There is a 2.34% convenience fee for processing credit card payments which is charged by our payment processing vendor. The assessor is responsible for determining the assessed value of all taxable property located in san mateo county.

Juan Raigoza San Mateo County Controller – Home Facebook

The city of san mateo’s hourly minimum wage applies to all businesses within city limits, regardless of size.

San mateo county tax collector.org. Multiple bill installments may be paid as one payment transaction utilizing our shopping cart feature. You may purchase duplicate tax bills for $1 at any tax collector’s office. Sign in and start exploring all the free, organizational tools for your email.

At least before they other assessors would take your plea for reduction into consideration. Take a trip into an upgraded, more organized inbox. With approximately 237,000 assessments each year, the assessor division creates the official record of taxable property (local assessment roll), shares it with the county controller and tax collector, and makes it publicly available.

San mateo county tax collector. The credit card payment limit is $99,999.99. Kathy schroeder and michelle leeson receive the lillie robinson humanitarian award.

She will charge you a 10% if it's one day late from the postal office. Support local businesses by using the choose local san mateo county app. 1, 2022, the hourly minimum wage will increase to $16.20 for all employees working within the city of san mateo limits.

San mateo county (/ ˌ s æ n m ə ˈ t eɪ. Is a private postage meter date the same as the united states postal service postmark? Collection of 2021 manatee county property taxes begins november 3.

To what address do i mail my tax payment? Tax payments are mailed to the: Effective 10/18/21, the traffic clerk's office will open fully from 8 a.m.

A 2.4% convenience fee ($2.00 minimum) is applied to each credit/debit card transaction. Keshia williams is the manatee county tax collector's employee of the quarter. State of california.as of the 2010 census, the population was 718,451.

Jim overton duval county tax collector 231 e. Please note, only our downtown branch office can accept cash payments. The assessor's office of san mateo county maintains a current list of valid property parcel numbers.

We are open monday through friday 8:30 a.m. Minimum wage increases starting jan. I don't like sandie arnott she is never willing to give any tax payers a break.

San mateo county tax collector 555 county center redwood city, ca 94063 for more information, please visit the san mateo county tax collector’s web site. There is a drop box located in front of the county administration building available for drop off of payments by check or. For more information, please visit the san mateo county tax collector’s website.

Check out new themes, send gifs, find every photo you’ve ever sent or received, and search your account faster than ever. Public property records provide information on homes, land, or commercial properties, including titles, mortgages, property deeds, and a range of other documents. Apply for a small business grant.

The property tax management system was created to help manage single or multiple assessments. Vaccination clinics for children ages 5 to 11. The office is located at the northern branch, 1050 mission road, south san francisco, ca.

This site provides property tax information on a 24/7 basis and allows for property tax payments to be made online. We hope these services help you in your search. 2 reviews of tax collector, county of san mateo the representatives are very courteous and knowledgeable to help surprisingly.

The county seat is redwood city. Electronic check (echeck) payments require your bank account and routing numbers. Heather alicky is the 2021 aimee brewer most valuable employee.

Learn more and download | businesses: Welcome to taxes on the web, tow, a service provided by the san luis obispo county tax collector's office. San mateo county property records are real estate documents that contain information related to real property in san mateo county, california.

The current delinquent penalty for late property tax payments is 10%, which is much higher than the credit card convenience. California law requires the tax collector to accept the us postmark, not a private meter date, as the date of payment. Payments can also be made using credit/debit cards (american express, discover, mastercard and visa).

To avoid unnecessary trips to the courthouse, we still encourage you to check out your online options for taking care of your traffic ticket.

Contact Us Treasurer

Secured Property Taxes Tax Collector

Search – Taxsys – San Mateo Treasurer-tax Collector

Receipt – Taxsys – San Mateo Treasurer-tax Collector Ebike San Mateo San

Gis Information Services

Secured Property Taxes Tax Collector

County Of San Mateo Linkedin

District 1 Dave Pine Board Of Supervisors

2018 Property Tax Highlights Publication Press Release Controllers Office

San Mateo County Postpones Property Tax Due Date Until May 4 Palo Alto Daily Post

2

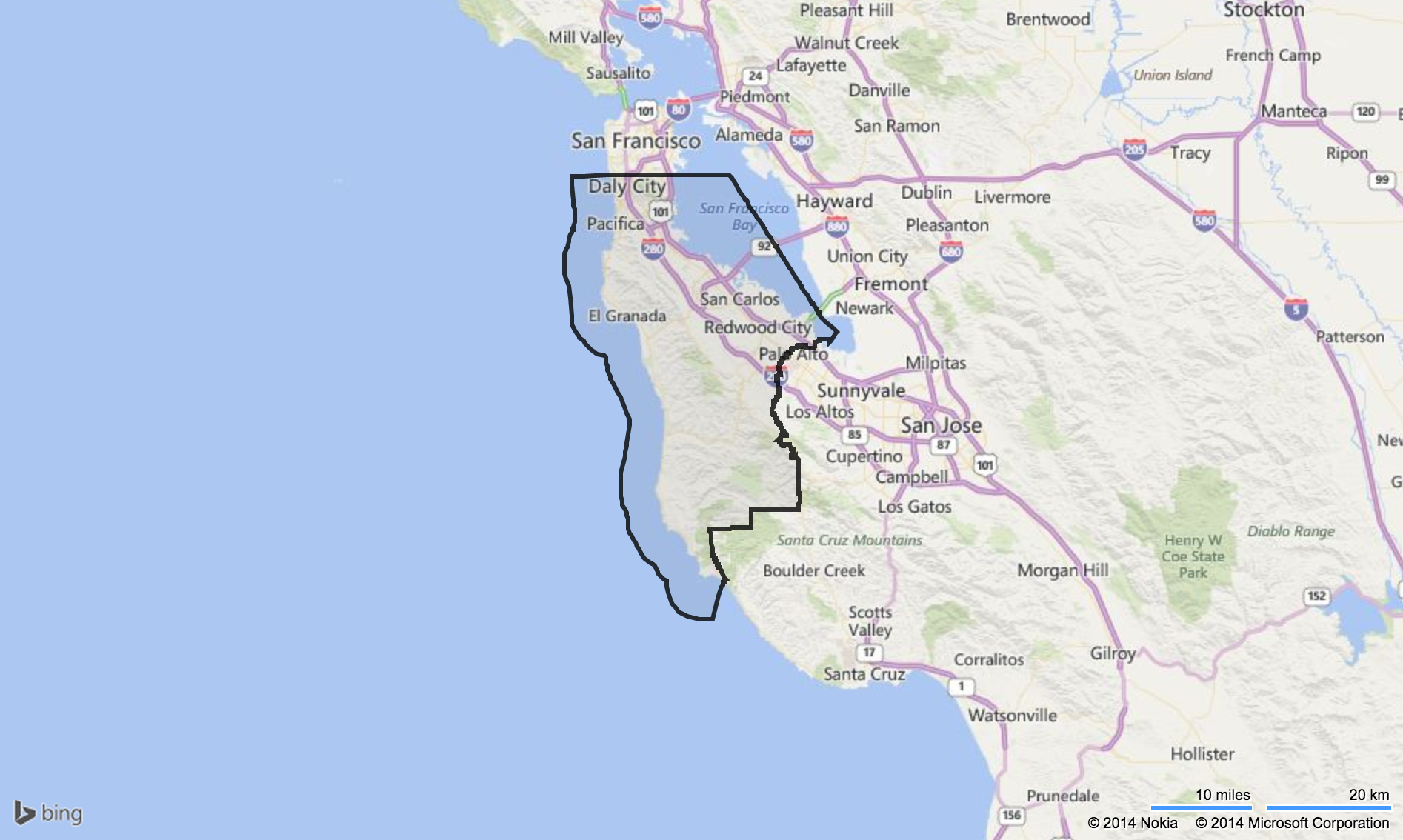

San Mateo County Assessor Map – Maps Catalog Online

San Mateo County Health Campus County Managers Office

Juan Raigoza San Mateo County Controller – Home Facebook

County Service Area No 6 Princeton-by-the-sea Lafco

San Mateo County Fire Jurisdictions Lafco

San Mateo County Property Values Reach Record High For 11th Year In A Row

Nabxkmk2xyvbum

July 26 2021 County Of San Mateo Requires Face Coverings Solely At County-operated Facilities County Managers Office