As a condition of receiving the tax benefits, a sort of quid pro quo, the j51 program mandates that owner of buildings that receive such benefits may only continue to take advantage of the tax subsidization if all of the dwelling units in the covered building are subject to the rent stabilization law, rent control law, or private housing finance law for the entire tax benefit. After the benefits expire, rent stabilization coverage may expire if the landlord follows the correct procedure.

J-51 Tax Program Decline Hpd To Revise

The benefit varies depending on the building's location and the type of improvements.

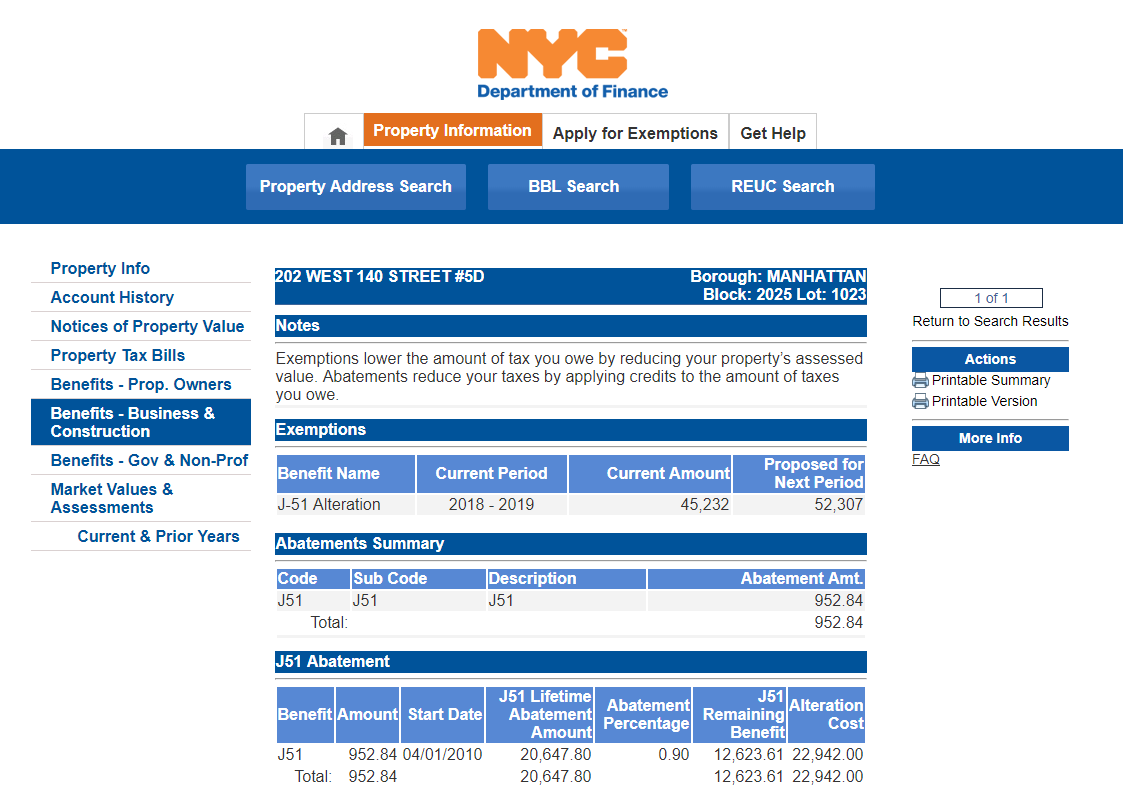

J-51 tax abatement rent stabilization. To be eligible for this benefit, you must have renovated your structure or plan to convert an industrial or commercial structure into a residential building. Nyc department of housing preservation and development (nyc hpd) status: The rent stabilization coverage remains in effect for approximately twenty (20) years.

However, for buildings that became stabilized because of. Eligible projects for this program include: The nyc department of housing preservation and development (hpd) determines eligibility for this program.

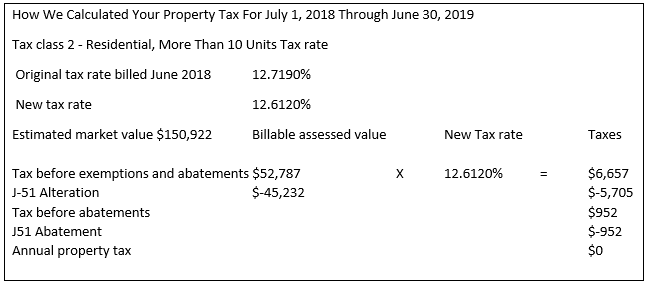

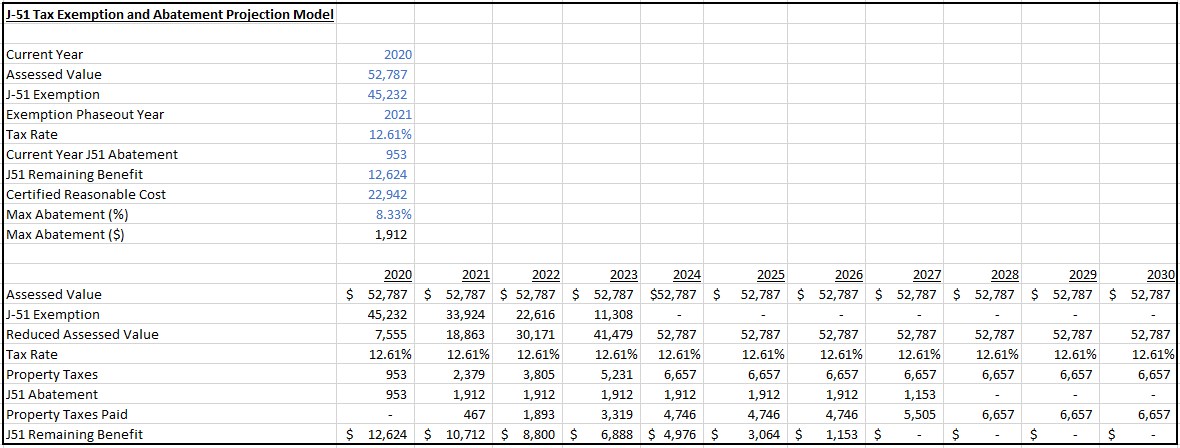

In return for this tax benefit, the building is placed under rent stabilization. If a landlord receives a tax abatement base on new construction or major renovations, the building becomes subject to rent stabilization. The j51 abatement consists of both a tax exemption that freezes the assessed value at the level before construction began, as well as a tax abatement that decreases.

Tens of thousands of apartments that had ostensibly been deregulated from rent stabilization were found to indeed be regulated after all. Decision was that in regina, the coa had Tenants in buildings of six or more units built before february 1, 1947, who moved in after june 30, 1971, are also covered by rent stabilization.

In a new building which receives a tax abatement,. See our tax abatements & exemptions faq for further information. If so, the benefits expiring do not change the rent regulation status.

If the building was rehabilitated or converted from another use, the abatement is known as a. New york city department of. Tax abatements in new york city, there are tax incentive programs frequently used by owners of rent regulated buildings.

Buying An Apartment With A J-51 Tax Abatement Hauseit

Rent Stabilization 101 Am I Rent Stabilized Rentcement

J-51 Rule Change Brings Confusion – The New York Times

/cdn.vox-cdn.com/uploads/chorus_asset/file/13191289/1_02032_0055.YoS0SmOC.jpg)

Two More Class-action Lawsuits Target Nyc Landlords Abusing J-51 Tax Program – Curbed Ny

Buying An Apartment With A J-51 Tax Abatement Hauseit

J-51 Property Tax Exemptions And Abatements June 4 Pdf Free Download

Buying An Apartment With A J-51 Tax Abatement Hauseit

The Benefits Of J51 Exemption And Abatement Today Prime Real Estate Partners

Buying An Apartment With A J-51 Tax Abatement Hauseit

Buying An Apartment With A J-51 Tax Abatement Hauseit

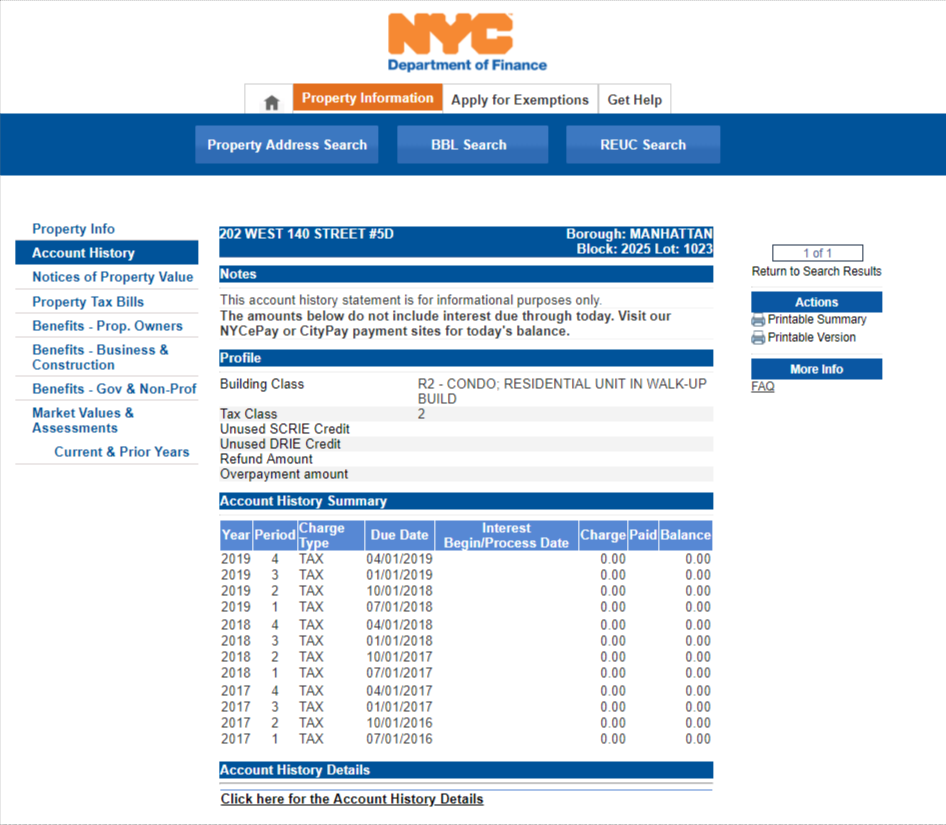

How To Find Out If Your Building Has A J-51 Tax Abatementand If Your Rent Was Raised Illegally

Buying An Apartment With A J-51 Tax Abatement Hauseit

Tax Abatements – Law Offices Of Walter Jennings Pc

Buying An Apartment With A J-51 Tax Abatement Hauseit

J-51 Consultants David Shurin

Buying An Apartment With A J-51 Tax Abatement In Nyc – Youtube

Buying An Apartment With A J-51 Tax Abatement Hauseit

Owners Call On City To Reauthorize J-51 Tax Abatement As Part Of Ida Recovery Real Estate Weekly

J-51 Tax Abatement For Co-ops And Condos Is Stuck In Limbo Habitat Magazine New Yorks Co-op And Condo Community