Sales tax rate as of july 1, 2021 counties municipalities * cook county imposes a 1.75% county home rule sales tax. The sales tax in chicago is 8.75 percent;

Chicagoland Il – Area Counties 2020- 2nd Installment Property Tax Due Dates Chicagoland Mchenry Dekalb County

The current total local sales tax rate in dupage county, il is 7.000%.

Dupage county sales tax vs cook county. On our website, we have collected a lot of different data on the cost of living. The total sales tax rate in any given location can be broken down into state, county, city, and special district rates. Douglas county $1,774 tax assessor :

The regional transportation authority (rta) is authorized to impose a sales tax in cook, dupage, kane, lake, mchenry, and will counties. Compare those numbers to nearby cook county, where you’ll pay 8% sales tax, or chicago, where you’ll pay 10.25%! The base sales tax rate in dupage county is 7% (7 cents per $1.00).

The minimum combined 2021 sales tax rate for dupage county, illinois is. General merchandise sales tax is remitted directly to state of illinois. The 2018 united states supreme court decision in south dakota v.

The dupage county sales tax rate is %. Property taxes are high in all of the counties. Has impacted many state nexus laws and sales tax.

The base sales tax rate in dupage county is 7% (7 cents per $1.00). 1304 rows 2021 list of illinois local sales tax rates. Dekalb county $4,267 tax assessor :

Dupage county, illinois cost of. Dupage county has one of the highest median property taxes in the united states, and is ranked 27th of the 3143 counties in order of median property taxes. In cook county outside of chicago, it's 7.75 percent;

Cook county $3,681 tax assessor : You will find links to both official statistics and people's impressions. Dupage county collects, on average, 1.71% of a property's assessed fair market value as property tax.

Dupage county $5,417 tax assessor : The part of naperville in dupage county had a 2005 tax rate of $5.7984. The illinois state sales tax rate is currently %.

De witt county $1,495 tax assessor : Illinois has a 6.25% sales tax and dupage county collects an additional n/a, so the minimum sales tax rate in dupage county is 6.25% (not including any city or special district taxes). Lowest sales tax (6.25%) highest sales tax (11%) illinois sales tax:

Thanks to the dupage county sales tax reduction, the new rate for services and parts is 7.5%, and the new rate for cars is 7%. Another way to arrive at the same answer is to multiply the price of the home by 1/3 of the tax rate ($400,000 * (0.073103 /3)) = $9,747.06. The december 2020 total local sales tax rate was also 7.000%.

Average sales tax (with local): This table shows the total sales tax rates for all cities and towns in dupage county, including all local taxes. Cumberland county $1,285 tax assessor :

In dupage county, it's 6.75 percent, and in lake,. Effingham county $1,640 tax assessor Searching for cost of living dupage county vs cook county information?

Edwards county $844 tax assessor : Sales taxes in illinois are calculated before rebates are applied, so the buyer who pays $9,500 after a $2,500 rebate will still pay sales tax on the full $12,000. Crawford county $927 tax assessor :

This is the total of state and county sales tax rates. At the time, the average rate for cook county, including municipal sales tax, was about 2.16 percentage points higher than in dupage, kane, lake, mchenry and will counties. Below are the most relevant links to cost of living dupage county vs cook county data.

Cook has a slightly higher sales tax. Illinois has state sales tax of 6.25% , and allows local governments to collect a local option sales tax of up to 4.75%. You need to be more concerned about where your working and what the commute will be like.

Dupage county, il sales tax rate. In dupage county, property tax rates vary widely between suburbs with 2005 taxes rates ranging from $8.2058 for glendale heights down to $2.7896 for oak brook. The following table summarizes local government sales tax rates on general merchandise in chicago, suburban cook county, dupage county and other collar counties (e.g., kane, lake, mchenry and will counties) in 2015 and the new composite rates in effect in 2016 after the new tax rate goes into effect in cook county.

The median property tax in dupage county, illinois is $5,417 per year for a home worth the median value of $316,900. Edgar county $1,122 tax assessor :

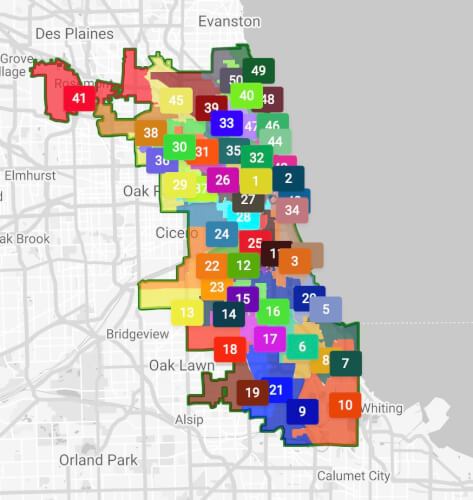

Preckwinkle Towns Should Annex Unincorporated Cook County

Opportunity Zones – Dceo

Cook County Triennial Property Tax Assessment Schedule Kensington

Medical Examiners Office

Palos Township Cook County Illinois – Wikiwand

30 Counties Including Dupage Dekalb On Idph Covid-19 Warning List Kane County Connects

Opportunity Zones – Dceo

Lawsuit Filed In Federal Court Challenging Cook County Property Tax Assessments

Cook County Illinois Png Images Pngwing

Qx7fu6i8pdhowm

Cook County Illinois Png Images Pngwing

Cook County Illinois Png Images Pngwing

Cook County Illinois Png Images Pngwing

Park Districts In Illinois The Civic Federation

Cook County Property Tax Bills In The Mail This Week

Cook County Illinois Png Images Pngwing

Dupage County Illinois Detailed Profile – Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Opportunity Zones – Dceo

Cook County Illinois Png Images Pngwing