Reg For The Digital Ad Tax – Lexology

New York Takes Another Shot At Taxing Digital Advertising Sales Cpa Practice Advisor

Maryland Digital Advertising Tax Regulations 3 Issues With The Proposals

Maryland Enacts Nations First Digital Advertising Tax With Strict Penalties For Noncompliance Subject To Immediate Challenges Thought Leadership Baker Botts

More States Start Taxing Online Advertising Tax Practice Advisor