Mayor levar stoney’s administration opposed the changes to the program. Effective january 1, 2020, the yearly income allowable increased to $60,000 and the net worth allowable increased to $350,000.

Vhdacom

Own and reside in the property being taxed.

Personal property tax relief richmond va. As of december 31 st of the year preceding the tax year for which assistance is requested, the taxpayer must be a richmond county resident and said property must be occupied as the sole dwelling for the taxpayer. Is more than 50% of the vehicle's annual mileage used as a business. Below you will find the forms you need to receive property tax relief for your vehicle as well as frequently asked questions about the individual.

Additionally, credit percentage guidelines were increased in most income categories, those with income between $50,001 and $60,000 becoming newly eligible in 2020. Answer the following questions to determine if your vehicle qualifies for personal property tax relief. For more information visit the elderly and disabled tax relief program page.

For applicants seeking relief because of permanent and total disability: The city of richmond has two exemption options in addition to the commonwealth's personal property tax relief act (pptra) which can be granted for motor vehicles: Elderly citizens and disabled persons who meet certain criteria may be granted relief from all or part of their real estate taxes, personal property tax on one vehicle, the vehicle registration/license fee, and the solid waste fee.

Be totally or permanently disabled. Personal property taxes are assessed on any vehicle, motorcycle, boat, trailer, camper, aircraft, motor home, or mobile home owned and registered as being garaged in richmond county as of january 1 st of each tax year. What is personal property tax relief or pptra?

The daily rental property tax is collected by businesses that derive at least 80 percent of their rental receipts (excluding the rental of vehicles licensed by the state) from rental of personal property for 92 consecutive days or less. How to qualify for personal property tax relief. The applicant must be permanently and totally disabled as of december 31st of the preceding year.

Real estate tax relief application. Personal property tax relief, (pptr) gives tax relief on the taxes due for the first $20,000 in assessed value on qualified personal vehicles. Personal property taxes are billed once a year with a december 5 th due date.

Filing deadline is april 1, 2019. With the city’s real estate tax rate of $1.20 per $100 of assessed value, the tax bill would be $2,964. Application for tax relief for elderly/disabled.

The taxpayer may be temporarily in the hospital, nursing home, etc, and still qualify for relief. If you can answer yes to any of the following questions, your vehicle is considered by state law to have a business use and does not qualify for personal property tax relief. The tax rate is 1 percent charged to the consumer at the time of rental payment.

The local governing body of each county, city, or town shall fix or establish its tangible personal property tax rate for its general class of tangible personal property, which rate shall also be applied to that portion of the value of each. If the qualified vehicle is assessed at more than $1,000, tax relief will be given at a rate of 50% (up to a maximum of $20,000 in assessed value) for 2020. Property owned by a church must be actively and exclusively used for charitable, religious or educational purposes to qualify for real property exemption.

Disabled veterans real estate tax relief. The state of virginia has allocated funds to provide tax relief for qualifying vehicles in the county of henrico. The amount of tax relief is based upon the total dollars from the commonwealth divided by.

Eligibility requirements and important information. There are certain requirements they must meet to qualify for the tax relief programs: Senior citizens and totally disabled persons have the right to apply for an exemption, deferral, or reduction of property taxes in virginia.

Owners of qualified vehicles assessed at $1,000 or less will receive 100% tax relief on that vehicle.

Dgipgoid

Soaring Home Values Mean Higher Property Taxes

Vhdacom

Vhdacom

Real Estate Tax Exemption – Virginia Department Of Veterans Services

City Of Vb Extends Application For Covid-19 Real Estate And Personal Property Tax Relief Program Wavycom

Taxvirginiagov

Cityofchesapeakenet

Taxvirginiagov

Taxvirginiagov

Martinsville Reversion Henry County Virginia

Henrico County Coronavirus Tax Relief Virginia Cpa Firm

Gop Claims That Vas Car-tax Relief Is In Danger Are Wrong Mcauliffes Office Says – The Washington Post

Vmlorg

Richmond Tax Amensty Program Henrico County Tax Relief

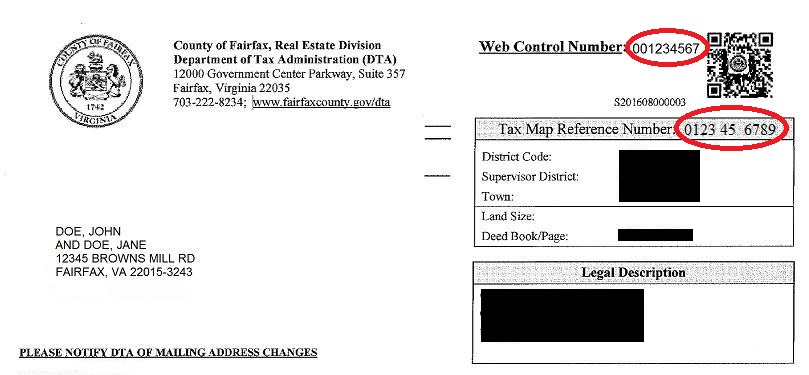

Real Estate Tax – Frequently Asked Questions Tax Administration

Vigcoopercenterorg

Repositoriiurindoacid

Richmond County Va Commissioner Of The Revenues Office