Tangible personal property tax tax rate: The total tax is 5 percent (4 percent state and 1 percent local) a seller is subject to a sales tax on gross receipts derived from retail sales or leases of taxable tangible personal property.

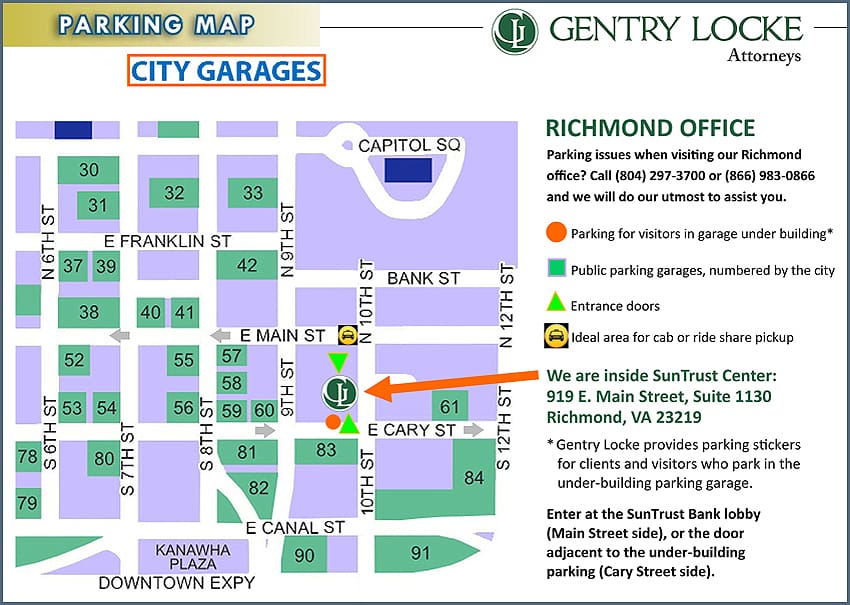

Visiting Our Richmond Office – Gentry Locke Attorneys

$3.50 per $100.00 of the assessed value $1.00 per real estate tax rate:

Personal property tax rate richmond va. If you have questions about personal property tax or real estate tax, contact your local tax office. Henrico county has one of the highest median property taxes in the united states, and is ranked 594th of the 3143 counties in. 4.3% † placid bay sanitary district;

Local tax rates tax year 2019. Effective tax rates/$100 † westmoreland county: Before the official 2021 virginia income tax rates are released, provisional 2021 tax rates are based on virginia's 2020 income tax brackets.

Richmond is the capital of virginia and the place where virginia’s property tax laws were established. Tax rates differ depending on where you live. $0.87 per $100.00 of the assessed value.

Annual tax amount = $354.35. Personal property taxes are billed once a year with a december 5 th due date. The median property tax in henrico county, virginia is $1,762 per year for a home worth the median value of $230,000.

This does not include the registration fee currently set at $40.00 per vehicle. Business personal property tax is a tax on the furniture, fixtures, machinery, and tools used in a business, trade, or profession. Personal property taxes are assessed on any vehicle, motorcycle, boat, trailer, camper, aircraft, motor home, or mobile home owned and registered as being garaged in richmond county as of january 1 st of each tax year.

Counties in virginia collect an average of 0.74% of a property's assesed fair market value as property tax per year. The median property tax in virginia is $1,862.00 per year for a home worth the median value of $252,600.00. City of richmond personal property tax rate:

Virginia is ranked number twenty one out of the fifty states, in order of the average amount of property taxes collected. Virginia consistently receives a triple a bond rating from the major rating agencies. Also, for credit card payments there is a 2.5% convenience fee in addition to the total tax and transaction fees charged.

Use the map below to find your city or county's website to look up rates, due dates, payment information, and contact information. Tangible personal property is the property of individuals and businesses in. 49% (for 2020) x $694.80 = $340.45.

State and local governments are required to operate with balanced budgets and are known for their fiscal responsibility. $2.14 per $100 of assessed valuation: $3.70 per $100.00 assessed value due:

The tangible personal property tax is a tax based on the value of the property, commonly referred to as an ad valorem tax. Chesterfield county has one of the highest median property taxes in the united states, and is ranked 470th of the 3143. Richmond’s average effective property tax rate is 1.01%.

Boats, trailers and airplanes are not prorated. Table 1 rates of county levies for county purposes (pdf) table 2 rates of city levies for city purposes (pdf) table 3 rates of town levies for town purposes (pdf) table 4 rates of county district levies for district purposes (pdf) Virginia tax forms are sourced from the virginia income tax forms page, and are updated on a yearly basis.

May 1st real estate tax rate: $3.50 per $100.00 assessed value first half due june 5th, second half due december 5th The median property tax in chesterfield county, virginia is $1,964 per year for a home worth the median value of $235,600.

Taxable assets include items that have been received free of charge, as. 1.0% † commonwealth of virginia: Personal property taxes and real estate taxes are local taxes, which means they're administered by cities, counties, and towns in virginia.

Business equipment, campers, utility trailers, storage mobile homes, etc. $1.38 per $100.00 assessed value total amount due by june 1st (penalty is 10% of tax bill) henrico county. The 2021 state personal income tax brackets are updated from the virginia and tax foundation data.

Henrico county collects, on average, 0.77% of a property's assessed fair market value as property tax. Real estate (including residential mobile. The daily rental property tax is collected by businesses that derive at least 80 percent of their rental receipts (excluding the rental of vehicles licensed by the state) from rental of personal property for 92 consecutive days or less.

Chesterfield county collects, on average, 0.83% of a property's assessed fair market value as property tax. Reduce the tax by the relief amount: Personal property taxes on automobiles, trucks, motorcycles, low speed vehicles and motor homes are prorated monthly.

Virginia’s corporate income tax rate has not changed since 1972. $0.76 † commonwealth of virginia: The tax rate is 1 percent charged to.

There is a $1.50 transaction fee for each payment made online. Tax rate † westmoreland county: In order to determine the tax bill, your local tax assessor’s office takes into account the property’s assessed value, the current assessment rate, as well as any tax exemptions or abatements for that property.

Formerly Redlined Areas Of Richmond Are Going Green – Chesapeake Bay Foundation

Schedule Your Eflyer Master Suite Plans Real Estate House Styles

Mehangai Ki Maar Essay In 2021 Essay Writing Tips Conference Planning Essay

Richmond Virginia Va Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

1 W Main St Richmond Va 23220 Realtorcom

Tax Exempt Bond Program Richmond Redevelopment Housing Authority

New Tax Assessments Show Richmond Property Values Surging 73 Percent The Biggest Increase In A Decade Richmond Local News Richmondcom

Kmu6ol-grwaxhm

Try The 4-both Method To De-clutter Your Living Room Place 4 Boxes On The Ground Let One Box Be Your Trash Investment Firms Investing Real Estate Investing

Richmond Va Multi Family Homes For Sale Real Estate Realtorcom

Guide-to-richmond-area-mls-real-estate-zones Mr Williamsburg

3224 Patterson Ave Richmond Va 23221 – Realtorcom

Home Down Payments In 2021 Home Buying Homeowners Insurance First Time Home Buyers

Richmond Virginia Va Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

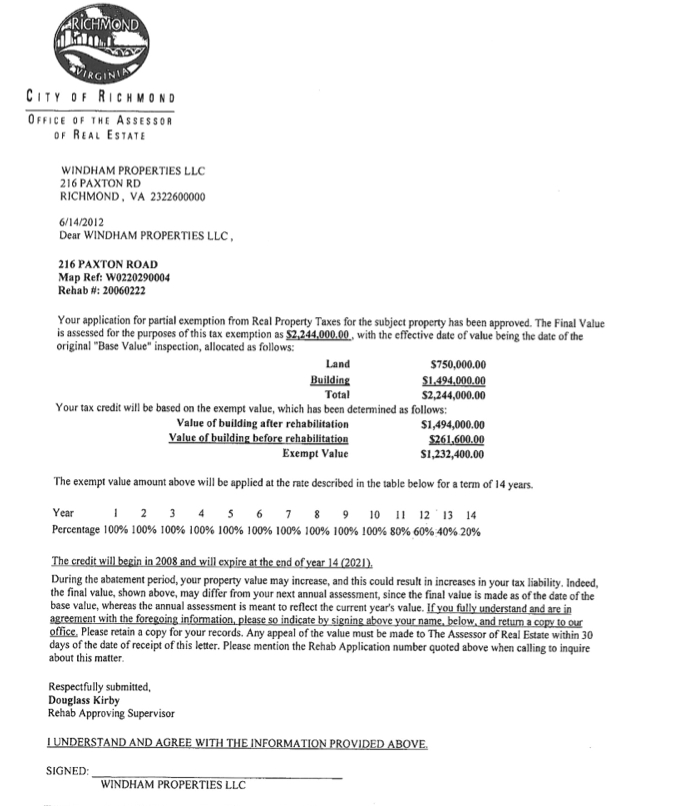

Tax Abatement In Richmond Virginia – Significant Properties In Richmond Virginia

Binswanger Glass Richmond Va 23230 Commercial Home Auto Glass

New Tax Assessments Show Richmond Property Values Surging 73 Percent The Biggest Increase In A Decade Richmond Local News Richmondcom

101 N 29th St Richmond Va 23223 Realtorcom

Sppup1jikcqccm