The internal revenue code (tax laws) allows the irs to collect on a delinquent debt for ten years from the date a return is due or the date it is actually filed, whichever is later. Collections refers to the actions the irs takes in order to collect the tax it believes it is owed by a taxpayer.

Irs Tax Refund Identity Theft How It Can Happen To You Irs Taxes Tax Refund Identity Theft

Requesting a collection due process (cdp) hearing.

How does irs collect back taxes. There are several options here, so we will be looking at the best path forward for you. The irs refers to this as a “collection statute expiration date.”. Due to the inability to collect the tax owed, the collection period gets suspended.

Here’s a look at the details. The private collection agency then sends their initial contact letter. These let you know that your overdue tax account was assigned to a private collection agency.

The irs can go back to any unfiled year and assess a tax deficiency, along with penalties. Publication 594 is a detailed description of the irs collection process. Tax is assessed when a taxpayer voluntarily files a tax return to assess the tax or the irs records the liability on its books.

A statute of limitations (sol) is a federal or state law that limits the period allowed to file legal proceedings. The irs is limited to 10 years to collect back taxes, after that, they are barred by law from continuing collection activities against you. This is called the irs statute of limitations (sol) on collections.

The irs has to use its levy powers or bring suit in district court to collect the taxes before this ten year period ends. The irs statute of limitations on collection. By law, the irs only has ten years to collect the unpaid taxes from the time of the initial tax assessment.

The irs is barred from doing so. The irs sends you a tax bill, including taxes you owe, together with penalties and interest if applicable. In other words, the statutes are deadlines, defined by law.

As i said, under the collection statute expiration date (csed), the collection period is usually 10 years (although there may be exceptions). The irs will first send notice cp40 and publication 4518 pdf. Instead, the clock for the 10 years begins when the irs notices your missing return, you file the return to get caught up with your taxes, or the irs files and submits a substitute return on your behalf.

Here are steps you can expect if you are sent to collections: It begins on the date of the last assessment, the date the form was filed and signed, or if you didn’t file the form, the start count for collection statute expiration date will be the date stated in the owe assessment document sent to you by. It is true that the irs can only collect on tax debts that are 10 years or younger.

However, that 10 years does not begin when you neglect, either accidentally or willfully, to file your return. Filing a tax return, billing, and collection. The federal tax lien statute of limitations is the exact same limitation as the one for back tax collection.

Basically, the case is either assigned to the irs automated collections system or to a revenue officer. Both letters contain a taxpayer authentication number. Publication 594 the irs collection process.

Even if the business declares bankruptcy, the tax burden will likely not be dismissed. It’s used to confirm your identity. If you owe the irs back taxes, you may be wondering if the irs forgives tax debt.

Our staff is here to help. All of that “quiet” debt does go eventually go away. During bankruptcy, the irs cannot collect tax.

For most cases, the irs has 3 years from the date the return was filed to audit a tax return and determine if additional tax is due. Your bill will detail payment options and the due date. While many private debts are dismissed in bankruptcy, taxes owed to the irs are not one of them.

After you file your tax return and/or a final decision is made establishing. You have the right to request a cdp hearing when the irs. Once the irs has assessed the tax, it has 10 years to collect it from the date of assessment.

Many taxpayers make the mistake of just knowing the period of time for the statute of limitations but not when it starts. Although the internal revenue service can only collect back taxes for a period of ten years, starting from the day your tax was assessed, but there are some factors that can extend the collection period and give more time to the irs to collect back taxes from a taxpayer so, it is better to know them rather than asking when does irs stop collecting back taxes later. You can stop it though and it's explained what you need to do.

This means that the maximum period of time that the irs can legally collect back taxes is 10 years from the date which they are owed. Your correct tax, we record the amount in our records. Also, most delinquent return and sfr enforcement actions are completed within 3 years after the due date of the return.

If you owe, we will send a bill for the amount due, including any penalties and interest. The 10 years begins when an act is taken to create the debt. The irs generally has ten years from the date the tax is assessed to collect unpaid tax debts.

The time period (called statute of limitations) within which the irs can collect a tax debt is generally 10 years from the date the tax was officially assessed. The irs has 10 years to collect a tax debt. Your tax return is filed and your tax liability is assessed.

As a general rule, the irs has ten years to collect back taxes. There is an irs statute of limitations on collecting taxes. The csed is generally suspended during the automatic stay and for six months after the stay is lifted.

The time to audit taxes can be extended. If a business closes, this does not mean that the business is not required to pay back taxes or the attendant penalties. From there, levies, garnishment and liens are issued.

Need help with back due tax debts? Determining the statute of limitations on collections. If you don’t pay the.

It has information on how to resolve your overdue taxes.

Can The Irs Collect After 10 Years Fortress Tax Relief

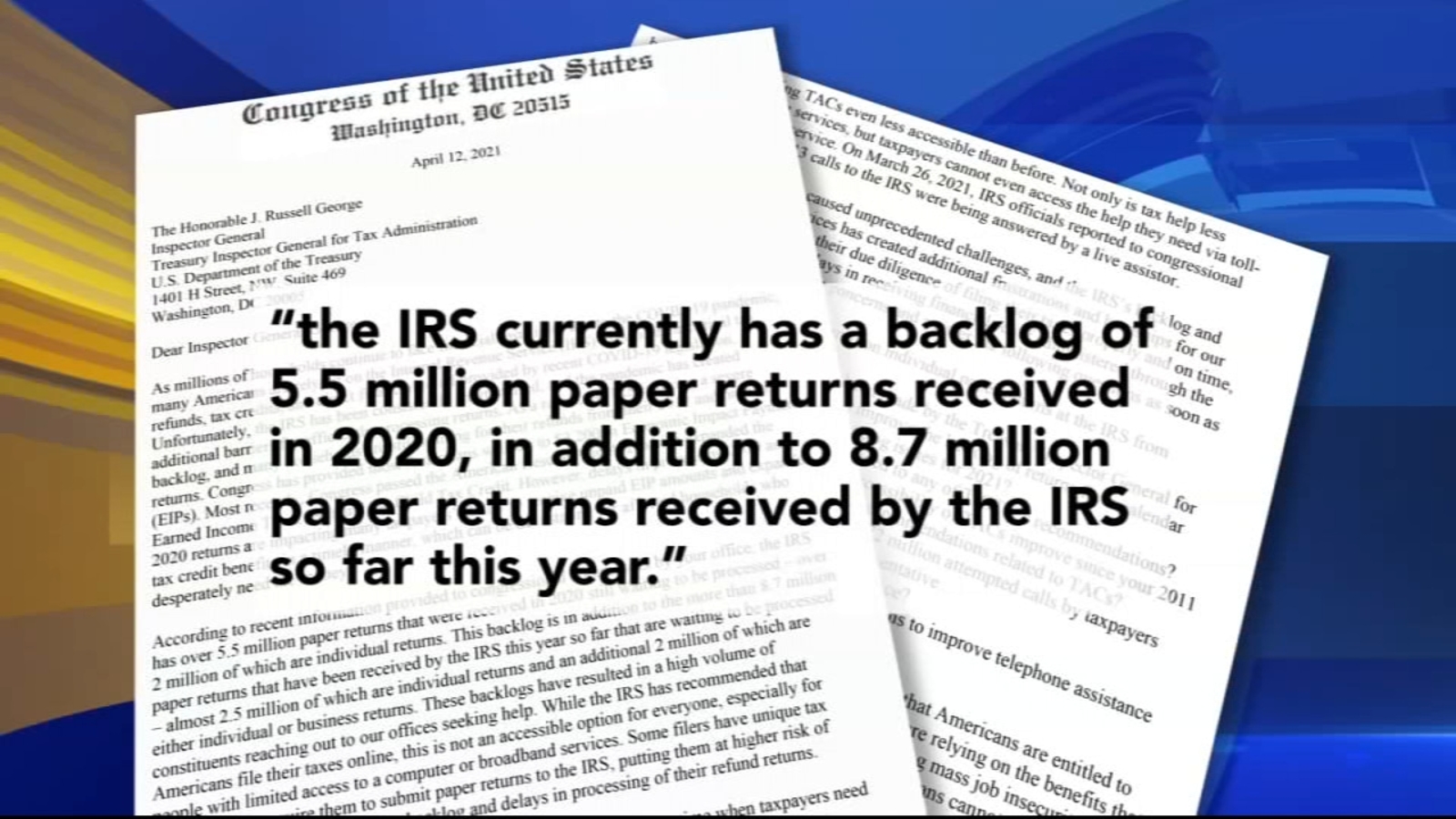

Irs Warns Of Delays And Challenging 2021 Tax Season 10 Tax Tips For Filing Your 2020 Tax Return

5 Reasons Why You Shouldnt Worry Over An Irs Audit Tax Accountant Accounting Firms Cpa

When It Comes To The Law No One Is Above It That Goes For Celebrities Too No Matter How Famous They Are In Infographic Social Media Infographic Celebrities

The Proven Way To Settle Your Tax Debt With The Irs – Debtcom

Taxes 2021 Everything New Including Deadline Stimulus Payments And Unemployment – Cnet

Know What To Expect During The Irs Collections Process – Debtcom

Irs Experiencing Major Backlog Delays On Tax Refunds – 6abc Philadelphia

Irs Failed To Collect 24 Billion In Taxes From Millionaires In 2021 Irs Millionaire Fails

Offer In Compromise Irs How To Settle Irs Tax Debt Flat Fee Tax Service San Diego Video Irs Taxes Tax Debt Tax Services

Owe The Irs You Have A Few Options If You Cannot Afford The Bill Forbes Advisor

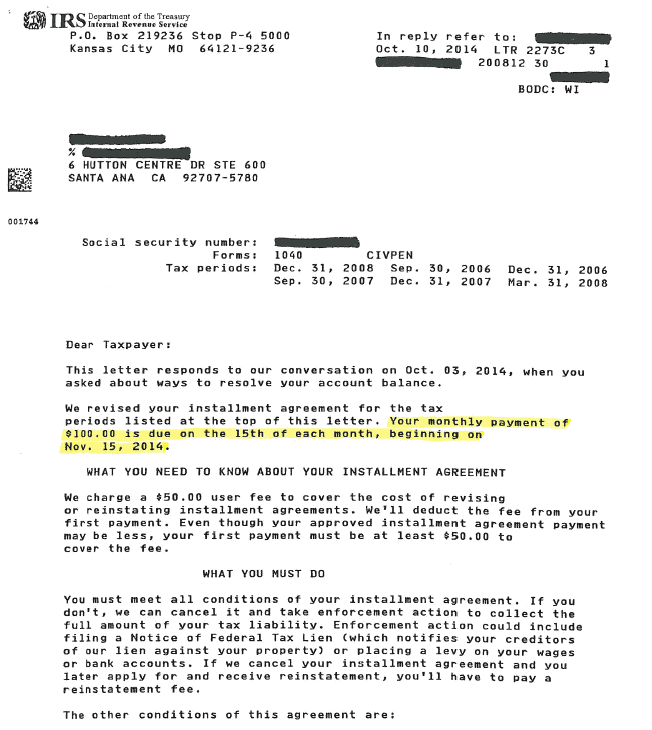

Irs Tax Letters Explained – Landmark Tax Group

How Far Back Can The Irs Collect Unfiled Taxes

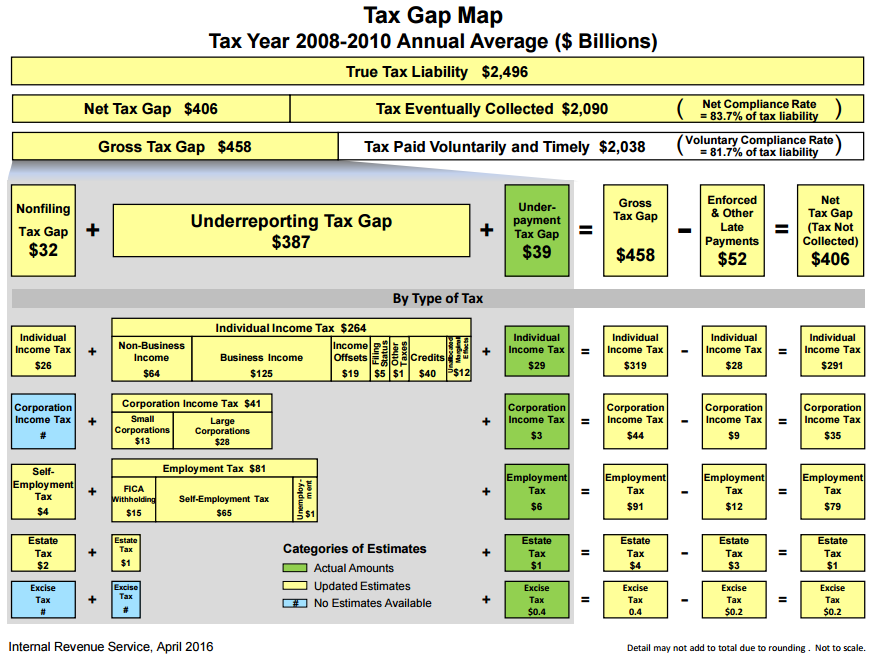

Irs Loses 400 Billion Per Year In Unpaid Taxes Committee For A Responsible Federal Budget

When Does An Irs Tax Lien Expire – Rjs Law – Tax And Estate Planning

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

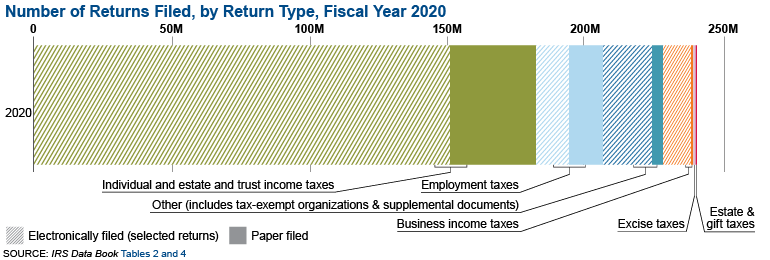

Returns Filed Taxes Collected And Refunds Issued Internal Revenue Service

Faqs On Tax Returns And The Coronavirus

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time