When the couple paid the excess (refund) $400 to the state in the prior year, it increased. Company k provides a director with 8 benefits in the tax year.

Ppt – Determining Gross Income Powerpoint Presentation Free Download – Id1641304

Expense accounts these are the accounts of expenses or.

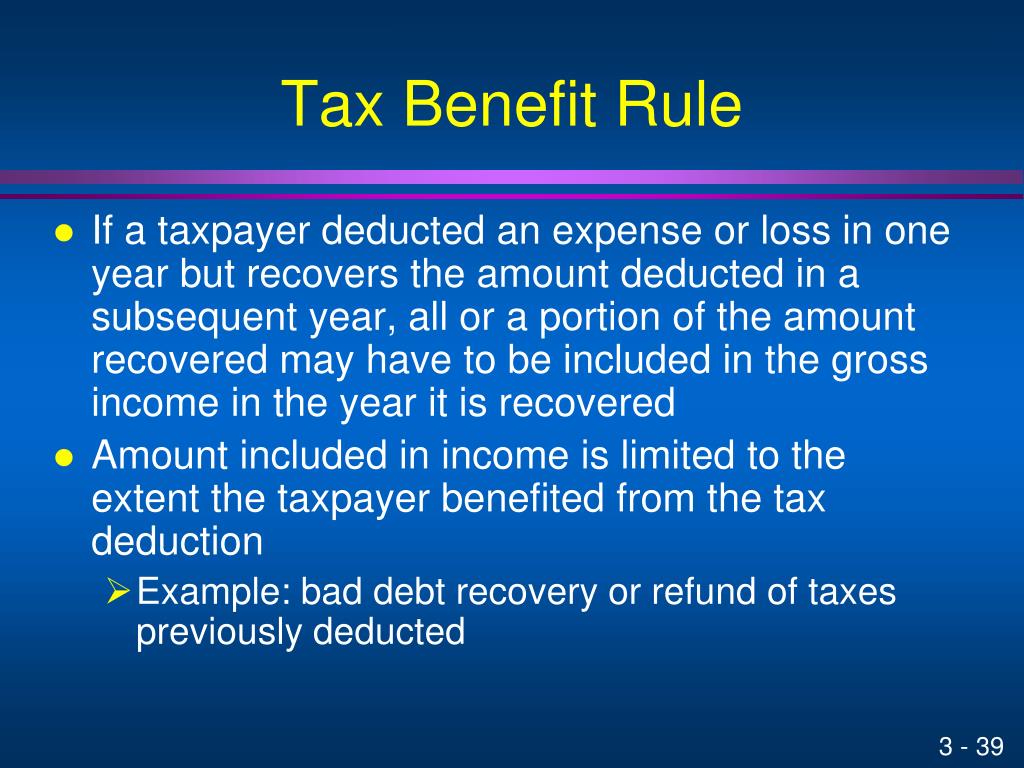

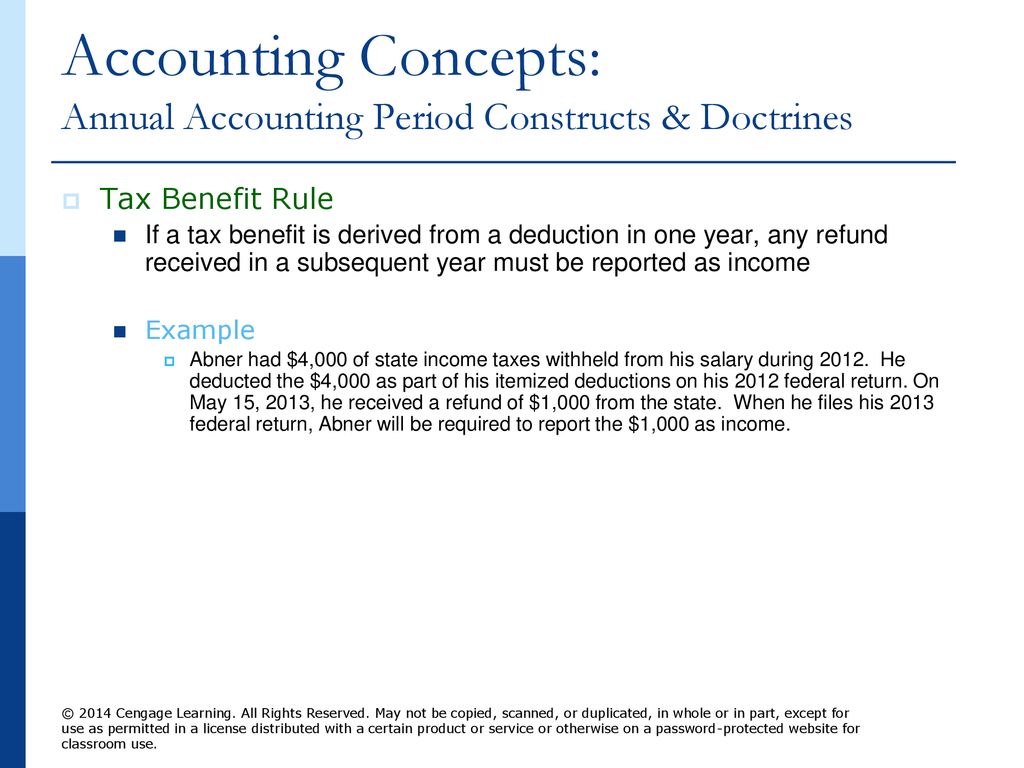

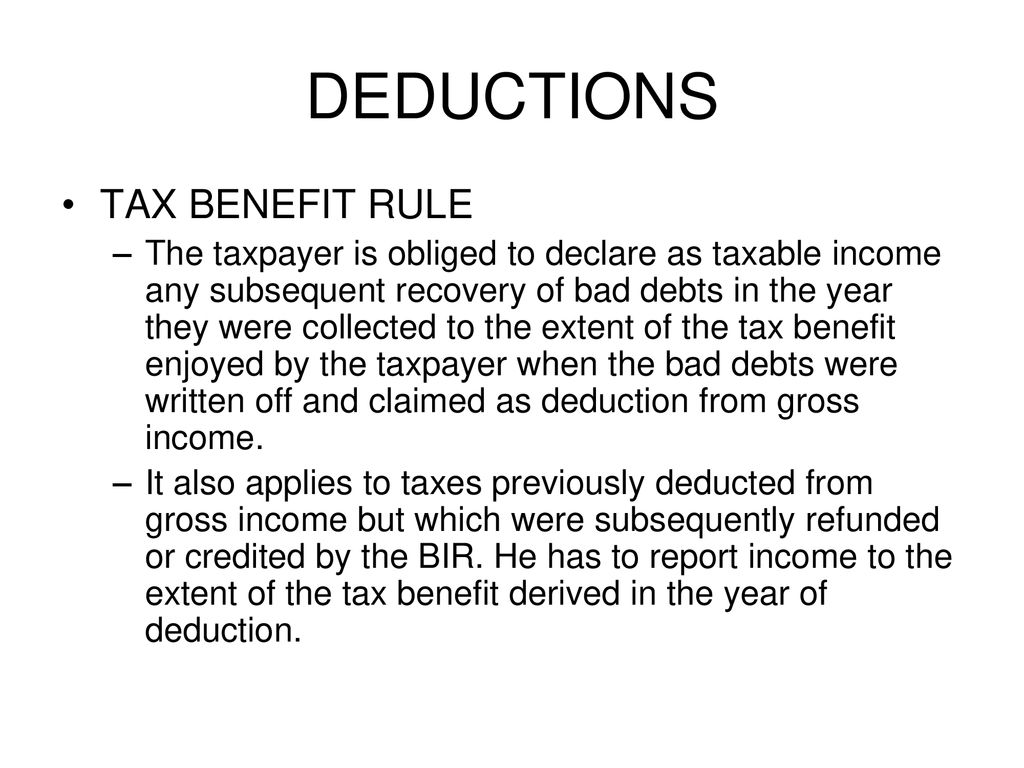

Tax benefit rule examples. Also note that if company xyz earned so little in 2009 that it owed no taxes at all, then it is not required to pay tax on the. For example, if a taxpayer recovers an expense or loss that he previously wrote off against the prior year’s income, then the recovered amount must be included in the current year’s gross income. Jones recovers a $1,000 loss that he had written off in his previous year’s tax return.

A “tax benefit” is defined under the sample gaar as: Tax benefit secondly, there must be a “tax benefit” in connection with the scheme. Some examples of nonrefundable tax credits include the saver’s credit, adoption credit, child care credit, and mortgage interest tax credits.

If this principle could be implemented, the allocation of resources through the public sector would respond directly to consumer wishes. Payroll taxes , for example, are commonly levied on labour income in order to finance retirement benefits, medical payments, and other. This represents the total amount of state income tax withheld from your wages in.

If a business incurs a loss in a financial year, it usually is entitled to. A “tax benefit,” is interpreted broadly and includes any exclusion, deduction or credit which reduced federal income tax due in a prior year. The last benefit is not exempt from tax.

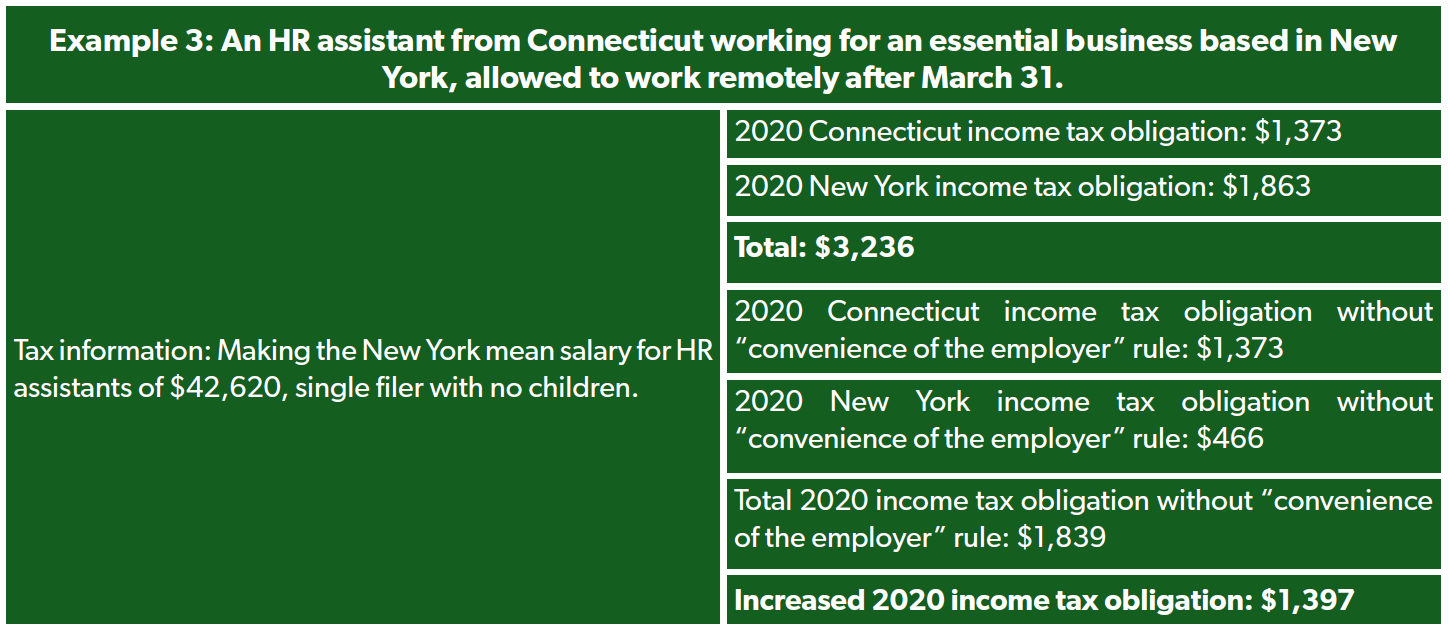

A couple paid $4,000 in state taxes in the prior year and claimed itemized deductions totaling $14,000. In the example above, company xyz could theoretically pay a lower tax rate in 2010 (or a higher one). In the third example, charlie paid $11,000 of state and local taxes in 2018, but after application of section 164(b)(6) she was only able to deduct $10,000.

There are, however, important exceptions: Had a paid only the proper amount of state income tax in 2018, a’s state and local tax deduction would have been reduced State income tax refund fully includable.

In the above example, the taxpayer’s agi was reduced by $24,323, resulting in a tax savings of at least $480 and possibly as high. Morrison, assignment of income and tax benefit principles in corporate liquidations, 54 taxes 902 (1976). The total cost is £350 which exceeds the annual exempt amount.

A tax benefit in the prior taxable year from that itemized deduction. The $1,000 must be included in his current year’s reported gross income. “scheme” which is motivated by tax considerations.

Example of the tax benefit rule. Significant tax savings can be obtained by understanding, recognizing, and applying the tax benefit rule. The tax benefit rule ensures that if a taxpayer takes a deduction attributable to a specific event, and the amount is recovered in a subsequent year, income tax consequences of the later event depend in some degree on the prior related tax treatment.

If the gift extends beyond one of the items mentioned above, for example from a bottle or two to a case of wine, or from a turkey to a christmas hamper, you will. In 2019, a received a $1,500 refund of state income taxes paid in 2018. That is, they help determine what activities the government will undertake and who will pay for them.

Examples like sales, discounts received, interest received, bad debts recovered , etc. One example of a situation covered by the tax benefit rule would be if a business listed an unpaid debt as an expense, lowering its taxable income, then recovered the money in a future tax year. O'hare, application of tax benefit rule in new case threatens certain

The tax benefit rule is codified in 26 u.s.c. Another example would be if somebody had to pay for repairs after an accident but later recovered the money in court from the person held responsible. While taxes are presumably collected for the welfare of taxpayers as a whole, the individual taxpayer’s liability is independent of any specific benefit received.

Note, however, that the tax benefit rule does not prevent companies from taking advantage of changing tax rates (it doesn't protect them, either). Broenen, the tax benit rule and sections 332, 334(b)(2) and 336, 53 taxes 231 (1975); Under the benefit principle, taxes are seen as serving a function similar to that of prices in private transactions;

(a) a reduction in a liability to pay tax, including on account of a deduction, credit, offset or rebate; Epstein, the tax beneft rule in corporate liquidations, 6 tax advisor 454 (1975); If the couple received a state tax refund of $500 in the current year, the taxpayer will include all of the refund in their current year income.

One straightforward example of a deferred tax asset is the carryover of losses.

Chapter 2 Income Tax Concepts Murphy Higgins – Ppt Download

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

2010 Cengage Learning All Rights Reserved May Not Be Copied Scanned Or Duplicated In Whole Or In Part Except For Use As Permitted In A License – Ppt Download

What Is The Tax Benefit Rule The Benefit Rule Explained

How Does The Current System Of International Taxation Work Tax Policy Center

Chapter 2 Income Tax Concepts Kevin Murphy Mark

2

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

What Is The Tax Benefit Rule The Benefit Rule Explained

Individual Issues Chapter 6 Pp 175 212 2016

Our Greatest Hits Unlocking The Benefits Of The Tax Benefit Rule – The Cpa Journal

New Yorks Aggressive Pandemic Tax Strategy Underscores Need For Congressional Action – Foundation – National Taxpayers Union

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

Chapter 2 Income Tax Concepts 2008 South-western Kevin Murphy Mark Higgins Kevin Murphy Mark Higgins – Ppt Download

Chapter 2 Income Tax Concepts Kevin Murphy Mark Higgins – Ppt Download

Income And Withholding Taxes – Ppt Download

Income Tax Deduction Exemptionsallowances To Save Tax Section 80c 80ccd 80d 80gg 24 Finserv Markets

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

Tax Benefit Rule Previous Deduction Recovery Los Angeles Cpa