The first half of the credit will be sent as monthly payments of up to $300 for the rest of 2021, and the second half can be claimed when filing taxes. The september installment of the advance child tax credit payment is set to start hitting bank accounts.

September Child Tax Credit Payments Are Here What Happens If Irs Misses You – Fingerlakes1com

The 2021 advance monthly child tax credit payments started automatically in july.

Child tax credit september 2021 direct deposit. Age of 6 for the 2021 tax year. Child tax credit september 2021 direct deposit. The child tax credit update portal allows families to update direct deposit information or unenroll.

Parents report problems receiving september child tax credit published fri, sep 17 2021 3:18 pm edt updated fri, sep 17 2021 7:29 pm edt alicia adamczyk @aliciaadamczyk Even though child tax credit payments are scheduled to arrive. Parents of about 60 million children will receive direct deposit payments on september 15, while.

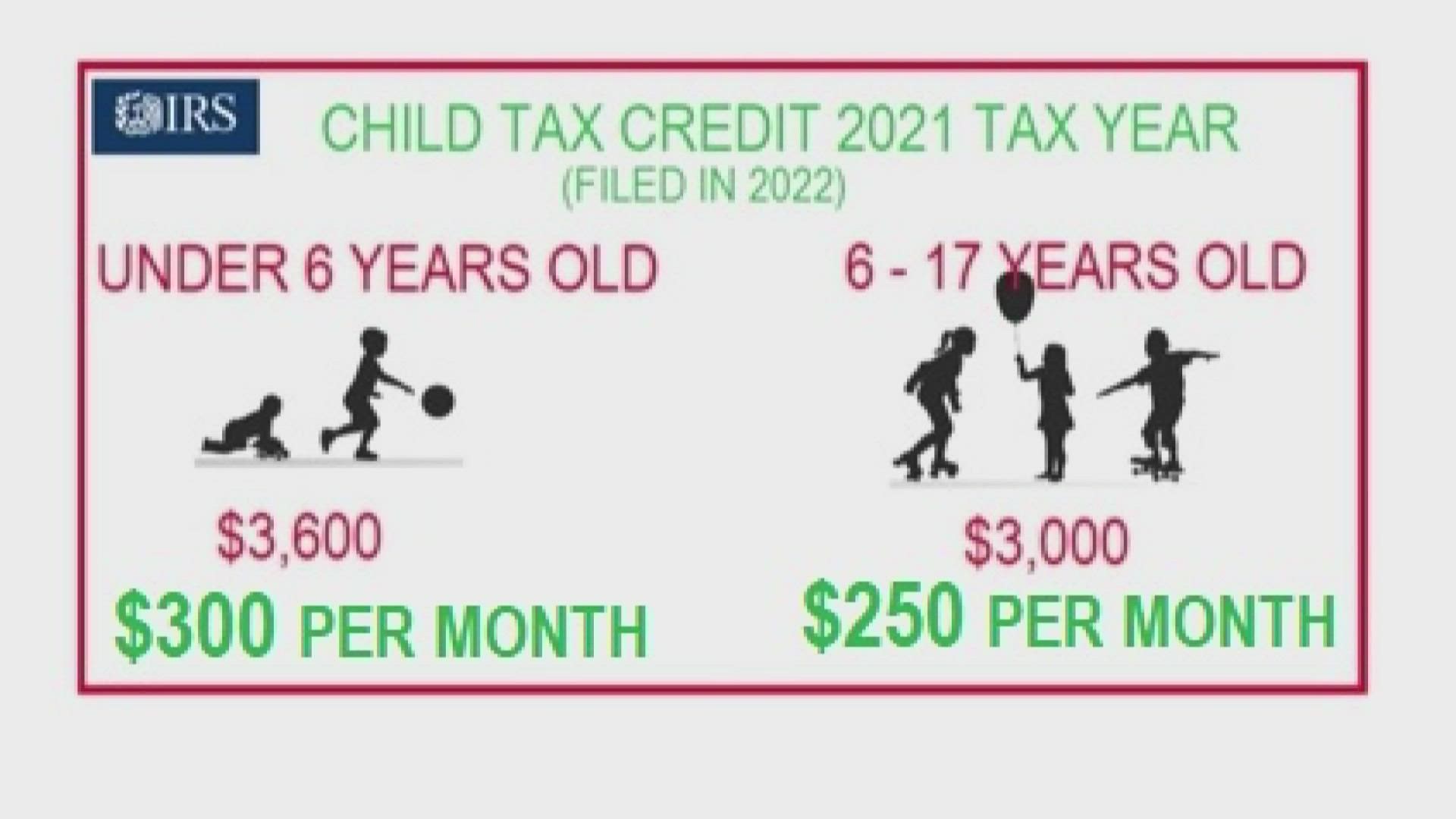

The american rescue plan raised the maximum child tax credit in 2021 to $3,600 for children under the age of 6 and to $3,000 per child for children ages 6 through 17. 5:14 pm cdt september 14, 2021. 16:31 et, sep 15 2021 taxpayers who are still waiting for their child tax credits to post could see the payments delayed for a handful of reasons, most of which can be determined by a quick look at the irs portal.

6:14 pm edt september 14, 2021 the september installment of the advance child tax credit payment is set to start hitting bank accounts via direct deposit and through the mail. Under the program, parents of eligible children under 6 receive $300 per child each month, while those with children between 6 and 17 get $250 per child. September 13, 2021 / 7:40 am cdt (istock / getty images plus) (((ktla) — another round of prepaid child tax credits is just a few days away from going out to tens of millions of americans.

6:14 pm edt september 14, 2021. Those who signed up for direct deposit should see the funds in their accounts today. The september installment of the advance child tax credit payment is set to start hitting bank accounts.

If the payment does not show then you have to fax/call/mail forms to track. This year, most qualifying families are getting. Child tax credit update 2021:

The couple would then receive the $3,300 balance — $1,800 ($300 x 6) for the younger child and $1,500 ($250 x 6) for the older child — as part of their 2021 tax refund. Tracy bloom, nexstar media wire posted: Eligible families can receive a total of up to $3,600 for each child under 6 and up to $3,000 for each one age 6.

Here's when the third check will deposit. The total child tax credit for 2021 is $3,600 for each child under 6 and $3,000 for each child 6 to 17 years old. Taking into account the last half of the child tax credit payment, which will arrive in 2022, those eligible households will receive a total of up to 3,600 per child aged five and below, with the.

2021, though you can still collect the remaining half of your credit (either $1,800 or $1,500) when you file your 2021 tax return in 2022. Before 2021, the credit was worth up to $2,000 per eligible child. Rep stated it takes 5 business days to process direct deposit.

Parents of about 60 million children will receive direct deposit payments on september 15, while some may receive the checks through the mail anywhere from a few days to a week later. The next payment goes out today, sept. The first half of the.

Posted september 13, 2021 / 7:40 am cdt / has been updated: The third monthly payment of the enhanced child tax credit will land in accounts this week, providing an influx of cash to millions of families at a time when most other major stimulus programs for u.s. I just spoke to irs rep.

The irs recently upgraded the child tax credit update portal to enable families to update their bank account information so they can receive their monthly child tax credit payment. You'll be getting the third advance child tax credit payment next week, assuming you received the first two advance monthly checks. The first half of the credit will be sent as monthly payments of up to $300 for the rest of 2021, and the second half can be claimed when filing taxes.

Some parents still haven't received the september child tax credit payment. The current changes to the 2021 child tax credit made the credit $3,600 for children under age 6 and let families qualify if they have little or no income. In july via direct deposit and a paper check for august.

Each month, the payments will be either $300 or $250 for each child. Update your direct deposit info or mailing address through the irs portal. That depends on your household income and family size.

Advanced child tax credits are expected to end in dec. 10:17 et, sep 15 2021.

Child Tax Credits Go Out Soon How To Check September Payment What To Do If One Hasnt Been Received Wfla

Where Is My September Child Tax Credit 13newsnowcom

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

August Child Tax Credit Payments Issued Heres Why Yours Might Be Delayed Wgn-tv

Child Tax Credit Missing A Payment Heres How To Track It – Cnet

Irs Child Tax Credit Payments Start July 15

Child Tax Credit 2021 8 Things You Need To Know – District Capital

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

Deadline To Opt Out Of September Child Tax Credit Payment Is Monday Heres How To Cancel It – Fingerlakes1com

Child Tax Credit Did Not Come Today Issue Delaying Some Payments 10tvcom

What To Know About The First Advance Child Tax Credit Payment

Irsgov

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit 2021 How To Track September Next Payment Marca

Child Tax Credit When Will Your September Payment Arrive Cbs Detroit

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Federal Reserve Banks Share Information About Advance Child Tax Credit Payments

Decembers Payment Could Be The Final Child Tax Credit Check What To Know – Cnet